Ann Arbor's commercial real estate market improving as vacancy rates fall

Data by Swisher Commercial

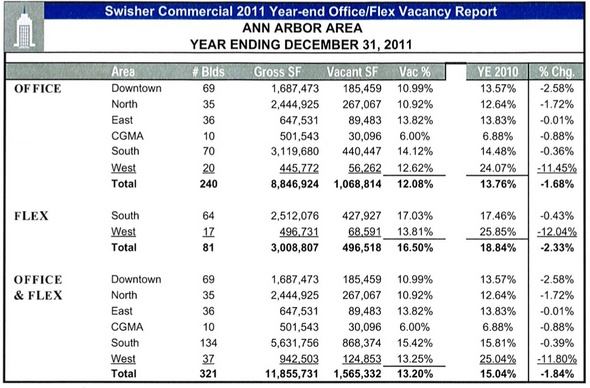

The 2011 report by Swisher Commercial shows that about 13.2 percent of the region’s 11.8 million square feet of leasable office space is vacant, an improvement over 2010’s 15.04 percent.

That number represents an indicator of improvement in the region’s business climate, said Swisher vice president Bart Wise. It also offers a sign of recovery, he said, though the amount of available office space remains higher than the years before the economic crisis.

“We’re happy to see the 13 percent,” Wise said. “… It’s good news in that businesses … don’t go out to rent more office space if they’re not optimistic.”

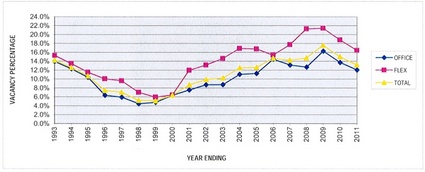

With two years of a slight decline, Wise said, there’s now a trend toward a more stable market.

Data and graph by Swisher Commercial

However, he said, “The trend is not because we’re out of this recession.”

He continued: The good news “is all tempered … because it’s compared to ’09 and ’10. 2011 still flags in comparison to stronger seasons.”

What it does show: Some overall growth in the market, even if the movement among individual companies is a mix of either growth or contraction, in the case of companies that moved into smaller spaces.

It also reflects a stable supply of office space, since construction of new office space is minimal. That’s likely to continue, with pricing pressures on commercial buildings - which have been affected by foreclosures, like the residential market - keeping new construction priced far over the price for comparable existing space when a company is looking to buy or lease a building.

Among the six submarkets of the area, all show at least a minimal improvement over 2010.

The most dramatic percentage change is the smaller West office market, which went from 25.85 percent vacancy to 13.81, a move largely attributed to the leasing of a building by medical device maker Terumo.

The downtown Ann Arbor market - the region’s third-largest, at 1.68 million square feet - went from 13.57 percent vacant in 2010 to 10.99 percent at the end of 2011.

That move, Wise said, shows that significant deals are still happening downtown and that companies that are actively leasing - namely technology firms - still value the downtown experience for their employees.

Menlo Innovations in November announced its plans to move into this space at The Offices at Liberty Square.

Angela J. Cesere | AnnArbor.com

Another key office deal was the leasing of the 3rd floor of the ex-Ann Arbor News building to Arbor Research as the building’s owner, University of Michigan Credit Union, converted 20,000 square feet of the facility for a tenant.

Neal Warling of Jones Lang LaSalle, a broker on the Menlo deal, said Swisher’s numbers confirm his experience with leasing in downtown.

“We’re seeing a significant diminishment of available space in the downtown area particularly,” he said, “and rates are stabilizing.”

Most of the demand, he said, exists in the downtown blocks from about South Fifth Avenue east to the University of Michigan campus.

Those offices often fit what Wise describes as “creative space.” They include traditional offices, and also lofts.

The most challenged submarket for many years has been the area’s largest, the 5.6 million square feet on the south end of Ann Arbor. Those buildings are a mix of traditional offices and “flex” buildings that include offices mixed with warehouse space.

The buildings in the south have been among the hardest hit by foreclosure, and some sales have resulted in deals for leasable space at drastically low prices. That’s kept the pressure on all landlords as they fought for limited pool of tenants, but today the vacancy rates is a slightly improved 15.42 percent, down from 15.81 percent.

In that market, the slight improvement is a critical step toward the area’s recovery.

And as the region’s highest-vacancy corridor, it still compares well to other Metro Detroit markets, where the vacancy rate has topped 20 percent in some communities, like Birmingham. In early 2011, a report from Colliers International pegged the overall suburban Detroit vacancy rate at 21.8 percent.

Brokers are still watching variety in pricing - and so are prospective tenants.

In general, Wise said, prices are not yet stabilizing.

“That’s the other caveat to this optimistic vacancy report,” he said. “A lot of the deals - I can’t say all - were at very low rental rates.”

Some landlords are telling brokers that they won’t drop rates further, but others have reduced asking rates by as much as 30 percent over recent years to retain cash flow.

Tenants are still feeling pricing pressures, too, brokers said, as they try to negotiate lower rates - sometimes putting more people in space that they normally would.

“They’re trying to reduce operating costs,” Wise said. “Rent is a big part of that. If they can negotiate a stable rental rate, that stabilizes their business and hopefully lets them grow in the future.”

Wise said he believes the vacancy rate will continue to improve in 2011, a forecast based in large part on the activity in his office toward the end of the year.

Paula Gardner is News Director of AnnArbor.com. She can be contacted at 734-623-2586 or by email.

Comments

Mike K

Fri, Jan 6, 2012 : 7:43 p.m.

Here's what I can add. Two buildings on my way to work went empty in 2008 / 2009. One was bought maybe 6 - 9 months ago, the other last month. This is of critical importance to us all. These new occupants (business's) are tax generators. They are the true "stimulus" we need, and it does "trickle down". Barring a disaster, you will start to watch surplus's continue to roll in on several levels. Somehow though, the ECRI is still calling for a recession. I just don't see it. <a href="http://www.businesscycle.com/#" rel='nofollow'>http://www.businesscycle.com/#</a>

PLGreen

Fri, Jan 6, 2012 : 2:36 p.m.

Clinton was in office for 8 years. Financially speaking that was the best "decade" that most anyone living has experienced.

Stephen Lange Ranzini

Fri, Jan 6, 2012 : noon

Rents for commercial buildings in the area continue to fall, as the article notes. One implication of this is that the tax base will drop when the new property tax assessments come out shortly for Ann Arbor and surrounding municipalities.

Veracity

Fri, Jan 6, 2012 : 7:02 a.m.

XMO: Not really. The vacancy rate was over 14% four years ago as compared to the 13.2% at the end of this year. The graph is interesting. Total vacancies in Ann Arbor was the lowest in 1998 (at about 5.5%) which was towards the end of Clinton's presidency. In fact, the vacancy rate fell progressively during Clinton's two terms until it plateaued in 1998-1999. During Bush's eight years of presidency the vacancy rate rose consistently until reaching 14%. The vacancy rate spiked 2 percentage points during President Obama's first year in office which was during the depth of the the economic catastrophe. Subsequently, as the country has slowly recovered from the recession during the past two years, the vacancy rate has improved. Still, as stated in the article, new construction costs remain high and thus rental rates for new space can not compete with existing rates for already existing commercial space. The DDA and City Council should keep this in mind when considering approving development of new commercial space. No sense to stemming the gradual decline in the vacancy rate and stabilization of rental rates.

clownfish

Fri, Jan 6, 2012 : 3:13 p.m.

Careful with those facts, Veracity, it may cause some to not legislate or comment via stereotype.

xmo

Thu, Jan 5, 2012 : 7:45 p.m.

I guess 13% is better than 15% but what was the vacancy rate when George W. Bush was President? I think we were better off 4 years ago!

clownfish

Fri, Jan 6, 2012 : 2:44 p.m.

I guess the socialism in Ann Arbor is keeping tenants out, not. Wonder what happened in 2007, when GWB was in office? Something with an "r"...? Something happened in the fall of 2008, when GWB was in office...what was that? Oh, right, the loss of about $13-16 trillion in wealth. Must have been Obamas fault.

Sparty

Fri, Jan 6, 2012 : 4:32 a.m.

Yup, gotten better every year of Obamas Presidency.

simply amazed

Thu, Jan 5, 2012 : 8:16 p.m.

Good question. I went to the website and it looks like they have reports posted back to 2003. Since I last looked at that, it looks like annarbor.com added a graph showing the vacancy rates over the last 19 years. Looks like the yellow line is the overall vacancy rate.

say it plain

Thu, Jan 5, 2012 : 6:06 p.m.

Good point @blahblahblah, but really the print media can be counted on for getting any overall "Please now, be over housing bubble burst, we want back to the days of it's-always-up-up-up!" message before anyone can step back and understand what the numbers really are, so.... Hoorah, I guess we'd have to say if commercial RE is 'improving' lol... Higher rents on top of higher rents! Booyah for the investor/landlord set! Too bad for the rest of us who care about the city and living in it...

blahblahblah

Thu, Jan 5, 2012 : 5:23 p.m.

Question? Does anyone know if the former Border's headquarters and downtown office space is officially included in these numbers? Given bankruptcy law, there can be a delay in terms of when an office is officially considered "vacant".

blahblahblah

Thu, Jan 5, 2012 : 7:18 p.m.

The south market in which the Border's headquarters in located, according to the article is " ...slightly improved 15.42 percent, down from 15.81 percent." So I would be very surprised if those numbers included the addition of the Border's vacant space.