Many Ann Arbor property owners can expect to see reduced property assessments

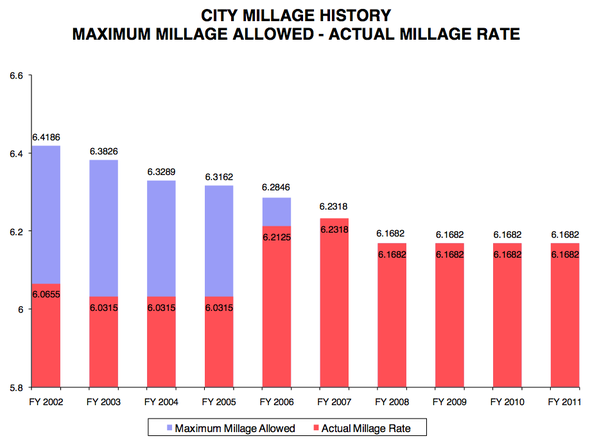

This chart shows trends in the city of Ann Arbor's general operating millage over the last several years. For many years, the city didn't levy the maximum amount allowed under state law, but that's no longer the case.

In the coming days, Ann Arbor property owners will receive their 2011 property assessment and taxable value notification letters in the mail.

City Assessor David Petrak says many residents will see a decline in both figures, as property values continue to go down in Ann Arbor.

So, are taxes going down?

"That's always the complex question," Petrak said, noting property taxes are calculated by multiplying the taxable value by the millage rate.

"Total taxable value is going down — down about 2 percent, I think, is the latest budgetary projection we've been making," he said. "And collectively assessments are going down. But to the individual person, that doesn't mean a whole lot, because there are some neighborhoods where the assessments are going up this year."

City records show total city property tax collections in Ann Arbor grew from $54.1 million to $81.9 million from 2001 to 2010, but growth has slowed in the last few years.

Total taxes netted by the city's general fund in the last three years have remained stagnant at about $51.2 million. And the adopted city budget for 2010-11 estimated general fund tax revenues would go down to about $49.4 million this year.

The city's most recent audit shows the total taxable value (real and personal property) in the city grew from $3.2 billion to $4.89 billion from 2001 to 2009, and then ticked down for the first time in 2010 to $4.86 billion — a drop of close to $30 million. The city's total direct tax rate also has fallen from 17.13 mills to 16.8 mills over the last decade.

Due to the unforeseen effects of Proposal A, many property owners may be confused about the changes in their assessed and taxable values, city officials said.

The city publicly released the following information on its web site today to help explain the factors involved in the sometimes confusing calculations:

Proposal A

In 1994, Proposal A was passed by Michigan voters and was designed to limit the amount property taxes could increase in any given year. The effect was to limit property tax increases by the lesser of the rate of inflation or 5 percent. This held true even in years when there were double-digit property-value increases. This calculation became known as taxable value. Property taxes are calculated by multiplying your taxable value by your millage rate.

Taxable vs. Assessed Value

Taxable value differs from the assessed value. The assessed value represents 50 percent of the market value of a property. In most cases, the taxable value is simply a mathematical calculation based on the previous year’s taxable value because Proposal A limits the annual increase. In many areas in Michigan, Proposal A has created a large difference between the assessed value (half the market value) and the taxable value (amount on which a property owner pays taxes).

Areas that are seeing a decrease in market value will also see a decrease in assessed value. However, this may not cause a decrease in taxable value or property taxes. The Consumer Price Index (CPI) is a measure of inflation. The CPI for the 2011 taxable value in Michigan is 1.7 percent. A property owner’s taxable value will increase by 1.7 percent unless the property’s assessed value is lower than the taxable value. Properties that have a taxable value that is very close to the assessed value and are located in a declining market may very well see a decline in taxable value and property taxes.

The following two examples are provided to help clarify this confusing calculation. Both examples assume a 2010 market value of $300,000 and a 2011 market value of $275,000 with a 2010 CPI of 1.7 percent.

Example 1

2010

Market Value = $300,000

Assessed Value = $150,000

Taxable Value = $98,000

2011

Market Value = $275,000

Assessed Value = $137,500

Taxable Value = $99,666

Example 2

2010

Market Value = $300,000

Assessed Value = $150,000

Taxable Value = $145,000

2011

Market Value = $275,000

Assessed Value = $137,500

Taxable Value = $137,500

Examples Explained

In example 1, the market value decreased, but the taxable value increased by the CPI 1.7 percent because the taxable value is still less than the assessed value.

In example 2, the market value decreased and the taxable value decreased as the taxable value can’t be higher than the assessed value.

For property owners who have owned their property for a number of years, Proposal A created a smoothing effect on their taxes. In years with rapidly increasing property values, property owners saw a limited increase in property taxes. As illustrated in Example 1, it also will mean small increases in property taxes in years where property values are stagnant or declining.

Appeals Process

Taxable value is simply a mathematical calculation and typically can't be appealed. The assessed value is 50 percent of market value and can be appealed if it is believed to be too high. A reduction in a property’s assessed value will not reduce property taxes unless the reduced assessed value falls below the taxable value.

For more information, contact the city assessor’s office by calling 734-794-6530 or e-mailing assessor@a2gov.org, or visit the assessor's website.

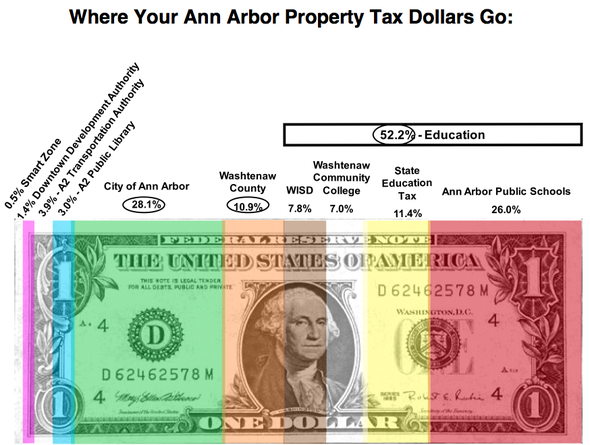

This is a chart included in the city's budget book, showing where each tax dollar an Ann Arbor resident pays goes. Most of it goes to education.

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529.

Comments

EcoRonE

Sat, Mar 5, 2011 : 10:12 p.m.

From the Northville city web page: 2010 Combined City Millage: 15.2296 2010 City Operating Millage: 13.3000 From the AA city web page General Operating 6.1682 Employee Benefits 2.0560 Refuse Collection 2.4670 AATA 2.0560 Street Repairs 1.9944 Parks Maint. & Repair 1.0969 Parks Acquisition 0.4779 Debt Service 0.5000 Total: 16.8164 House with taxable value of $100,000 Northville: 100,000 * (15.2296/1000) = $1,523 or about $127/month Ann Arbor: 100,000 * (16.8164/1000) = $1,682 or about $140/month

EcoRonE

Sat, Mar 5, 2011 : 8:28 p.m.

This debate about Ann Arbor tax rates has been raging forever. Whenever I talk with someone who lives outside Ann Arbor, they think we're elitist snobs who enjoy paying high taxes. The last time I checked, the city of Ann Arbor general fund is fairly typical with it's rate less than many neighboring cities including Milan and Ypsilanti. (Ann Arbor.com should publish a chart showing the general fund rate for cities in the state.) The high cost of property taxes in this city are due to the school/education taxes including WISD and WCC. In the example given by Blahblahblah, a 240,000 market value home costs $450/month in total property tax. About $100 goes to the city general fund. Many people easily spend this and more on TV and phone service each month. I happen to believe I get excellent value for this $100/month. I would argue the other $350/month doesn't provide nearly as much value to me. Note that a significant portion of state sales tax collections also go to education. The fact that people don't understand proposal A but voted it in just goes to show how we are our own worst enemies. As for the chart, any educated person knows to look at the scale on the vertical axis to understand what is being depicted.

blahblahblah

Sat, Mar 5, 2011 : 8:13 p.m.

Wow, I received my assessment today, accessed value increased by 4.88%???? The city was sure slow to lower assessed values and now seems quick on the trigger to be raising them again (we know why of course). So my bank assessed my property 2-3% lower last year and now the city is saying otherwise. I guess it will be back to the review board again.

snapshot

Sat, Mar 5, 2011 : 5:30 p.m.

48.8% of my taxes go to education? And they still need more money? 3% go to the DDA and they are not even subsect to eclectoral influence? And they want a bigger piece of the tax pie? Michigan has one of the highest property tax rates in the states and new milliages just keep popping up each year. Ann Arbor taxes are about 25% higher than state averages. We are an affluent community with much of our employment in, suprise, education and government, and most of those folks live "outside" the city of Ann Arbor. Why? Because the taxes are lower!! This is why we need an Income Tax and a reduction in property taxes.

snapshot

Sat, Mar 5, 2011 : 5:32 p.m.

OK make that "subject" and "electorate"

Old Salt

Sat, Mar 5, 2011 : 12:25 a.m.

That's great but having lived in Ann Arbor for 85 years I know the tax will not go down.

Buster W.

Fri, Mar 4, 2011 : 5:43 p.m.

Does anyone know why we play this game whereby the assessed value is 50% of market? Why not call the assessed value what it really is (market) and just divide the mills by 2?

David Cahill

Fri, Mar 4, 2011 : 4:49 p.m.

This is an excellent article! I hope it appears in the Sunday print edition.

Ryan J. Stanton

Fri, Mar 4, 2011 : 5:05 p.m.

Thanks, David. As I understand, it's on the budget for Sunday print edition.

blahblahblah

Fri, Mar 4, 2011 : 2:49 p.m.

Yes property taxes are too high. When a home valued at approx. $240,000 will cost a city resident around $450 per month in property taxes alone. That is too high a price for many, especially middle class families with children. Luckily the Ann Arbor school district extends far beyond the city's borders, which is where many young families choose to reside.

John Q

Fri, Mar 4, 2011 : 3:58 p.m.

A family can live in the city and get away with having only one car. Try living outside the city and doing that. What's the cost of a car each year? Easily thousands of dollars. People can't afford to pay property taxes to live in the city but can afford a car tax to live outside the city? Sounds illogical to me.

Bob W

Fri, Mar 4, 2011 : 12:54 p.m.

" However, I would like to see a concrete example of how the "TAXABLE" value of a home is actually calculated." Me too! Why is this such a mystery and why can't it be documented for all to understand?

dotdash

Fri, Mar 4, 2011 : 2:57 p.m.

It's not a big mystery. When you buy your home, both taxable value and assessed value are one-half the market price (presumably the purchase price). Thereafter, the assessed value can go up or down depending on how the assessor's office thinks the market has changed. This year, it will be -2% or something, but it could be -10%, 5%, 10%, 25% -- whatever the market does or is determined to have done. Your taxable value would then go up or down as the assessed value did, but SUBJECT TO THE LIMITATION that taxable value cannot rise more than 5% or the CPI in a single year, whichever is smaller. So even if the market goes up 50%, your taxable value cannot go up by more than 5%. Over time, if the housing market rises, your taxable value will grow smaller relative to the assessed value. If the housing market falls (like this year), your assessment will go down by that amount (say, -2% this year), but your taxable value will UP by the CPI (+1.7% this year). HOWEVER, if that 1.7% increase pushed your taxable value over your assessed value, then taxable value would be capped at the assessed value. (This last would probably only happen to houses purchased in the past few years.) The final taxable value is a combination of last year's taxable value, the assessed value, the change in the market as determined by the assessor's office, and the CPI.

Susan Montgomery

Fri, Mar 4, 2011 : 12:44 p.m.

Ryan, I am disappointed in your chart at the top of the page, Ryan. For 2002 actual millage is 94% of maximum allowed millage, but your graph, starting at 5.8, makes it look closer to 42%. This is very misleading and irresponsible journalism. I expect better from you...

Susan Montgomery

Fri, Mar 4, 2011 : 11:56 p.m.

I should add that my intention was not malicious, Ryan. I think highly of your work, as you might recall I mentioned when I introduced myself to you at the Dingell "get out the vote event" at Rackham. I was trying to point out a case in which I felt you could have done better.

Susan Montgomery

Fri, Mar 4, 2011 : 11:05 p.m.

I did mean "irresponsible." As my technical communications colleagues in the UM college of engineering teach our students, graphics communicate information much more powerfully than numbers alone, and it is our responsibility to ensure that the graphic conveys that information accurately. The reader shouldn't have to read the details of the numbers to check the veracity of the data.

Ryan J. Stanton

Fri, Mar 4, 2011 : 5:01 p.m.

For the record, the city made that chart, not AnnArbor.com. And I see what you're saying, but I still don't think it's misleading. When you're talking about tenths of a percent, it makes sense to zoom in to that level. If you read the numbers, I think it's quite clear what it's saying.

Waterdipper

Fri, Mar 4, 2011 : 1:46 p.m.

A bit severe ("irresponsible journalism") - the chart is clear if one takes time to read it... which you obviously did since you noted the baseline is 5.8, not "0". In addition, the data are all there. Granted, one could look at (not read) the chart and visually be misled, but whose fault would that really be? And if you try resetting the chart with "0" as a baseline, you lose the detail at the top. But I suppose Mr. Stanton could have noted in the text that the true ratio of levied vs allowed is over 0.9, just to avoid confusion. Or the graphic could have been made with a "0" baseline, but with a scale break in the vertical axis to retain the detail at the top. But "irresponsible"...no, I don't agree.

a2grateful

Fri, Mar 4, 2011 : 11:27 a.m.

The only thing wrong (if you are a government spender) or right (if you are a taxpayer) with Prop A has to do with definition . . . What is inflation? Prop A limited increases in property taxes to the rate of CPI. This means that tax bills could not rise above the federal government's overall rate of inflation. This concerns the definition of taxable value. The problem is that housing is not included in the CPI calculation. Housing inflation rose meteorically in relation to CPI. Most people thought that their houses were going up in value with higher prices. The opposite occurred. Value of the dollar went down as house prices went up. Case in point: Year one: your house cost $100,000. Year two: cost of an identical neighborhood house was $120,000. The housing price inflated 20%. However, the dollar purchased less house, and had less value. Year one it purchased 0.00001 of a house. Year two it purchased 0.0000083 of a house. The value of the dollar was 17% less the following year. In other words a loaf of bread in year one is $1. In year two it is $1.20. At that rate of inflation, the cost of bread doubles in 4.24 years. This concerns the definition of assessed value. Although this type of tax bill, based on assessed value inflation, might be desired by local big government spenders, it would crush almost every homeowner. Government is being asked to operate with less. This mirrors the situation in the private sector, as we simmer in our current economic stew. As we are forced to make do with less, government needs to do the same. It all boils down to essential service provision versus folly projects. As the combined volume of the holes in our streets approaches the volume of the hole for the Library Lot, this becomes clearer.

Dalex64

Fri, Mar 4, 2011 : 3:23 a.m.

When prop A was passed, the taxable value was set at the assessed value. From there, changes in the assessed value were unrestricted. Changes in the taxable value then track the assessed value, but are limited in how much it can go up. When a property changes hands, the taxable value is reset to match the assessed value. This is how your taxes jump when you buy a home, but your neighbor's doesn't, even when the homes have similar assessed value. As for replacing bookstores with 7-11's, that is up to the people deciding where to spend their money.

UtrespassM

Fri, Mar 4, 2011 : 2:57 a.m.

I live in Ann Arbor, I like the city a lot. But please stop closing book stores to open an 7-11.

Sallyxyz

Fri, Mar 4, 2011 : 1:31 a.m.

"In 1994, Proposal A was passed by Michigan voters and was designed to limit the amount property taxes could increase in any given year. The effect was to limit property tax increases by the lesser of the rate of inflation or 5 percent. This held true even in years when there were double-digit property-value increases. This calculation became known as taxable value. Property taxes are calculated by multiplying your taxable value by your millage rate." "In most cases, the taxable value is simply a mathematical calculation based on the previous year's taxable value because Proposal A limits the annual increase." The above quotes are an excerpt from the article. However, I would like to see a concrete example of how the "TAXABLE" value of a home is actually calculated. The statements above only describe the general rules and the Prop A rule of how TAX INCREASES are limited and calculated. It does not explain how the TAXABLE VALUE is actually calculated to start with. Maybe someone on this forum can provide a concrete example of this calculation using real numbers and not generalities. Using the examples above, why would two houses with the same assessed value of $150,000 in 2010 have two different taxable values that same year (98,000 vs 145,000)?

dotdash

Fri, Mar 4, 2011 : 1:34 a.m.

I think the implication is that one of the houses had been bought recently (the one with the taxable value of 145K). The other had been purchased earlier for less and its taxable value had been held down by Prop A. Both houses were now worth 300K (and therefore had an assessed value of 150K).

Tim Darton

Fri, Mar 4, 2011 : 12:12 a.m.

The Greenbelt is part of the city's 28%.

DagnyJ

Thu, Mar 3, 2011 : 11:59 p.m.

Where's the greenbelt?

bugjuice

Fri, Mar 4, 2011 : 3:52 a.m.

It's the one in which you hide your money.

aajeff

Thu, Mar 3, 2011 : 11 p.m.

Did you ever look at the bottom of your tax bill and see the amount they charge you for an "administrative" fee? I guess in addition to the tax they charge, that's the additional charge for depositing your check!

logo

Thu, Mar 3, 2011 : 9:46 p.m.

Right Drewk: But unless you live downtown and your unit was built recently your tax dollars are not going to pay for the new structure. The point is also that the DDA's TIF funds can't be spent outside of the downtown. The DDA collects only the tax "increment" of new development. The "base" still goes to whoever it would have, the county, the city, etc. Most DDA's also collect the tax increment that would go to schools but not the one in A2. Just about every city and some townships have DDA's. The DDA's mission is to promote economic development and it looks to me like they are doing a fine job. Ann Arbor has one of the best downtowns of any mid sized city anywhere and better than a lot of big cities. A new parking structure is one of the best ways to promote business activity.

drewk

Thu, Mar 3, 2011 : 9:37 p.m.

And where do you think the DDA funds come from. Our taxes of course.

bugjuice

Fri, Mar 4, 2011 : 4 a.m.

Every taxpayer pays a bit more for city operations from the tax money that is apportioned to the DDA. I don't have a problem with that because I think we all benefit by supporting a healthy downtown. Nevertheless, the way it's viewed is that the DDA "costs" every city taxpayer a few dollars by "diverting" some tax dollars for what it does instead of those $$ going to the GF or to lower taxes.

KJMClark

Fri, Mar 4, 2011 : 12:26 a.m.

Unless you live in the DDA, you're wrong. DDA funds come from taxes on properties in the DDA area (downtown). I live in AA, but not in the downtown. My taxes do *not* go to the DDA.

logo

Thu, Mar 3, 2011 : 9:24 p.m.

Theresa: Unless you live in a fairly new condo downtown your tax dollars are not going to pay for the new parking structure. It is being paid for by a combination of DDA TIF (tax increment financing) funds that can only be spent in the downtown and parking revenues. If we want to continue to have an active and wonderful downtown that can attract businesses, a new parking structure was needed. This is a solid way to promote economic development and it also brings in money (from the parking system) paid by commuters who don't live in A2. I am so glad it is underground. I agree with havefun on the overall tax picture. When you realize that 40% of the land is non taxable and the city has to care for a huge park system, they do a good job. I an always amazed the city does it with only 28% of the tax stream. And the schools, while expensive, are top notch.

1bigbud

Thu, Mar 3, 2011 : 9:08 p.m.

Northfield Twp Just Jacked my assessment up by about 10% Last year was also Higher than 2009 My assessment has never gone down I have lived in Washtenaw Co for 40+ years It may be time to complain

a2grateful

Thu, Mar 3, 2011 : 8:55 p.m.

For many homeowners, property taxes are increasing, as house values decrease, and city service levels decrease. This affects long-term homeowners most, including seniors and fixed-income recipients. It also impacts rental property owners, as property taxes increase in an environment of lower rent and higher vacancy. Mr. Stanton: Can you publish the percentage of city properties that fall into the example 1 category above (properties that are incurring property tax increases this year)?

Ryan J. Stanton

Fri, Mar 4, 2011 : 5:25 p.m.

"Mr. Stanton: Can you publish the percentage of city properties that fall into the example 1 category above (properties that are incurring property tax increases this year)?" Unfortunately, the city assessor's office does not track that number.

cjenkins

Thu, Mar 3, 2011 : 10:04 p.m.

a2grateful you are missing the point, these are not investors that ended up paying more tax, these are average residents. I moved here 6 years ago from out of state and paid market rate for my home. I wasn't investing or even trading up in size or price. I never heard about prop A until a year after purchasing my house when I got a tremendous increase in my taxes. I could never understand why my neighbor with a similar house of equal value got to pay less tax than me just because he lived in the house for a longer period of time. IMO prop A was a stupid proposal that penalized recent homebuyers in order to give long time home owners a discount. I did not have cash to burn. I don't think you understand exactly how this proposal has benefited many in the community over the years, while penalizing others.. It is a matter of perspective.

dotdash

Thu, Mar 3, 2011 : 9:46 p.m.

I agree with what cjenkins said: if your taxable amount goes up this year, it is because it was artificially held down in past years. There is no way your taxable assessment will rise to what it would have been if there had been no Prop A (the market rise was much steeper than your "catch-up" amount) so you will still be ahead of your newer neighbors.

a2grateful

Thu, Mar 3, 2011 : 9:46 p.m.

It may appear to be "underpayment" on the surface . . . if you believe that the pre-burst bubble values were correct. Proposal A may have actually let the long-term owners pay the correct amount all those years, while the bubble babies paid their due . . . They had cash to burn . . . to their crash and burn . . . ; )

cjenkins

Thu, Mar 3, 2011 : 9:04 p.m.

It affects long term home owners most because they have been underpaying compared to recently purchased home owners. Prop A allowed them to underpay for many years. This is not a tax "increase", it is a tax realignment.

bugjuice

Thu, Mar 3, 2011 : 8:49 p.m.

We cannot continue to rely on property taxes alone to foot the bill. Declining values and property owners, particularly single family owners who cannot afford tax shelters and accountants, getting tired of being sucked dry are two reasons that come to mind.

cjenkins

Thu, Mar 3, 2011 : 8:48 p.m.

Keeping in mind that you pay property taxes on what property is WORTH and not what you initially paid for it: Proposal A has been giving people a decrease or to put it another way a discount on their taxes all these years. This discount benefited people who remained in their homes while property values were skyrocketing, their taxable value was always LOWER than their assessed value. However this is not true for new (as in more recent) home buyers. Anyone who has purchased a home during the real estate boom (before the market crash) can tell you that this decrease/discount goes away for the new owner. The new owner of the house paid the going rate of the taxable value EQUALING the assessed value. There was a financial tax benefit to staying put in the same home throughout the 90's and early 00's. People really need to see this as a discount that is going away rather than an increase in their taxes. Having bought a home right before the market crashed, I have always felt penalized that I was paying a higher tax rate than others who owned an equivalent house in value, just because I did not live there for the previous 10 years. Now that home values are falling, this discount gets smaller each year until the tax assessment is equal to someone who has newly purchased a property. There has not been a tax increase for anyone; people are just realizing that their discount is disappearing. I am fine with the tax rate for Ann Arbor. Ann Arbor has a lot of good, quality services that I appreciate, especially since I have lived in other places that did not have them.

Edward R Murrow's Ghost

Sat, Mar 5, 2011 : 1:23 a.m.

@forever27: The escrow account bit is a racket. After my second re-fi, where, for the THIRD time with THREE different banks, they had mis-calculated the amount that needed to be in escrow (and it was THEIR fault--had nothing to do with the minor increase in assessed value), I told the mortgage holder to either let me pay my own taxes or I would take my business elsewhere. They did, and that was the end of the problem. And, as i say, it's a racket--they have your money and are investing it until the taxes are paid--it's why they really don't like to go into negative balance even if, in any given year, you're going to pay enough to cover your taxes. They want a positive balance, always!! Last point: for the first time in three years my assessment went up this year. I take that as good news all around--my property value is finally going up again, and cash-strapped governments are going to see more revenue. I am more than happy to pay the resultant increased bill. Good Night and Good Luck

cjenkins

Thu, Mar 3, 2011 : 9:09 p.m.

I am for the city income tax and believe that many people who live in the city are too. However the sales tax and UM ticket tax are against state law so neither can be considered as far as I know.

bugjuice

Thu, Mar 3, 2011 : 9 p.m.

All the more reason to spread the tax "pain" around to a wider constituency. i.e. Income tax, sales tax, UM ticket tax, etc.

Forever27

Thu, Mar 3, 2011 : 8:54 p.m.

As someone who bought a house in 2008, that was a rude awakening when we got our adjustment last march. The problem was that because we have an escrow account for our taxes, we didn't find out about it until almost 8 months later (the end of the calendar year) that our tax payments weren't enough. The result was an increase in our monthly payment by hundreds of dollars. So, long story short, new homeowners get hit harder by this amendment.

A2K

Thu, Mar 3, 2011 : 8:04 p.m.

Is special ed rolled into the general "Public School" portion of the graph? Either way, 52% for education - wow! WCC is the only one that seems to be a great return on investment, but I am in danger of digressing. I seethe every time I get the Dread July property tax bill in the mail...steady increases every year! It was easier to deal with when it was split evenly...but alas, no more. Don't even bother with the "Reassessment" board at the courthouse, it's a joke. They'll smile, nod, glaze-over, and make your SEV = Taxable Value - and VOILA, a tax increase even if your house lost 50K in value. The state Tax Tribunal is backlogged for over a year, and you have to PAY to fight your increases anyway (It's like trying to get blood from a turnip.) but somehow the city is broke. Hmmm!

havefun

Thu, Mar 3, 2011 : 8:02 p.m.

I voted "no" on the poll. There is no question that the property taxes in Ann Arbor are high. However, If you look at where the money goes we are getting a good value. The public schools are outstanding, WCC provides a quality low cost post secondary option, the city takes care of business(fire, police, etc) and our library system is incredible. If I was paying a lot for subpar services then I'd say property taxes are too high. That just isn't the case. Ann Arbor is a great town and quality services don't come cheap.

Theresa Taylor

Thu, Mar 3, 2011 : 7:58 p.m.

Considering that we actually pay LESS than Ypsilanti and some Milan residents, I do think that our property taxes are not too high...however I would like to see priorities set, as well in regard to Safety, Education (WHY I bought a home in Ann Arbor) and some public services such as snow removal. I don't like funding needless, gluttonous parking structures...WHERE our tax dollars go is something I've been growing more and more concerned about, as an Ann Arbor resident.

Bertha Venation

Thu, Mar 3, 2011 : 9:30 p.m.

I'm with you, Theresa, and I'm sure there are several others!!

dotdash

Thu, Mar 3, 2011 : 7:51 p.m.

Our tax spending should reflect our values, so I don't mind being taxed for education. I hope every tax payer is proud of the things that their dollars bring to others. Safety. Education. Protection. Libraries. Snow-free streets (okay, not so much). But still -- we should be proud of our community.

Forever27

Thu, Mar 3, 2011 : 8:51 p.m.

I agree 100%. also worth noting, when it comes to property value the most influential factor will be surrounding schools. So, for the people who think that because they do not have children in the school system, that means that they don't have a vested interest in keeping schools in good shape, think again.