Washtenaw County residential property values still falling in 2010 but pace slows

Dave Woodside, a special deputy from the Washtenaw County Sheriff's Department, attaches an eviction notice to the door of a house in Ypsilanti in 2008.

File photo

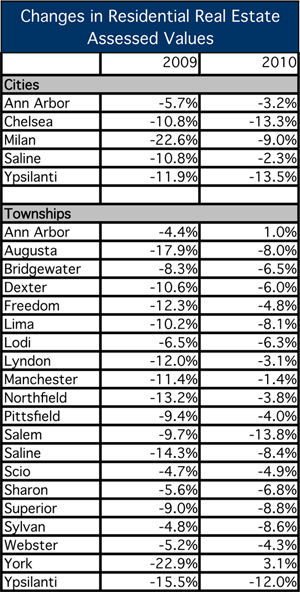

Residential property values fell last year in all but two communities in Washtenaw County, based on 2010 assessment reports.

Only York Township and Ann Arbor Township showed gains in home values, while other communities fell from a low of 1.4 percent in Manchester to highs of 13.8 percent in Salem Township, 13.5 percent in Ypsilanti and 13.3 percent in Chelsea.

But overall drops were less acute than in 2009, when 14 communities recorded double-digit value drops - and none improved. That compares to four communities with double-digit drops this year.

The numbers, said Dick Steffen, manager of the county’s equalization department, “are a preliminary report card.”

The percentages are based on the factor municipal assessors use to set assessed values. Those will be sent to homeowners by the end of February before their respective boards of review meet to finalize them.

The county studied property sales, as recorded on deeds during 2009, to determine the values.

“It all comes from the market,” Steffen said.

The market showed, on average, a similar sales volume to 2008 and falling average sales price.

But since the second half of 2009, Realtors and appraisers have reported areas of stabilizing prices - particularly in communities with few foreclosures - which likely is driving the improvements in the county data.

"The last three quarters are the first time we've seen average sales prices trend (up)," said Peter Hendershot, an appraiser with Affinity Valuation Group in Ann Arbor. "It means prices are stabilized or are in the process of stabilizing."

The falling numbers in the county valuation report represent averages across a community. So individual homeowners can expect to see variations in their own assessed values when municipalities send them out by the end of February.

The numbers also show how property values are faring during the recession - and indicate how cities and townships need to budget for future tax revenue.

In Chelsea, City Manager John Hanifan said officials have been forecasting with multiple budget scenarios to prepare for wide swings in value changes.

“Every year when we go through budgeting, we go through different scenarios … and figure out what the impact would be on services,” Hanifan said.

In 2009, Chelsea’s residential value dropped 10.8 percent, equal to the drop in Saline and near the median for the county. In 2010, the value drop is among the three highest.

But Chelsea’s worst-case scenario anticipated a 15 percent drop in revenue, Hanifan said, so it will have a roadmap for making adjustments.

“We’ll adjust the budget accordingly … and do our best to adjust to any budget decrease,” he said.

In Ypsilanti Township, officials watched their community rise to the top among the county’s foreclosure rates early in the recession. They used those numbers as an indicator to prepare for tax revenue drops, said Supervisor Brenda Stumbo.

“We knew we had to reduce expenditures to meet revenue, and that’s what we did,” Stumbo said.

Recent steps include dropping full-time staff to a 32-hour workweek and cutting pension contributions to pension plans for elected officials from 20 percent to 9 percent. Staff also face furlough days.

By next year, the township will be dealing with the closure of the General Motors Corp. factory near Willow Run, Stumbo said. That will add to concerns over erosions in the residential property values, which dropped 12 percent for this year after falling 15.5 percent in 2009.

The numbers are a contrast to the years when the township was among the fastest-growing municipalities in southeast Michigan.

“We used to budget for 6 percent (revenue) growth every year,” Stumbo said. “It’s just a different time.

“… We’re just making the business decisions to make expenses equal to revenue,” she said. “It’s getting really close. But this year is a little better than last year, so hopefully the downward trend has stopped.”

Comments

lefty48197

Wed, Jun 23, 2010 : 3:45 p.m.

This is more good news regarding the housing market and the economy in general. It's not great news by any stretch of the imagination, but it is another positive sign that we are coming out of the economic hole that we've been in for a couple of years now. For the last year and a half there hasn't been any residential construction to think of around here. Now it looks like they're even building spec homes in certain areas. Things are looking up! I'm anxious for the ultimate END of that horrible recession we're coming out of.

confused

Wed, Feb 17, 2010 : 11:15 a.m.

2010 Values are based on sales from 10/1/2008 through 9/30/2009. Assessed Value is NOT what you pay property taxes on. Taxable Value is decreasing this year by the CPI of.997 (last years taxable *.997 = 2010 taxable). Unless you purchased a home, or had new construction your taxable value should drop this year. Has York Township benefited from Toyota moving in out of state workers needing homes?

Chelsea Fellow

Wed, Feb 10, 2010 : 10:37 a.m.

I live in Chelsea, and the city has done a good job of belt-tightening in recent years. But the possibility of a 15% drop in value/revenue in 2010 is pretty daunting. What is the source of the chart in the body of this story - the one captioned 'Changes in Residential Real Estate Taxable Values'? I'm reasonably familiar with the County Equalization website, but this sort of chart/analysis doesn't seem to fall out of the reports there. Especially not in terms of forecasting for this year. Am I missing it? Or is there another place where this information comes from? Thanks for any pointers.

Val Losse

Fri, Feb 5, 2010 : 9:25 p.m.

This is no way to collect taxes for the operation of the government. Property taxes are evil. They keep going no matter what. You can negotiate with a bank but you cannot negotiate with the tax collector even if you have lost your job. Now you will loose your house because you really don't own it paid off or not. Income tax is the real way to pay for government or schools. Having income means that you can pay taxes based on income and not the value of your property which you don't determine. If everyone would pay taxes via income tax the overal taxes paid by an individual or family will decrease because more people are paying.

beaumont_slave

Fri, Feb 5, 2010 : 6:30 p.m.

house values in ypsi township dropping fast yet my taxes havent gone down.. go figure

Subroutine

Fri, Feb 5, 2010 : 5:03 p.m.

I don't know or understand much about real estate, but I can say with certainty that the "market value" of my house has gone down by tens of thousands of dollars, or approximately 40 percent, based on what similar properties in my area sell for now. However, my "assessed value" went down five hundred dollars and the change in my property taxes for last year was negligible. Can someone help me by explaining why this is?

Pat Ivey

Fri, Feb 5, 2010 : 3:48 p.m.

Can anybody explain how York Township rebounded from a 23% decrease (biggest loss) in 2009 to a 3% increase (biggest gain) in 2010?

Top Cat

Fri, Feb 5, 2010 : 2:50 p.m.

We are still two to three years away from seeing the bottom of this market.

Ryan J. Stanton

Fri, Feb 5, 2010 : 11:53 a.m.

Here's a link to the county's equalization website. It's useful for property/parcel lookup, searching individual assessment data and property map data.

Paula Gardner

Fri, Feb 5, 2010 : 9:44 a.m.

Depends on what you mean by "use." The 2010 numbers are the ones that, ultimately, will affect residents' valuations this year. We'll be getting those numbers by the end of this month.

Ralph

Fri, Feb 5, 2010 : 9:24 a.m.

2010 numbers are only based on two months. The 2009 numbers are the ones to use at this time.

Paula Gardner

Fri, Feb 5, 2010 : 9:10 a.m.

This i just municipality - overall, not broken down by neighborhood or school district. The county isn't looking at the school district boundaries for these purposes. The assessors for each municipality then will take the numbers/changes down to individual properties based on the "drill-down" to neighborhood trends.

KJMClark

Fri, Feb 5, 2010 : 8:32 a.m.

OTOH, to get back to the recent Shiller housing index trend of about 110, we have around 20% further to fall for house prices (nationally). We probably are over the fastest declines, but we still have a ways for prices to fall. This chart (http://www.ritholtz.com/blog/wp-content/uploads/2009/06/case-shiller-updated-1024x804.png), at Barry Ritholtz's "The Big Picture", one of the top economics/finance blogs, shows the "big picture" for housing in a chart (http://www.ritholtz.com/blog/2009/07/update-case-shiller-100-year-chart/). Another top blog, Calculated Risk, expects this year to be the year of short sales and walk aways. A walk away is where the owner is so underwater on their mortgage that they decide to hand over the keys to the bank and just leave. That's legal in a lot of states (not sure about Michigan). It affects your credit rating, but that's about it. The NYTimes just had a big article about walking away (http://www.nytimes.com/2010/02/03/business/03walk.html). Short sales are just a sale for less than the mortgage amount. In that case, there's a negotiation between the lender and the owner over who takes how much of the loss. Lenders are often willing to consider that because foreclosure is expensive for them. Here's the Wikipedia page describing short sales http://en.wikipedia.org/wiki/Short_sale_(real_estate), and here's a pdf from the US Treasury describing short sales and the government incentives to lenders to consider short sales (https://www.hmpadmin.com/portal/docs/hamp_servicer/sd0909.pdf) Either way, houses that are currently being withheld from the market are put on the market. That's likely to lower prices some more.

missy

Fri, Feb 5, 2010 : 8:18 a.m.

Is this by school district or overall municipality? If someone lives in Pittsfied but goes to Saline Schools is the evaluation done by township or school district like the MLS?