Venture capitalists increase demands as Michigan startups seek cash

Startup companies are being forced to jump through more hoops and agree to more concessions to attract the few investors who are dangling dollars in the midst of a funding crunch, experts said this week at the Michigan Growth Capital Symposium in Ypsilanti.

The national economy is gradually recovering from the global financial crisis, but investors who survived the turmoil are scrutinizing potential deals more intensely and embracing caution.

That means that Ann Arbor’s tech startup companies need to consider agreeing to unattractive deal terms to secure private financing.

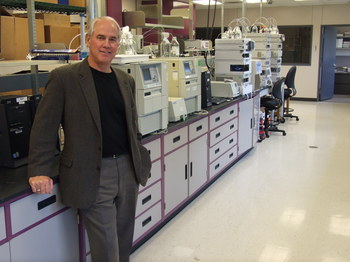

Esperion Therapeutics CEO Roger Newton, pictured here at the company's lab in Plymouth Township, said venture capitalists are making more demands before dishing out funding for startup companies.

Nathan Bomey | AnnArbor.com

Lipitor co-discoverer Roger Newton, CEO of Plymouth Township-based Esperion Therapeutics, said investors are no longer willing to provide one major round of funding all at once. Instead, they are choosing to require that startup companies achieve specific milestones that trigger access to additional dollars.

“There’s not a lot of wiggle room in how much money they’re going to give you,” Newton said.

The milestone strategy, typically referred to as “tranche” financing, is “something that’s done almost universally now, because no one has that luxury of being able to put lots of dollars in and saying, ‘Hey, we believe in you,'" Newton said.

The increased demand from investors means that startup companies need to polish their business plans and stick to specific promises. For example, biotech companies need to meet certain clinical goals with their therapeutic technologies to secure staged funding.

University of Michigan biotech spinoff Lycera Corp., for example, landed $36 million in financing in 2009. But the drug discovery firm only recently secured access to the second $11 million phase.

To wow investors, entrepreneurs need to have a well-defined strategy and path to commercialization, regardless of industry.

Newton said it’s a stark contrast to the golden biotech era of the late 1990s and early 2000’s, when the first Esperion raised more than $200 million with comparative ease.

“You need to have your budgets honed, you need to have your patents pretty well secured, you need a prototype,” Newton said.

Terry Cross, an investor and founder of consulting firm Windward Associates, said that even angel investors -- wealthy private individuals who fund startup companies -- are becoming more demanding with deal terms. Some are demanding that company executives temporarily give up equity for a few years and gradually earn it back if they’re still with the company later on.

Jeff Bocan, managing director of global investment firm Beringea’s Michigan office, said many venture funds are focusing on propping up their existing investments. That makes new investments rare and intensifies the competition for a small pot of dollars.

“They’re trying to make their current funds last longer than possible,” Bocan said. “They’re reserving more for their current investments, which also has the effect of them doing fewer new deals.”

Still, “deal flow” - a term that refers to the rate at which investors are funneling dollars to startup companies - is not dead. Beringea, for example, joined California VC firm Khosla Ventures to deliver $7 million in funding to Ann Arbor battery startup Sakti3.

And organizers of the Michigan Growth Capital Symposium, which U-M finance professor David Brophy formed 29 years ago, are encouraged by the level of interest in the state’s entrepreneurial efforts. Several hundred investors and entrepreneurs attended the event, which was organized by the U-M Ross School of Business' Zell Lurie Institute for Entrepreneurial Studies and the Michigan Venture Capital Association.

“We’re starting to really achieve a meaningful critical mass of venture capitalists,” Bocan said. “The right kind of people are here now and enough of them are here.”

Contact AnnArbor.com's Nathan Bomey at (734) 623-2587 or nathanbomey@annarbor.com. You can also follow him on Twitter or subscribe to AnnArbor.com's newsletters.

Comments

Ann Arbor SCORE

Thu, May 13, 2010 : 11:05 a.m.

Ann Arbor SCORE provides free business counseling services to help the techpreneurs focus on the business issues just not the technical feasibility. SCORE counseling emphasizes developing a cogent realistic business plan. Ann Arbor SCORE has over 40 counselors ready, willing and able to assist techpreneurs. For more information check our website at www.annarborscore.org or call for an appointment at at 734-332-4477 or 800-686-1883

Nathan Bomey

Thu, May 13, 2010 : 8:33 a.m.

Great points! Yes, several local venture capital firms are playing an increasingly influential role in boosting Michigan's startup community. Ann Arbor-based Arboretum Ventures, for example, funded U-M startups HealthMedia and HandyLab -- two success stories for Ann Arbor. Venture Investors, which maintains an Ann Arbor office, has funded U-M startup NanoBio. And Ann Arbor-based EDF Ventures has funded firms like U-M drug discovery startup Lycera. Other local companies that have benefited from venture capital include ForeSee Results, Accuri Cytometers, Sakti3, A123Systems and Esperion Therapeutics.

Somewhat Concerned

Thu, May 13, 2010 : 8:22 a.m.

It's all relative. VCs are more demanding now than in the recent past when they threw money at people who had no idea how to build a company. Most of that money was wasted: no lasting companies were built, no lasting jobs were created, no new products served society. A few new graduates and some out of work lucky ones lived on VC money for a year or two, but nobody else benefited. These more demanding times are better because more of the money will go where it is more likely to produce something of lasting value. The folks that can't get financing in sane times will complain, but everyone else will be better off. The other good news is that the local VC community is growing up. A couple of local firms are doing well and have proven themselves even in tough times. They are financing potentially good companies - our future.