Ann Arbor officials revisiting city's travel policies after auditor raises concerns

Ann Arbor officials are revisiting city policies after an auditor raised concerns about city employees with vehicle allowances also being able to claim mileage reimbursements.

In the city's recently released audit report for the fiscal year that ended June 30, 2012, the Rehmann accounting firm noted it found three instances in which a city employee was requesting and receiving mileage reimbursements while also receiving a monthly vehicle allowance.

The auditor's letter doesn't name any employees, but city officials have said both City Attorney Stephen Postema and an appraiser for the city claimed mileage reimbursements while also receiving a vehicle allowance last fiscal year and that didn't violate city policy.

A letter from the auditor originally claimed that violated city policy. But upon further review, the auditor and the city's administration are now in agreement the city doesn't actually have a clear policy that prohibits employees with vehicle allowances from claiming mileage reimbursements.

The issue took center stage at Thursday's meeting of the City Council's audit committee. Tom Crawford, the city's chief financial officer, said the issue is being addressed.

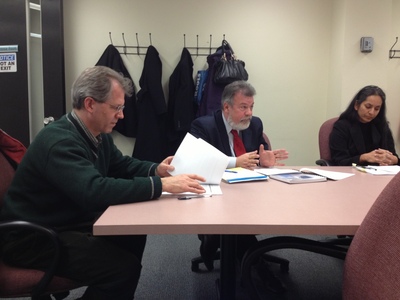

Members of the Ann Arbor City Council's audit committee discuss the city's travel policies with an auditor Thursday.

Ryan J. Stanton | AnnArbor.com

Mark Kettner, an accountant with the Rehmann firm, said based on new information he plans to revise the audit letter to remove the statement that anyone violated city policy.

Commenting on the amount of mileage being claimed, Kettner remarked: "We're talking about small dollars." Nonetheless, he said, the city should establish a clear policy.

"That is really the whole purpose of this," he said. "Is there a policy or isn't there? Does it apply or doesn't it? So there are areas that you need to look at."

Four council members who serve on the council's audit committee were present for Thursday's meeting: Sumi Kailasapathy, Stephen Kunselman, Margie Teall and Chuck Warpehoski.

Kailasapathy asked if she could be assured after the policies are revised that no employee getting a vehicle allowance can claim mileage reimbursements again.

"Not necessarily actually," Crawford said.

Crawford used the example of property appraisers who get vehicle allowances of $200 a month for driving around town on the job. He said that allowance is not intended to cover their costs if the city sends them to a conference out of town, so they still could claim mileage for that.

Crawford said vehicle allowances are used as an efficient administrative tool so busy city employees don't have to waste time filling out mileage reimbursement sheets.

"I don't want my appraisers who have limited time that they can get in to see people … filling out a mileage reimbursement form if I can (compensate them) through an administratively efficient way that's fair, and that's what we've moved to," he said, making a case for keeping vehicle allowances for certain employees and clarifying the circumstances when they can and can't claim mileage.

City Administrator Steve Powers said he's glad to say the city had an essentially clean audit overall, and the clarification on the use of vehicle allowances will be helpful going forward.

The city's administration maintains the few instances where mileage reimbursements were claimed on top of vehicle allowances involved employees who used their personal vehicles to travel to meetings outside the county, and the administration maintains those employees were allowed to do that.

Postema collected more than $1,000 in mileage reimbursements dating back to June 2011 while he had a vehicle allowance worth $330 a month.

Since he wasn't at Thursday's meeting, Postema said he couldn't say much, but he understands all of the mileage reimbursements in question are allowed under city policy.

"Not much more to say," Postema said.

One of the trips Postema claimed mileage for was a trip to the Sixth Circuit Court of Appeals in Cincinnati where he successfully defended the city against a $30 million lawsuit. He called the roughly $250 reimbursement he claimed "just a normal business travel expense."

"Also, pretty good return on the expense, given the result," he said.

Crawford released a report on Thursday stating the city has followed up on the issue and found three trips (one conference and two out-of-town court cases) by Postema and one trip for an out-of-town training event by a city appraiser that occurred during the last fiscal year.

Crawford noted Postema had an employment agreement with the city that included provisions for a vehicle allowance and reimbursement of travel expenses. A review of the city's travel and mileage policy, Crawford said, revealed there isn't clear guidance how to handle these situations.

"A follow-up conversation with the city's auditor determined he was not made aware of the employment contract prior to completing the report and concurs that the phrase 'which violates city policy' should not have been included," Crawford stated in the report.

Crawford said the city's vehicle allowances have been used in different ways. He said some employees are given allowances as standard practice for the work they do on a day-to-day basis that requires driving around the city. Other employees have allowances written into their contracts.

"It's not uniform," Crawford said. "Assuming that an allowance is given to pay for the use of the vehicle when that vehicle is used for city service — we don't have that in a policy."

Members of the Ann Arbor City Council's audit committee discuss the city's travel policies Thursday.

Ryan J. Stanton | AnnArbor.com

"It's just a straight-outright perk," Kunselman said. "No strings attached."

Kunselman said he's reviewed everything and he's confident no city employees were trying to "game the system."

"That would be the No. 1 concern that I have and I don't believe that was happening," he said. "These are policies and practices that have been carried over from a previous administration, so to speak, and we have a new auditor, and so now we are addressing it."

Kunselman said he's not sure he would even characterize it as "double dipping" since it seems the vehicle allowances are intended for "in-area" travel and mileage reimbursements are intended for "out-of-area" travel. He said that's "all logical and fine with me."

Crawford said the issue is not as complex as it seems and the city's system for travel and mileage reimbursement seems to be working, though he agreed the policies could be made more clear. He said the city's administration already has started work on that.

There was some debate Thursday about whether staying overnight on a trip should be the trigger for whether an employee with a vehicle allowance can claim mileage reimbursement. Crawford said that could create a "perverse incentive" for an employee to stay overnight on the city's dime, just to have his or her travel costs covered, when they would not have stayed overnight otherwise.

AnnArbor.com has filed a Freedom of Information Act request with the city for a list of all employees receiving vehicle allowances.

Kunselman said the city already is moving away from vehicle allowances. Postema no longer has a vehicle allowance under his new contract, and Powers hasn't been given a vehicle allowance, a perk enjoyed by former City Administrator Roger Fraser.

"What we're hearing is there's going to be a lot less car allowances," Kunselman said. "As we update contracts … that's phasing out."

Postema's salary was adjusted upward by the City Council in November, going from $141,538 to $144,934. At the same time, his vehicle allowance was eliminated.

Crawford said the city takes the auditor's comments seriously. But the way he sees it overall, the city got a clean audit and has a couple of minor items to address.

Kailasapathy said she's not happy with the administration's response. She still considers it double dipping for employees to get a car allowance and claim mileage reimbursements.

"It needs to be addressed," she said. "The auditors have not backed off. They're going to pull the words 'policy violation' out because we haven't clearly stated when you take a car allowance you should not be also taking mileage. It's not there, but it should not be done."

Warpehoski said he thinks Crawford's plan for addressing the auditors concerns is solid, but he said he can see where someone might have a different interpretation on the policy.

"Tom's recommendation to clarify the policy and make sure we don't have these ambiguities," Warpehoski said, "is a move in the right direction."

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's email newsletters.

Comments

Colorado Sun

Fri, Feb 8, 2013 : 3:42 a.m.

Good for Sumi Kailisapathy in going after Steve Postema. Postema needs to be held accountable. This conduct is appalling.

Jlaw

Tue, Jan 29, 2013 : 1:51 p.m.

As a lawyer generally familiar with negotiated employment contracts, I find it interesting to observe readers who rush to criticize matters they evidently know little about. Many of the comments criticize a car allowance as a "perk", which is apparently a bad thing. What they miss is that a car allowance is simply one aspect of a total compensation package. Car allowances, while taxable income, would typically not be counted as compensation for pension purposes. In other words, Mr. Postema would be taxed for this component of income, but it would be excluded in calculating his pension benefits. Therefore, it likely was a good provision for the City insofar as its characterization reduced pension costs. Such a car allowance is a legitimate way to offset a cost that an employee would otherwise have. A car allowance usually covers a car or lease payment, insurance, repair etc. This amount is intended to offset the cost of getting a vehicle (or partially offset this.) Travel reimbursement is something entirely separate, as it is set forth in the City Attorney's contract. The City Council clearly realized this distinction as they offered and approved the contract, and the City has paid travel reimbursement. Further, here travel reimbursement was paid for out of town court cases and a conference, according to Mr. Crawford's report. I would also echo what Attorney Graham stated above. Mr. Postema is widely regarded as an excellent lawyer by the legal community. His leadership, professionalism and energy are greatly appreciated. Through his work, the City has avoided many of the legal turmoils that other cities in Michigan have routinely faced in the last decade. This is a tribute not only to the City Attorney's office, but also to the City's management practices and the City Council's processes and decisions.

Fred Pettit

Mon, Jan 28, 2013 : 1:59 a.m.

This is so simple. Only in Ann Arbor could this unethical form of double dipping be supported by a reporter and others in the community. It's no wonder that the Mayor continues to rule this city despite the fact that services continue to be on the decline, as do our roads, while his green projects and the DDA continue to flourish along with public art that is contrary to what the taxpayers and voters deem appropriate.

dave

Sun, Jan 27, 2013 : 9:56 p.m.

I write to defend our public servants, and our city attorney in particular. I agree with lawyer Graham and Jon here. A review of the City Attorney's contract shows not only travel for business in one section, but also travel for professional development matters in another section. So a mileage reimbursement to a conference would also clearly be proper. No one should have any problem with this. Any person can just read a copy of the contract and understand the situation. Indeed Mr. Crawford's report demonstrates that the city attorney is entitled to additional reimbursement that was not even requested. So much for "bilking the system" It is too facile to disrespect those who actually engage in public service. I personally know too many good people in government. It is this unwarranted cynicism that discourages people from making sacrifices to go into public service in the first place. I am bothered by some people's cynical and immediate assumption that something wrong was done. Now, it certainly wasn't helped by the inaccurate statement of the auditor here. But any professional auditing firm will simply correct an error,and it seems as this is being done. Mr. Crawford's report and analysis seemed to appropriately handle the situation and makes good suggestions. I'm quite happy to live in a City where the financial "scandal" of the day is that the City Attorney was paid $250 in mileage according to his contract to appear in federal court out of state to defend the City. I applaud the energy of people who want to engage in democratic criticism of those in power and their decisions, but I wish this were more grounded in the boring details of the actual contracts and the relevant if mundane facts. In particular criticizing the City Attorney is unwarranted. As the News reports have made clear over the years, Mr. Postema has done an outstanding job for the city. He deserves our thanks.

Basic Bob

Mon, Jan 28, 2013 : 3:15 a.m.

He is entitled to reimbursement for travel expenses. We get that. He is the highest paid city attorney in the entire State of Michigan. Why would the city also pay him $4000 a year to drive the 3 or 4 miles from his home to the office? The auditor found a problem with the financial management system rather than Mr. Postema's actions. A response to the auditor's concern is warranted.

Greg

Sun, Jan 27, 2013 : 4:06 a.m.

I suspect the outrage many are feeling towards government has nothing to do with petty cash for gas. More likely it is that the salaries are quite high, with benefits many would kill for already. We are always told, we have to offer huge amounts of cash and benefits to get anyone qualified. Sorry, I do not buy this any more as there are thousands who would bust their butts for such pay who are talented and will never get a chance to try.

Jon

Sat, Jan 26, 2013 : 11:03 p.m.

I agree with Attorney Graham that the contract makes clear that there is no conflict at all between travel reimbursement and car allowance in this case and that the contract should have been reviewed first. I'm no lawyer. But it seems pretty simple to me. The city agrees to pay the City Attorney for travel expenses in his contract. The City Attorney travels to defend Ann Arbor in court (successfully). The city pays the City Attorney according to contract. Auditor is unaware of contract. Auditor then realizes that this is actually no violation of City policy either. This is ridiculous....I'm no fan of government spending, but the City Council should probably provide the City Attorney an "absurdity allowance" to put up with such foolishness along with a difficult job. Perhaps that is just part of being a public servant. (The contract by the way is easy to read and attached at the end of Mr. Crawford's report which is linked above.)

Basic Bob

Sun, Jan 27, 2013 : 3:46 a.m.

@Jack, "Crawford said vehicle allowances are used as an efficient administrative tool so busy city employees don't have to waste time filling out mileage reimbursement sheets." Does the city keep their employees so busy that the city does not have to follow federal payroll tax laws (illegal)? Or is the city supplementing wages which council has not approved rather than account for actual expenses (unethical)?

Jack

Sun, Jan 27, 2013 : 2:35 a.m.

@Basic Bob - And your point is?

Basic Bob

Sat, Jan 26, 2013 : 11:43 p.m.

Unless he is able to document work-related travel from his normal place of business (office) to other locations, the travel allowance is taxable by the IRS and State of Michigan as ordinary income on the W-2. Other people are required to keep travel logs as part of an accountable expense plan. City officials are no different - even if it is "hard" or "absurd" it is the law.

Richard T. Graham

Sat, Jan 26, 2013 : 9:18 p.m.

From: Richard T. Graham, Attorney at Law I read with interest the article by Ryan J. Stanton on January 25, 2013 regarding city policies concerning the reimbursement of mileage for city employees and the apparent conflict of that with employees who also have a vehicle allowance. The article singles out City Attorney Stephen Postema unfairly. In this case an audit by the Rehmann accounting firm originally determined that Mr. Postema's reimbursement violated city policy and subsequently determined, after further review, that no such violation occurred but added that there was no clear cut policy that addresses the issue. If the auditor had thoroughly researched the issue before delivering the report (and had actually read Mr. Postema's contract as I did), it would have been clear that the two issues are distinct from each other. Mr. Postema's contract call for a car allowance of $330.00 per month under Section 2.14 and, under 2.2, grants him the right to reimbursement for travel expenses, cell phone expenses, entertainment, and other professional expenses as are necessary in the performance of his duties. One of the alleged violations was a request for reimbursement of $250.00 for mileage when he went to Cincinnati to argue and successfully defend a 30 Million dollar lawsuit against the city at the 6th Circuit Federal Court of Appeals. Let's do the math, folks. 30 Million vs. $250.00 in travel allowances! Give me an another example of a better return for the public's money. Mr. Postema is clearly owed an apology from the auditors and from those respondents to the newspaper article that pilloried him before ever doing their research to see if a violation occurred in the first place,. Anyone who has followed Mr. Postema's career as City Attorney knows with certainty the esteem, respect and admiration that he is held in by the judges and the legal community in this area. The uniformed criticism and vitriol hurled his way was undeserved and unwarranted.

Jack

Sun, Jan 27, 2013 : 2:32 a.m.

Amen!

DennisP

Sat, Jan 26, 2013 : 11:36 p.m.

That sounds very good but what is the $330.00 per month supposed to reimburse? For what other purposes does a City Attorney need a vehicle. It seems that any travel that Mr. Postema does in the course of his business would be reimbursed under the travel clause. I assume the remaining $330.00 then is to pay him for going to and from work from his home, then? Most everyone is expected to pay for their own transportation to and from work. The contract may be legal but that provision is questionable. What is the purpose of an allowance and why should an employee be paid simply to find his way to his place of work? If the allowance isn't for that, then it is for business travel--in which case he is being reimbursed twice for the same expenses. In my mind, it is either double-dipping or an unwarranted reimbursement. My guess is these types of perks are used to enhance salaries that are fixed by ordinances or laws. As for comparisons to private businesses, Mr. Postema's chooses his position. If he feels he can be better compensated in private business, then by all means, go for it. The City does need to be competitive to get good candidates for City Attorney but the position has never seem to go wanting. At the very least, it attracts those who hope to one day seek appointment or election to judicial office.

say it plain

Sat, Jan 26, 2013 : 8:58 p.m.

Wow, I don't often feel that a story about the city being found guilty of possibly problematic practices is much ado about nothing... But I do here! I'd much rather see stories challenging the city's actual policies on so very many things than this non-story...honestly, if this is the only problem the auditors found then the city's doing very well on avoiding violations of its own rules and accounting. Now, if someone could 'audit' how they avoid fixing the streets and how they managed to spend nearly a million dollars on that piece of junk 'art' outside city hall...

snapshot

Sat, Jan 26, 2013 : 5:27 p.m.

I'm more interested in knowing how many times a month folks with car allowances actually are required to leave the office on city business. Is there a policy or some parameters that are applied. It may be more economical to require infrequent travelors to use their own vehicle and pay them mileage. I also would like to know the policy on the use of city owned vehicles being used for personal use or taken home with the employee. There are insurance issues that may apply also. Lots of questions that the city should just volunteer the answers rather than require FOIA to be filed. Lets get some transparency and quit dodging and weaving and hiding behind confidentiality barriers.

Mick52

Sat, Jan 26, 2013 : 1:55 p.m.

Vehicle allowances are usually ridiculous. Often they are given to the people who are paid the most and can afford any car they want, and do not care a whit about how high gas prices get. I think all of them would take the job without a car allowance or just hire someone who will. They are fine for people who are not paid handsomely and have to use their own car for business but that is about it. Serious lack of ethics here when they are taking both auto and mileage benefits.

Stephen Lange Ranzini

Sat, Jan 26, 2013 : 1:22 p.m.

The scope of the internal audit was and still is too narrow and ineffective because it did not detect the many instances where employees are driving city owned vehicles to and from work every day from outside the county.

Mick52

Sat, Jan 26, 2013 : 2 p.m.

And you know of this? I think you should names some names or titles at least. I worked at a place once where that happened under the guise of "well they might be called in to work at odd hours." So what? Lots of people did and those guys were all paid way over the top. They could easily afford any car they wanted. And they rarely responded after hours. I know police K9 officers take their vehicles home. No problem with that. They have the pooch too and can then go straight to a scene without having to stop at the station. In cases like that with other departments, I would have little issue with it, as long as call ins are regular and somewhat of a nature where response is to the location they are needed.

Boo Radley

Sat, Jan 26, 2013 : 1:07 p.m.

I see the usual public employee haters are out in force on this again, blowing this way out of proportion because THEIR money is being stolen by the evil slackers on the public payroll. I don't know anything about Stephen Postema other than he is the city attorney. Why the outrage over his salary and benefits? Let's see a comparison with other attorneys for similar sized governments and with private sector law firm partners. If one has completed a university degree, then gone on to receive a JD, then passed the bar exam and all of the associated licensing hoops, how much salary is reasonable? I want to see an article here about how public employees here in Michigan have given concessions on their contracts, wages and benefits over the last several years. Also paying much more for those gold plated health benefits and pensions everyone envies. Along with drastically cutting the workforce. You read this article and are jumping up to say they are thieves, unethical and criminal tax cheats. Typical ...

Jack

Sun, Jan 27, 2013 : 2:28 a.m.

@snapshot - Really, snapshot? Do you really know what you are talking about? City employees worked for years with radon in the air and asbestos in the ceilings. Further, most have not had a raise in years due to economic conditions. There is no law that prevents the firing of employees who are not satisfactory; a number have been fired. You made that up, I think. It is more difficult to fire if an unsatisfactory employee belongs to a union, as is true everywhere, not just government. For many employees, the pay isn't all that great, but it is a job, it does have benefits and they have family to support; they are grateful to have the job. To quote you, "I suggest you get a fix on reality and stop complaining about how "bad" you have it."

Boo Radley

Sat, Jan 26, 2013 : 9:03 p.m.

Again @Snapshot - Even critical public jobs like police and fire have absolutely been adversely affected by the economy. Michigan now has more than 3600 FEWER police officers working in the state than in 2001. And it is very common for the norm in collective bargaining agreements agreed to recently for no pay raises at all for the life of the contract, to go along with the higher contributions for health care and pensions. Many have taken wage concessions, just like the private sector.

Boo Radley

Sat, Jan 26, 2013 : 8:55 p.m.

Snapshot - "law prevents the firing of goverment employees" that they can only be "diciplined" That is absolutely false. I can't even imagine where you came up with that. I also have never complained about how "bad" I have it, because I don't have it bad at all. I do object to the false representation of how much better public employees have it than private employees and how any public employee who makes a decent wage and has decent benefits is ripping off the taxpayers. We are taxpayers also, so I guess that makes us self-employed?

snapshot

Sat, Jan 26, 2013 : 5:20 p.m.

Boo, I agree that this is a minor issue but yhou should get off your high horse about public employee "concessions". Public employees have far better conditions than private employees. What really irks me is when I hear that "law prevents the firing of goverment employees" that they can only be "diciplined". Must be nice to have a job with no accountability, great pay, benefits, and retirement and not be held accountable for perormance and competence and most of all not subject to the adverse affects of an economy. How many private companies operate at a deficit and still give their employees raises? Government does. I suggest you get a fix on reality and stop complaining about how "bad" you have it.

JRMjr

Sat, Jan 26, 2013 : 1:40 p.m.

A comparable litigator in Michigan with a similar resume to Mr. Postema makes welllll more than double that Mr. Postema makes. That is before you even get to the benefits, the tax treatment of law firms (often partnerships), etc... I 100% agree with you, many are jumping to conclusions here.

Townspeak

Sat, Jan 26, 2013 : 6:30 a.m.

How is this news again

Mick52

Sat, Jan 26, 2013 : 2:02 p.m.

Golly, how could this be news??? Perhaps because is looks like double dipping by a select few people? Duh.

Patricia Lesko

Sat, Jan 26, 2013 : 6:11 a.m.

First of all, this whole situation stinks to high heaven. Here's why: 1. Tom Crawford claims Postema's employment contract allows him to take a car allowance and mileage? It did not in 2010, and was not modified by Council resolution in 2011 or 2012 to include mileage reimbursement. His contract can ONLY be modified by a vote of Council. So, if he suddenly "has a contract" that includes mileage, someone needs to ask where he got it from and when. Then, they need to produce the Council resolution that spelled out that change and when Council voted on it. 2. A2Politico FOIAed Council resolutions related to the amendment of Mr. Postema's contract going back to 2009. Crawford's claim is highly suspect in light of those resolutions. None of them changed the section dealing with his car allowance until 2012, and that was to ELIMINATE the car allowance. Period. 3. In 2006 a different audit firm called out Roger Fraser for double-dipping ($400 car allowance and a request for over $1,000 in mileage reimbursement). That audit firm didn't "revise" its findings. Furthermore, in response to that audit, Tom Crawford assured auditors that "controls" had been put into place to keep the same thing from happening again. Tom Crawford's office has been cited by two different auditing firms and multiple times for sloppy oversight of P-cards (credit cards) issued to city employees, reimbursement of expenses and a variety of other issues related to oversight. This "vindication" of Postema should only spur Council members into asking more questions and demanding proof that Postema's contract was, in fact, revised by a vote of Council prior to June 2011, when he asked for the mileage money on top of his car allowance.

Jack

Sun, Jan 27, 2013 : 3:01 a.m.

Mr. Postema's contract can be found near the end of this link. http://www.annarbor.com/audit_response_letter_012413.pdf

Jack

Sun, Jan 27, 2013 : 2:59 a.m.

Ms. Lesko: "2.2. Employee is authorized to incur such reasonable budgeted travel, cell phone . . . as necessary in the performance of his duties." That is from Mr. Postema's contract. It is in addition to the car allowance. It would seem to refute your rather spiteful analysis.

Blue Eyes

Sat, Jan 26, 2013 : 8:09 p.m.

It's not Crawford's "staff" that needs to be investigated, it's Crawford himself. He's the one who "instructs" his staff what to approve and what to ignore. A database or monthly report of detailed credit card use is way overdue. The abuse has been longstanding and prevalent among the "higher echelon".

JRMjr

Sat, Jan 26, 2013 : 1:36 p.m.

please link to the public contract.

Chester Drawers

Sat, Jan 26, 2013 : 1:09 p.m.

Reminds me of when 'Seinfeld's George Costanza, just before he was fired for misconduct, said to the boss, "Nobody told me not to have sex with the cleaning lady on my desk when I was hired!"

Jay Thomas

Sat, Jan 26, 2013 : 11:49 a.m.

So it's deja vu all over again. Typical.

Carole

Sat, Jan 26, 2013 : 1:33 a.m.

One or the other, but not both. That clearly is double-dipping. And, if they did receive both, they should repaid one or the other.

JRMjr

Sat, Jan 26, 2013 : 1:33 p.m.

what is the logic for one or the other? How are they in the same basket?

cook1888

Sat, Jan 26, 2013 : 1:24 a.m.

Government clamours for taxes to feed itself and the greed knows no boundaries.

JRMjr

Sat, Jan 26, 2013 : 12:57 a.m.

As someone formerly involved in government (and familiar with government audits), I hate to tell an auditor how to do their job, but... doesn't it make sense to read City Policy before saying it was violated? I know that looking through the contracts and familiarizing yourself with the subject matter is a prerequisite for commenting that something is inappropriate. I was surprised to find out in Mr. Crawford's letter that the auditor was not even "aware" of the City Attorney's contract. Yet he opined on terms clearly set out in the contract and agreed to by the Council… Also, travel reimbursement is a totally separate matter from a car allowance, which is taxable income. There is no double dipping (by definition.) Why would you provide both benefits? To attract a top candidate who 1) may have such a comparable government salary and benefit package or, more likely, 2) is in private practice and would face a significant decrease in overall compensation and benefits from such a job change. Mr. Postema has a stellar private sector resume, can handle complex litigation in house, and has a good record as City Attorney. You win a $30M case that he argued himself in addition to countless other suits? Seems a little bit less "outrageous" if you know the facts/circumstances. Just get the auditor to apologize for the mistake (a professional courtesy) and remedy the report and let us all find more important things to focus on...

Indymama

Sun, Jan 27, 2013 : 7:19 a.m.

Sure...just sweep it under the rug, and act as if nothing wrong/misleading happened. It is amazing how the Democrats do this and at the same time provide excuses for unethical pracdtices and also defends the perp!! Greedy government!!

snapshot

Sat, Jan 26, 2013 : 5:10 p.m.

JR.....You're off base....the auditor mistakingly thought that the "standard' fiscal paractices would apply to an established "well run" city such as Ann Arbor. This is a reflection on the city for avoiding and neglecting its fiduciary responsibilities of "establishing" concrete policies instead of allowing amibiquous policies to dominate. So if you were a former government official and aloowed this ambiquoity to persist, then you were remiss in your fiduciary duties.

Mick52

Sat, Jan 26, 2013 : 2:10 p.m.

Well I think you are dead wrong. IMHO there is not such thing as a top candidate who is any more capable than another qualified candidate who will accept the job for one less benefit. I would never vote to hire a candidate who demanded both.

tommy_t

Fri, Jan 25, 2013 : 11:26 p.m.

Whoops! somebody needs re training in pig carving at the Bar B Ques.

Homeland Conspiracy

Fri, Jan 25, 2013 : 11:04 p.m.

How do I get on this GRAVY TRAIN?

Nicholas Urfe

Fri, Jan 25, 2013 : 10:58 p.m.

What would it take to get a database or listing of gas and credit card spending for every single city and county employee, on a monthly basis? I'll bet the taxpayers' heads would explode. How do you know that city employee with an assigned Ford Excursion isn't using it to tow their boat up or snowmobiles north every weekend? It happens. Has anyone checked?

glenn thompson

Fri, Jan 25, 2013 : 10:51 p.m.

Sumi, the CPA, seems to be the only one on the committee that really understands. A car allowance is given as a monthly payment whether or not the employee uses the car for city business. The argument is that the car is used for city business but somehow in these days of smart phones, tablet computers, etc. it is too much of a burden to keep a record of actual use is hard to accept. the car allowance is really a salary boost. To take the car allowance and then request payment for actually using the car for city business is outrageous.

javajolt1

Fri, Jan 25, 2013 : 10:36 p.m.

How many non-public service sector employees (i.e. people NOT paid by the taxpayer) receive a $330 per month automobile allowance from their employer?? .....juuuuuust asking.

An Arborigine

Sat, Jan 26, 2013 : 2:39 a.m.

No one where I work, and I'm fortunate to work for a great company.

a2trader

Sat, Jan 26, 2013 : 12:20 a.m.

I agree with Jack. People who get a car allowance from their employers - - the employee buys the car, pays the payments, maintains the car, and insures the car - get WAY more than $330 per month. Worldatwork's 2011 survey showed an average allowance between $500-$1000 in 2011. Their survey showed almost 40% of mid-level executives got more than $1000. I don't blame Postema for giving up the car allowance. He only needs to drive about 600 miles on business under the current IRS mileage reimbursement to make up the $330.

Jack

Fri, Jan 25, 2013 : 11:54 p.m.

My guess would be quite a few. I know when I worked in the private sector, they did.

Ann23

Fri, Jan 25, 2013 : 11:03 p.m.

"voting IN change" *sigh* I'm 0 for 2.

Ann23

Fri, Jan 25, 2013 : 11:01 p.m.

I've known a few private business employees who had good or decent salaries, a car allowance, free health insurance and probably employer matched (up to a certain amount) 401k's or some other pension/retirement plan. As well as being reimbursed for long distance travel by plane and expenses for hotel and food. I guess driving longer distances instead of flying could justify the extra mileage. But, I tend to think that private businesses, especially the smaller ones, are more careful in weighing their expenses and the benefits and need for them than government is. Private businesses can raise the cost of their services but their individual customers or clients can stop giving them business if they feel they aren't getting enough bang for their buck. And the business wants to make a profit. It's not so easy for taxpayers. The nature of some politicians, uninformed or misinformed voters and government bureaucracy and the size of government can make voting change not as effective as we would like.

javajolt1

Fri, Jan 25, 2013 : 10:39 p.m.

....oh, and a giant taxpayer funded salary, a pension and free healthcare?

Ann23

Fri, Jan 25, 2013 : 10:27 p.m.

Being reimbursed for business travel mileage is standard practice. Having an allowance probably reduces administrative costs and saves time for those who need to travel frequently for their jobs. As long as they aren't charging gas on a company or city credit card also. But, there was no mention of that in the article. I think the question should be whether the city employee's amount of regular business travel justifies the amount they are given for the allowance. Determining this and/or the money wasted in possible cases where the allowance isn't justified may cost as much or more for the administrative time spent. So, only doing only mileage reimbursements may be more cost effective and reduce the ability of city employees to take advantage of taxpayers and the system. Especially if there isn't a consistent mileage history to look at when determining and justifying the allowance. Basically, I think that in order to make an informed judgement, more information than what is in this article is needed.

Ann23

Sat, Jan 26, 2013 : 10:27 p.m.

Thank you!

Stephen Lange Ranzini

Sat, Jan 26, 2013 : 12:57 p.m.

@Ann23: I have an iPhone too. There is a way. FYI, If you hold your finger in the text box long enough and then move your finger to the top of the box, you can read and edit what you wrote, since the cursor will then move up into what you wrote as far up as you want to go.

Ann23

Fri, Jan 25, 2013 : 10:32 p.m.

If that makes sense to anybody. I knew what I was thinking when I wrote it but, reading it almost confuses me. Especially since I missed that I doubled-up on the "only"'s and could have done a better proofreading job. When I type long responses on my iPhone I can't scroll up to see everything I typed.

a2citizen

Fri, Jan 25, 2013 : 10 p.m.

"...Crawford said vehicle allowances are used as an efficient administrative tool so busy city employees don't have to waste time filling out mileage reimbursement sheets..." Do you realize how lame this statement is? The employees get vehicle allowances to cut back on paperwork, then the employees go and fill out paperwork to get reimbursed mileage.

a2citizen

Sat, Jan 26, 2013 : 5:26 p.m.

Ryan, If the vehicle allowance is taxable income then this probably is a non-story. But, this doesn't go on at the federal level.

Ryan J. Stanton

Sat, Jan 26, 2013 : 2:30 p.m.

The appraisers are bouncing from place to place throughout their work days, and according to Crawford, busy work days. He's arguing the allowance makes sense so they don't have to fill out long mileage reimbursement sheets every month; the one trip mentioned that an appraiser claimed mileage for was an out-of-town training event. Just for clarification.

a2citizen

Fri, Jan 25, 2013 : 9:46 p.m.

Ryan, an important question is the reimbursement rate. Is it .555/.565 per mile? It probably is and this does matter to the IRS. "...Crawford said vehicle allowances are used as an efficient administrative tool so busy city employees don't have to waste time filling out mileage reimbursement sheets. Chances are the IRS will consider the allowance taxable income..." Federal employees MUST fill out a reimbursement sheet if they want ANY mileage reimbursements. From the IRS: "...Mileage-rate reimbursements for allowable business travel are excludable from the wages of the employee..." "...Personal commuting between the residence and the principal place of business is considered non-business travel or personal use..." The IRS will probably find the vehicle allowance taxable income. FYI city officials: When the IRS starts looking at your tax records they are not going to just look at travel. Good luck with that IRS cavity search. www.irs.gov/pub/irs-tege/fringe_benefit_fslg.pdf

Mick52

Sat, Jan 26, 2013 : 2:18 p.m.

I like your post A2, especially the part "allowable business travel." That is an issue very difficult to track, whether or not the city is funding personal use of the vehicle. If a city is flush and has no budget problems, fine, but if you are cutting or have cut fire, police, etc and have budget concerns this is the junk that should go first. But no, never cut from the high paid at the top, you cut from the bottom, the employees that have to struggle or suddenly have to look for new jobs. And those who have the most contact with the public.

a2citizen

Sat, Jan 26, 2013 : 2:49 a.m.

Jack, If the vehicle allowance is taxed then I doubt there is an irs issue. But please see my 5:00pm post about receiving both - sounds like logic out of the Joseph Heller classic Catch 22.

Jack

Fri, Jan 25, 2013 : 11:51 p.m.

You seem to be confusing mileage reimbursement with a vehicle allowance. Persons who use their vehicles for city business are entitled to a mileage reimbursement, which they request through the proper channels. There are also a few city vehicles available for use for city business and these can be checked out. In both instances, the mileage is checked. And why are you assuming that the employees are hiding their vehicle allowance from the IRS? I see no reason to do so.

a2citizen

Fri, Jan 25, 2013 : 9:54 p.m.

I didn't mean to misquote Crawford on my cut-and-paste. Take out "Chances are the IRS will consider the allowance taxable income..." from Crawford. That is my statement.

Jaime

Fri, Jan 25, 2013 : 9:23 p.m.

Anyone receiving a vehicle allowance is only entitled to be reimbursed for actual gas expenses. I think the IRS might have an interest.

misty80

Fri, Jan 25, 2013 : 9:15 p.m.

The Question should be if these employees get a monthly vehicle allowance why does millage reimbursement paperwork go through with no problem. There should be something in the system to raise that red flag, it is double dipping and the City should already have regulations for that. There was an embezzlement case over 20 years ago when an employee paid herself for a fake company she created, after that all sorts of new guidelines were created, this is ridiculous!!!!

Jack

Fri, Jan 25, 2013 : 11:47 p.m.

Obviously because there was no clear guidance as to exactly what the vehicle allowance encompasses. Does it encompass vehicle payments so the employee can travel to and from work in a vehicle? Or go to meetings around the city and other relatively closely located sites for meetings, etc.? Clearly, it was never defined and resulted in confusion. As for the embezzelment case, there really is no parallel here. There was no deliberate misuse of city funds. It's a tempest in a teapot.

whojix

Fri, Jan 25, 2013 : 9:01 p.m.

My moral compass isn't determined by Ann Arbor City Policy. There are many people that profit from loopholes and oversights in all walks of life. Whether that's acceptable is up to the individual.

Mick52

Sat, Jan 26, 2013 : 2:19 p.m.

My moral compass insists that if it is going to point me in the right direction, my ship must be tightly assembled, not leaky.

SMAIVE

Fri, Jan 25, 2013 : 8:55 p.m.

The city might not have a clear policy, but the IRS does.

walker101

Fri, Jan 25, 2013 : 8:45 p.m.

Must be nice to get an allowance plus mileage and then write off your car for all the tax credits for business use, I think the IRS would like to see this? They're probably filling up at the yard gratius on the cities dime.

Ryan J. Stanton

Fri, Jan 25, 2013 : 8:45 p.m.

We welcome a vigorous debate about the merits of these payments, but keeping in mind that no one violated city policy, let's try to refrain from loosely tossing around accusations of "stealing" and "fraud" and instead have a more thoughtful discussion about what should and shouldn't be allowed under city policy. For instance, should an employee with a vehicle allowance for day-to-day business travel also be able to receive mileage reimbursement when using a private vehicle to drive to an out-of-county destination as part of their job? Let's talk about why that is or isn't acceptable.

Fred Pettit

Sun, Jan 27, 2013 : 1:09 a.m.

For a reporter I think this statement is pretty naive. I know the city doesn't want you to get your hands dirty and ask the hard questions but Ryan, it's time to put on your big boy pants and do your job. Take off the gloves. Do you report to the Mayor or the City Administrator? Sure seems like it....and so does all of A2.com.....dig, dig, dig...find where the bodies are buried. There are many buried under the memorial built by the Mayor and Fraser that some call city hall. I refer to it as the "Toaster memorial."

RUKiddingMe

Sat, Jan 26, 2013 : 1:45 p.m.

I agree with Ryan. Let's concentrate our focus of fraud and inappropriate capture/usage of funds conversation on the everexpanding and zero-accountability SPARK (which just added multiple staff members: http://www.annarbor.com/business-review/ann-arbor-spark-receives-1-million-in-state-funding-for-new-business-incubator-collaboration-efforts/)

Fred Pettit

Fri, Jan 25, 2013 : 10:20 p.m.

Ryan - It may not violate city policy but it is hardly ethical to do so. If it's not ethical, then what should we call it?

Fat Bill

Fri, Jan 25, 2013 : 8:44 p.m.

How about the city employees who drive city owned cars waaay out of town home every night? I know of at least one who lives near Genessee County and takes home a city vehicle...

Mulberry Bank

Fri, Jan 25, 2013 : 8:43 p.m.

I do not understand why any city, muninciple, or state employees, receive a car, or mileage, or insurance. They get paid. Do your job. just like the rest of the citizens. No need for cars and phones and lunch write-offs. We no longer have the $ for these impossible to validate expense accounts. You get the job. Figure out to get there and bring your lunch. Bah! Humbug!

Jack

Sun, Jan 27, 2013 : 2:12 a.m.

@arborigine - My sincere apologies. I replied via my cellphone with all the inherent difficulties of a small screen. My comment should have been addressed to Mulberry Bank, whose comment seemed to me to reek of feelings of entitlement. To address your overtime question, salaried employees do not receive overtime. As for contributing toward insurance, city employees do and have done so for many years. The only group that hasn't done so is the police and fire and I believe they now do so also to some extent.

An Arborigine

Sat, Jan 26, 2013 : 2:36 a.m.

@Jack-Municipal employees are qualified, hopefully. Who works OT w/o pay? Why has the city cut OT? They can't afford the pay. If OT was not paid, they should be tapping that like other industries with salaried employees. When I see administrative positions being compensated at $65K, I find it hard to believe that they work for less than the private sector. PTO and insurance of course, but pay your share like the private sector, don't expect the taxpayers to fund it when they contribute to their own plans. I'm a citizen, you "service" me and many others. We pay your salary with our tax dollars. Are we the enemy?

Jack

Fri, Jan 25, 2013 : 11:42 p.m.

@Aborigine - So City employees should not only be well qualified for their jobs, work overtime without extra pay, etc., they should also work with lower pay than private employees, no benefits, no insurance, no days off, no dental, no eye care, because they are public employees? To service whom? People like you? Gee, what a privilege.

seldon

Fri, Jan 25, 2013 : 10:31 p.m.

Look, if you want the job done, you pay one way or the other. The attorney gets a vehicle reimbursement, or he gets more salary. When he travels, his employer covers his expenses. They should never be covered twice, obviously, but they should be covered.

An Arborigine

Fri, Jan 25, 2013 : 9:52 p.m.

Yes, but not at taxpayer expense.

seldon

Fri, Jan 25, 2013 : 9:25 p.m.

Private employees at the same level sometimes get these things too.

An Arborigine

Fri, Jan 25, 2013 : 8:38 p.m.

How nice, inflated salary, excellent healthcare coverage, taxpayer-funded pension, free car AND mileage reimbursement. Don't even THINK about asking us for a tax increase!

Carole

Sat, Jan 26, 2013 : 1:21 p.m.

Plus short work period to qualify for retirement -- look at admin who work for only five or six years and received a $40+ yearly salary and full health insurance. No, no.

HB11

Fri, Jan 25, 2013 : 8:35 p.m.

In the case of city attorney traveling to Cincinnati, if he is paying for his own gasoline then I can understand the reimbursement. However, if the a city credit card is also used to fuel the cars of those receiving an allowance, there is a problem.

Jack

Fri, Jan 25, 2013 : 11:38 p.m.

There has never been any double dipping there to my knowledge. Postema certainly did not. My understanding is that he asked for the vehicle allowance to be removed from his contract.

whojix

Fri, Jan 25, 2013 : 8:35 p.m.

Making $144k and still stealing tax money. This is not just shameful behavior, it's FRAUD and should be grounds for termination.

DDOT1962

Fri, Jan 25, 2013 : 8:35 p.m.

Please guv'nor, may I suck on the city's teat a bit too?

Bob W

Fri, Jan 25, 2013 : 8:35 p.m.

Yup, one or the other, not both. How about clawing the money back?

Elaine F. Owsley

Fri, Jan 25, 2013 : 8:25 p.m.

Either one - not both. Have the use of a company car, or drive your own and claim mileage. How simple can it get?

applehazar

Fri, Jan 25, 2013 : 8:20 p.m.

Vehcle allowances are TAXABLE income per IRS rules. Is that practice being done in AA per IRS rules?

DennisP

Sat, Jan 26, 2013 : 2:03 a.m.

It's commendable that you want to ensure that our politicians pay their federal taxes, but I'm sure the IRS is right on that. You're looking at the trees and not the forest. The real issue here is the double-dipping. It's unethical yet Council and this paper seem to get lost in the fact that a policy didn't clearly outlaw what should be obvious to anyone with ethics. Let's just say that an attorney like Postema has a legally ethical obligation under the rules of the State Bar to avoid even the appearance of impropriety. While this may not be clearly identified as against policy, it would seem obvious that if you receive an allowance to use a car that allowance would cover your routine mileage. If you have a special use of the vehicle, you should have to clear that first with your supervisor through a travel voucher that ensures your use falls outside of the intent of the regular vehicle allowance. Double-dipping is unethical--plain and simple.

GoNavy

Fri, Jan 25, 2013 : 8:13 p.m.

Lax oversight, coupled with employees who enjoy their own perks so much they'd never call out another co-worker. Oh, the joys of other people's money.