Congressman John Dingell and University Bank president to host Q&A after film screening

U.S. Rep. John Dingell, D-Dearborn, and University Bank president and CEO Stephen Ranzini will participate in a question-and-answer session after a special showing of “Inside Job” at 5 p.m. Sunday at the Michigan Theater.

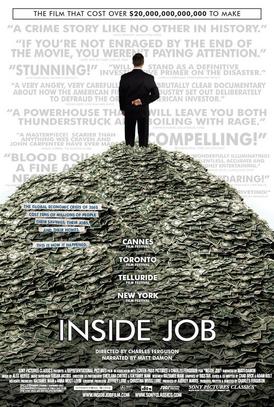

The film, narrated by Matt Damon, documents the events leading up to the global financial crisis in 2008 and subsequent actions by politicians, regulators and investment bankers.

“For 21 years I was proud to say that I was a bank president,” he said.

“As a result of these investment banks suddenly appropriating our brand names by becoming ‘banks’ I had to change what I described my profession as so now I only say I’m a community bank president… The brand of ‘bank’ has been destroyed as far as I can determine because of the actions of the people show in the film.”

It was Ranzini’s idea to host a screening of the film, and he hopes that people who missed seeing the 2010 Academy Award winner for best documentary will come out to watch and discuss.

“The theater seats about 900, I think, so the more the merrier,” he said.

“The Ann Arbor Democratic Party is helping promote it, but it’s not a political event per se. We’re trying to get a good group of people from town to show up and to have an interesting discussion about a very interesting film.”

The showing is free to the public with pre-registration. Tickets at the door are $10 for adults and $8 for students. To register, email your name and address to ranzini@university-bank.com.

Ben Freed covers business for AnnArbor.com. You can sign up here to receive Business Review updates every week. Reach out to Ben at 734-623-2528 or email him at benfreed@annarbor.com. Follow him on twitter @BFreedinA2

Comments

mhirzel

Mon, Feb 18, 2013 : 3:13 a.m.

Hope there is a follow up article on the Q & A session for those of us who are reading this after the event is over. Thanks to Mr. Ranzini for making this happen. Wish I'd been there!

arborani

Sun, Feb 17, 2013 : 10:09 p.m.

Once again, wish this had been posted a day or two earlier.

Superior Twp voter

Sun, Feb 17, 2013 : 7:23 p.m.

Hope Mr. Dingell can stay awake through the *whole* thing.

Stephen Lange Ranzini

Sun, Feb 17, 2013 : 5:37 p.m.

@IndyMama: Before you complain, you might want to see the film. Half the people blamed in the film for the financial crisis are Republicans, and half are Democrats! Pay careful attention in the film as to who refuses to be interviewed on camera.

northside

Sun, Feb 17, 2013 : 8:54 p.m.

Admirable effort Stephen, but I wouldn't bet my next paycheck that IndyMama shows up at the screening. Or at anything else outside the NewsMax/Fox bubble.

Stephen Lange Ranzini

Sun, Feb 17, 2013 : 5:18 p.m.

Great question, @Fresh Start. You may also ask why the taxpayers bailed out Goldman Sachs and the other mega investment banks by paying 100 cents on the dollar for the $160 billion in derivatives issued by AIG, when AIG had failed. In the question and answer session following the movie, I plan to provide updated information on the size of the outstanding derivatives held by the mega banks. If you think $160 billion is a large number, you will be shocked and amazed!

Fresh Start

Sun, Feb 17, 2013 : 11:24 p.m.

The derivative paper debt (due to unregulated betting) is supposedly many times that of the true collateralized mortgage debt ($$$ borrowed by the homeowner occupant). I believe taxpayers have no responsibility to cover manufactured unregulated derivative paper debt and to put it on the tax rolls violates the constitution and the public trust.

northside

Sun, Feb 17, 2013 : 4:23 p.m.

Indymama, the entertainment value of your comments is off the charts. Keep 'em coming!

Indymama

Sun, Feb 17, 2013 : 4:14 p.m.

Don't waste your time on this PROPAGANDA!! I'm truly disappointed in the Michigan Theater.....refused to show the historically correct film about Obama's life before he got into politics in the United States, yet is promoting Democratic propaganda. I thought you were a Community theater for ALL citizens of Ann Arbor and surrounding communities. Unfortunately, it seems you have become a tool for the Democratic Propagandists! So Sad!!

David Briegel

Sun, Feb 17, 2013 : 7:06 p.m.

Utter nonsense!

Vivienne Armentrout

Sun, Feb 17, 2013 : 3:55 p.m.

That is TODAY. The original announcement says 5 p.m. Sunday, February 17. This article does not offer a date.

Fresh Start

Sun, Feb 17, 2013 : 3:43 p.m.

Can someone please explain how unregulated private banks, who gambled and lost using derivatives (papered money schemes that the banked created and controlled), which by the way are "too complicated to explain" is the responsibility of taxpayers? The collateralized housing downturn is one thing but the papered "mezzanine" debt is something entirely different! It does not belong to the taxpayers!!! Our politicians have either been bamboozled, are incompetent or both. The banks don't share their profits with the taxpayers so why on earth should we cover their losses?

Fresh Start

Sun, Feb 17, 2013 : 11:11 p.m.

To GoNavy - I did not suggest banks are public because I know they are not. And that is exactly the point. The entire banking system is controlled by private banks. The Federal Reserve is a private bank. And private banks should not receive taxpayer money to cover their careless bets. The attached link provides some very good information. http://vimeo.com/36566257

GoNavy

Sun, Feb 17, 2013 : 5:56 p.m.

Banks are regulated at a number of levels, starting at the federal level and falling to the state level. There are no "public" banks in the United States, at least in the sense that you're suggesting. To answer a couple of your questions.

SEC Fan

Sun, Feb 17, 2013 : 2:55 p.m.

Perhaps Mr. Dingell will explain what the (roughly) $125,000 in campaign contributions he received from the Securities/Investment lobbyists (from 2004-2008) bought them... maybe that's why he didn't see it coming...

GoNavy

Sun, Feb 17, 2013 : 5:04 p.m.

What is there to explain, exactly? The people who gave Rep. Dingell that money clearly expected something in return. Considering that they came back year after year, we can only assume they got what they wanted. If you use the words "legal bribe," rather than the sugar-coated term "campaign contribution," it helps you focus on exactly what is happening in the transaction.

beardown

Sun, Feb 17, 2013 : 3:55 p.m.

That's assuming he can remember that far back.

Kai Petainen

Sun, Feb 17, 2013 : 2:46 p.m.

This should be mandatory viewing for any business student (even if you politically disagree with it).

beardown

Sun, Feb 17, 2013 : 3:54 p.m.

Hopefully not as a "how-to" video.

GoNavy

Sun, Feb 17, 2013 : 1:43 p.m.

Why do I get the distinct feeling that Rep. Dingell will attempt to paint himself as the type of individual who "attempted to prevent this disaster?" Rep. Dingell - the longerst serving member of Congress - has walked hand-in-hand down the aisle with many of his Republican colleagues on thousands of bills which eased the path for this crisis during his career. Before we experienced partisan gridlock in our national legislative body, it was "old timers" like Rep. Dingell who eased lobbyists into his office, heard their "needs," and wrote special provisions into bills, the sum of which helped create the atmosphere that enabled this crisis. If you watch this movie and indeed believe that this was an "inside job," never forget the insiders in our system of government who - at every step - helped grease the wheels of fraud, deceit and financial destruction. Rep. Dingell is no different in that regard.

GoNavy

Mon, Feb 18, 2013 : 2:35 a.m.

@Leah Gunn- The US was alone among G8 countries in separating investment and commercial banking (the essence of Glass-Steagall) - what did they know that we didn't? There wasn't a CDS crisis in Canada, nor was there a ratings agency problem in Germany.

Leah Gunn

Sun, Feb 17, 2013 : 6:24 p.m.

If Rep. Dingell is "no different" then why did he vote "no" on repealing the Glass-Steagall Act, which prohibited banks from investing in various financial instruments. If you read :The Short Sell" by Michael Lewis, you will learn that it was a combination of new financial instuments, such as credit default swaps and collaterized debt obligations that brought down the banks. That, of course, was combined with lying and cheating by the likes of Standard & Poor's & Moody's, who combined AAA through junk status instruments, and graded them "AA" for sale to unknowing investors. I find it laughable that Goldman Sachs is now a "bank".

northside

Sun, Feb 17, 2013 : 12:17 p.m.

Inside Job is an outstanding film. Thanks to University Bank for bringing it back!

Stephen Lange Ranzini

Sun, Feb 17, 2013 : 11:48 a.m.

Was the global financial crisis really an inside job? The shocking answer is yes! Please come see the special screening of "Inside Job" today at 5pm at the Michigan Theatre. It should be a very interesting discussion between our special guest Congressman Dingell and I and the audience immediately after the film is shown. The quotes in the official Inside Job movie poster reproduced above in the article accurately portray this powerful Oscar Award winning movie: "A crime story like no other in history." "The film that cost over $20 trillion to make." "If you aren't enraged by the end of the meeting, you weren't paying attention." "Stunning" "Compelling" I hope to see you there! Stephen Lange Ranzini, President & CEO of University Bank