Ann Arbor residents win about 43 percent of property tax assessment appeals

But what are your chances of winning an appeal and getting your assessment lowered if you live in Ann Arbor?

Maybe not as bad as you think.

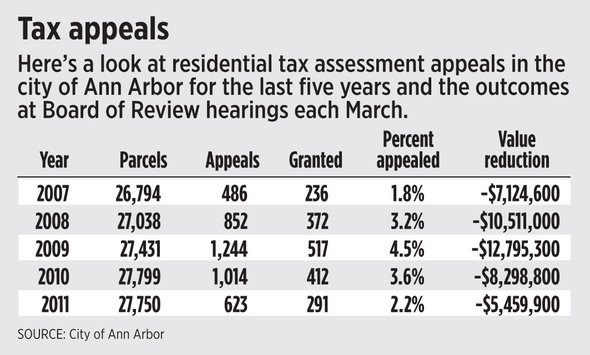

An AnnArbor.com analysis of outcomes from the city's board of review hearings for the past five years shows residents win their appeals about 43 percent of the time.

Out of the 4,219 residential appeals between 2007 and 2011, residents were granted the adjustments they sought on 1,828 occasions.

But only a small percentage of residents ever take that step.

There are 27,750 residential properties in the city, and typically only 2 to 4 percent of those are the subject of an appeal each year.

"It's a small percentage that are actually appealing," said City Assessor David Petrak, noting many of those are people coming in with good evidence they were over-assessed, such as recent homebuyers or people who recently refinanced their homes.

"I wouldn't want to characterize it that if everybody in the city came in, 43 percent would get a reduction," Petrak said.

Last year, there were 623 residential appeals and 291 were granted. That amounted to a $5.5 million downward adjustment of the city's total taxable value or $18,763 per property.

City officials say that's a drop in the bucket when considering the city's total taxable value hovers just above $4.6 billion.

Mayor John Hieftje, who gave up a career in real estate to become Ann Arbor's mayor a decade ago, said he thinks the city assessor and the city's board of review do a good job.

Ryan J. Stanton | AnnArbor.com

City officials are expecting a large number of appeals again this year as the city forecasts a 0.7 percent uptick in tax revenues, which means many can expect higher assessments.

The assessor's office breaks the city up into different neighborhoods and conducts sales studies for each neighborhood to determine assessments.

Petrak didn't have neighborhood-by-neighborhood data to share on Friday afternoon, but said some neighborhoods are going up and some are going down. Overall, he said, the assessed values across the city are increasing a little more than 2 percent collectively.

The new assessments will be used when the city sends out tax bills in July, and the collections from those bills provide revenue for the city's next fiscal year starting July 1.

Tom Crawford, the city's chief financial officer, said general fund property tax revenues are projected to come in $600,000 higher than expected this year.

"The bottom line is we're thinking tax revenues are going to be up like seven-tenths of a percent," Crawford said. "These are good estimates. We are expecting to be up 0.7 percent total in taxes, and that's compared to a minus 0.3 percent we had planned."

Crawford called that a "mild improvement," but an improvement nonetheless.

For residents interested in appealing their assessments, the city will hold board of review hearings over four days from March 19 through March 22.

The hearings take place inside city hall from 9 a.m. to 4:30 p.m. the first two days, from 1 p.m. to 9 p.m. the third day, and from 9 a.m. to noon the final day.

Residents should appeal in person or send an authorized agent. Residents unable to appear in person can submit a written appeal by noon March 22.

City officials warn that claiming your property taxes are too high and continue to go up is not a valid basis for appeal. To have a valid basis for appeal, you need to provide evidence that indicates the assessed value of your property is in excess of 50 percent of true cash value, and that requires some research and fact-finding on your part.

"The best cases are ones where they have some comparable sales that indicate a value that's less than the market value we have on their property," Petrak said.

Because commercial property owners can appeal directly to the Michigan Tax Tribunal, the city's board of review doesn't see many of those cases. Last year, there were 77 commercial appeals to the board of review and 15 reductions were granted.

Tom Crawford, the city's chief financial officer, said people coming before the city's board of review are appealing their assessed values, not their taxable values, so their property taxes don't automatically go down if an appeal is granted.

Ryan J. Stanton | AnnArbor.com

"For the people who successfully appeal, that doesn't necessarily translate into a savings in taxes because the tax savings aren't achieved until the assessed value drops below the taxable value," he said. "Taxable value is less than assessed value in a lot of cases, so it depends on whether assessed value went down enough to hit the taxable value."

According to the city's website, board of review appointments typically last six minutes, but it could be 12 minutes if three or more properties are involved.

Members of the board of review are citizens appointed by the mayor, with City Council approval, and are not employees of the city.

Residents are required to first protest before the board of review. If unsatisfied with the board's determination, they can appeal to the Michigan Tax Tribunal.

Residents who want to go the extra step have until July 31 to appeal to the Michigan Tax Tribunal, while commercial property owners have until May 31.

Mayor John Hieftje, who gave up a career in real estate to become Ann Arbor's mayor a decade ago, said he thinks Petrak and the city's board of review do a good job.

"I know David closely follows every rule that is laid down in Lansing and he's pretty strict about it," Hieftje said. "And I think there are good people on the board. If that high a percent of people are getting relief, that shows they're really listening and paying attention."

To handle the large volume of appeals that came with the downturn in the economy, the city in recent years has established two separate board of review panels.

Hieftje noted that among the members are local appraisers, a University of Michigan regent with a legal background and a member of the city's Historic District Commission.

The board of review members listed on the city's website are Katherine White, Paul Herndon, Robert White, Timothy Somers and William Brogan.

Hieftje said he stays out of the assessment process as mayor, but he did field a call from an Ann Arbor resident recently who is "really fired up" that she's being penalized for installing solar panels on her property, which increased her assessment.

Hieftje said it's his understanding it's state law that solar panels are considered an addition to the property, and that increases the assessment. He said state Rep. Jeff Irwin, D-Ann Arbor, has introduced legislation so solar panels won't increase property assessments, but there isn't the political will in Lansing right now to take up the issue.

Stephen Ranzini, president of University Bank in Ann Arbor, said it's been his observation that the city over-values many properties and the board of review fails to be an effective watchdog protecting the citizens.

University Bank hired a lawyer and took the city to the Michigan Tax Tribunal to get an adjustment, which Ranzini said cost $16,000 in legal fees. He said the bank eventually settled with the city for a new assessment that valued the property at $2.1 million.

"Based on what I hear from our customers, this is a pretty typical experience, spending $5,000 for an appraisal and $16,000 on legal to reduce your property tax bill to close to what it ought to be," Ranzini wrote on AnnArbor.com. "From my point of view, the whole point of the effort by the city is to grind you down and make it hard to get a fair assessment."

Hieftje said he's happy with the board's performance and thinks the fact that Ann Arbor residents are granted their appeals nearly half the time is good.

"People do get relief at a fairly good percentage," he said. "It's not as if they're saying no to everybody. It sounds to me like they're digging into it and doing their work."

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's email newsletters.

Comments

HappySenior

Mon, Mar 12, 2012 : 10:54 a.m.

In college (1970s), I took a course on government accounting taught by a local tax assessor. He made the comment that cities decide on the budget they want to spend. Then, using the tax millage in effect, they divide to find the total assessment they need to generate that amount of revenue. The assessor "spreads" the necessary assessment around the various properties. The teacher kept a straight face and insisted that this was procedure when questioned by the class. Okay, I still have my doubts, but not everyday.

Me

Mon, Mar 12, 2012 : 2:59 a.m.

We took our tax appeal to the MI Tax Tribunal and won. While I agree with Stephen Ranzini that the City's approach is to obstruct, I expect that. The City is poorly financially managed, spending large amounts to put in expensive retaining walls alongside the new Washtenaw Ave sidewalk and million-dollar artwork at City Hall, at a time when revenues are down. When a body such as this lacks fiscal restraint, they must continue to fleece a major source of revenue, the property owners. Clearly, the City should diversify its avarice, and put forth a proposal for a city income tax, so that those who come to work in Ann Arbor would actually start paying for the services that they help consume. As the University continues to consume more property (remember that property-tax paying behemoth, Pfizer?), the burden of property tax payment will continue to fall on a smaller proportion of city dwellers. Vote for city income tax, which would necessitate a proportionate reduction in property tax!

Southern Experience

Mon, Mar 12, 2012 : 2:04 a.m.

The assessor needs to be an elected official which is very common in other cities outside of Michigan.

snapshot

Sun, Mar 11, 2012 : 11:28 p.m.

There is also the problem of the assessor "reinstating" the original value that was appealed and lowered in many of those 43% properties as a matter of "routine". I think an official audit should be required to ensure the assessor is doing a good job. Has the mayor performed such an audit to give credence to his statement, or is he playing the "good ole boy" network game of you scratch my back, I'll scratch yours.

snapshot

Sun, Mar 11, 2012 : 11:24 p.m.

I agree with Ranzini, that the assessor is habitually inflating values of Ann Arbor properties. In addition, my research and personal experience indicates that properties are not re-assessed properly when sold. When properties are sold the assessed value is "uncapped". After years of ownership the "uncapped" value can be twice as much as the market value and unless the new owner appeals the uncapped value stands. I believe this is not in compliance with Lansing's laws. Just as the assessor is required to increase values he is required to decrease them when properties are sold, without the new owner appealing.

Richard Wickboldt

Sun, Mar 11, 2012 : 9:23 p.m.

Maybe it is just time to have a citizen revolt. Also maybe we need to get petitions going to rescind some of the frivolous taxes... like greenbelt for one. I also still don't understand why we have to pay for NAP to do burns and kill weeds which just grow back like they do in our gardens. What we need is an income tax!

Irwin Daniels

Sun, Mar 11, 2012 : 8:44 p.m.

To me personally, the local tax board already has their mind made up, we moved in 2005 and have gone in front of the tax assessment people with tons of data and we get denied every time. They don't seem to look at facts other than we paid "x-amount" for our house so it must be worth that much. If the city of Ann Arbor really thinks our house is worth as much as they do, find me a buyer at what you say and I will sell in a heart beat. However, it is not their job to find a buyer - I understand that but we did put our house on the market and no one is offering 1/2 of what the city thinks. Look at the numbers from the chart, you have almost no chance of winning and we don't have enough money to take this to the tax tribunal. So sooner than later we drown in housing over taxation.

Val

Sun, Mar 11, 2012 : 6:01 p.m.

Why should any government have the right to tax your home? The value of your home is based on how much someone else is willing to pay. It has nothing to do with an assessor who has a magic wand so that they can determine what someone is willing to pay for your home when you are ready to sell. There should be no property tax. Property taxes in Ann Arbor are controlled by people who own no property, renters and University students who out number we the property owners. Property tax is based on economic conditions at the time of assessment. Here is a tax that is not based on your income and ability to pay. I cannot imagine what it would feel like to own my own home and not be under the threat of the government coming one day and taking my home because I was unable to pay the EVIL PPROPETY TAXES. Just imagine having worked and retired and really owning your home, really, REALLY, REALLY owning your home. No more sleepless nights if you couldn't pay property taxes. By the way, everytime the City buys a piece of property for the green zone it is lowering the property taxes to farm value. Guess who picks up the difference? Less then half of Ann Arbor is taxable. So half of Ann Arbor is living off the property owner. How fair is that??????

Are you serious?

Sun, Mar 11, 2012 : 5:03 p.m.

This is an uninformative headline. It should real "Of the 1% of AA property that is appealed, less than 1/2 of the 1% are approved to some extent." The headline as written in no ways indicates the substance of the story. The only way this system is going to change is if many more people appeal their assessments. Only then will the city (and the other taxing authorities in the county) begin to come to their senses. Anyone who appeals to their local authority is almost always going to get denied. The only way to get relief is to appeal to the Tax Tribunal. There are some jurisdictions in the county that will agree to reduce assessments rather than have to spend time and money going to the tax tribunal. I have first hand knowledge of a number of those who after being denied were made deals by their assessor. Don't give up the fight!

dotdash

Sun, Mar 11, 2012 : 2:54 p.m.

We bought a house from owners who had already filed a petition with the Michigan Tax Tribunal for the previous year. The year after, we appealed our assessment based on the purchase price of the house, which seemed persuasive to the Board in Ann Arbor (kudos to them). The Michigan Tax Tribunal, however, only lowered the previous year's assessment by a third of the distance to the purchase price. I guess they thought the market had been completely fine up until hours before the sale. It was pretty outrageous and completely unfair to the previous owners. I understand the cynicism people have toward that Tribunal.

russellr

Sun, Mar 11, 2012 : 1:50 p.m.

What in the world does this city spend on $39,000,000,000 a year???? They need to get a financial manager to find out why taxes continue to go up every year and wages go down or stay the same. Also property taxes go down every year. Please tell me why the assessor lives in Brighton?????

YpsiLivin

Sun, Mar 11, 2012 : 11:26 p.m.

Perhaps the assessor *likes* the commute along US-23.

countrycat

Sun, Mar 11, 2012 : 2:18 p.m.

Could it be that the assessor lives in Brighton because he knows taxes are too high in AA because he's overinflated the assessments?

havefun

Sun, Mar 11, 2012 : 1:25 p.m.

The appeals system is seriously flawed. Two years ago, I had a current appraisal(due to a refinance) from a reputable appraiser that indicated my SEV should be $107,500 as opposed to $112,000. I "won" my appeal and got my SEV dropped to $110,000 which coincidently was just high enough to have no impact on my taxable value. Based on Ranzini's comments this is a common and seemingly arbitrary practice. Seems like this could be grounds for a class action lawsuit against the city. The most frustrating part is that the new SEV($110, 000) is only temporary. The following year, the tax assessment formula is based on the original $112,000 SEV and the previously adjusted SEV is completely forgotten. Unless, you appeal again. In other words, the only way to get a successful appeal to stick is to appeal every single year there after.

Meral

Mon, Mar 12, 2012 : 12:16 a.m.

why does city of AA hires people work in AA BUT does not live in AA?

Brad

Sun, Mar 11, 2012 : 1:09 p.m.

Ryan - any idea of the state-wide success rate of appeals?

countrycat

Sun, Mar 11, 2012 : 2:17 p.m.

I too would like to know if AA has an exceptionally high appeal success rate and therefore that original assessments are historically too high and this is possibly because they know few people appeal them and they can get away with it.

Richard Wickboldt

Sun, Mar 11, 2012 : 12:56 p.m.

The city assessor office should do a better job of assessing properties. Once they have over assessed it is up to the owner to take plenty of time and sometimes money for proper resolution. Clearly the methods and rules for assessment are not effective. I refinanced my home this past spring which required assessing the value of the home. These days lenders aren't over assessing. The city over assessed the value of my home by 19%. I consider this a gross error by the city. Now I will have to take my precious time to get a proper value on record with the city assessor. Time which could be spent with my family and friends.

gsorter

Sun, Mar 11, 2012 : 12:54 p.m.

I agree with Mr Ranzini. We recently purchased a property in Monroe county that has an assessed value TRIPLE what we paid for the property. We quickly found out that our purchase price was pretty much irrelevant to the assessed value. Many people do not realize this to be the case. We came up with comparables, went to the review board, and were promptly told the tripled value would stand. The review board really has a vested interest in keeping values high. I am happy to say that we recently got a docket number with the State tax tribunal, and if we win, will retroactively get a property tax reduction. I offered to settle with the review board for DOUBLE the purchase price, but that wasn't enough for them. It should not be that difficult to have a reasonable SEV.

Bcar

Mon, Mar 12, 2012 : 11 a.m.

good luck, having just gone through this last year. make sure you normalize your comparables based on upgrades, property differences etc.

Brad

Sun, Mar 11, 2012 : 12:48 p.m.

"If that high a percent of people are getting relief, that shows they're really listening and paying attention" Really? I'd ask the question: "Why are so many Ann Arbor property assessments so high that people are being driven to seek correction by the board of review?". Mr. Mayor - any chance that *you'll* ask that question?

Alan Goldsmith

Sun, Mar 11, 2012 : 12:35 p.m.

"Mayor John Hieftje, who gave up a career in real estate to become Ann Arbor's mayor..." That's a very diplomatic way of putting it. Lol.

pseudo

Sun, Mar 11, 2012 : 12:33 p.m.

I think strong trustworthy and reasonable government is the best most efficient way to deliver services and make appropriate decisions for the public good. BUT that belief gets shattered when the government involved is clearly STEALING from its citizens by using its legal authority. This is a case where the city and its assessors are clearly over charging. The process one has to go through to defend their property (and wallet) is cumbersome, expensive and time consuming. Citizens should have more than a painful appeal process at their disposal to defend themselves from this overreaching government. It may be that if the city if found to have over-assessed a property's value that the property owner should 'win' more than just an adjusted tax rate. The city should pay a penalty back to the property owner to compensate them for the trouble they were put through - say a years worth of taxes?

Stephen Lange Ranzini

Sun, Mar 11, 2012 : 12:20 p.m.

From my point of view the city forces too many citizens into the Michigan Tax Tribunal, where they use various legal tactics to grind you down & make it hard to get a fair assessment. The article has no statistics on how many appeals have been filed with the Michigan Tax Tribunal, and how many of those citizens who appeals had any amount of reduction in their assessment. Those are the statistics we need to see. "residents win their appeals about 43 percent of the time" What does "win" mean? Does it mean 43% of citizens appealed had some reduction in value, but then how many people appealed to the Board of Review with a certified appraisal in hand and the reduction was granted but the result was an assessed value amount *higher* than what the appraisal said? It's been my observation based on our customers' experiences (I can't talk publicly about experiences of the bank's customers so I related a story about the bank's own experience) that the Ann Arbor City Board of Review fails to be an effective watch dog protecting the citizens and doesn't reel him in as often as is required. If they were doing an effective job, few appeals would be successful at the Michigan Tax Tribunal. I believe that our Mayor, who since he used to be a Realtor ought to know better, should do a better job making appointments to the Ann Arbor City Board of Review, and the people serving there should be more willing to stand up to the assessor (who by the way lives in Brighton). The point of the board isn't about maximizing the city's revenue but about ensuring that people's property assessments aren't too high or too low, so that they pay the fair amount of tax that they are supposed to pay. If they were doing "a good job" as our Mayor asserts, very few citizens would be forced to go to the Michigan Tax Tribunal.

Mr. Me

Sun, Mar 11, 2012 : 10:50 a.m.

Whenever there's paperwork, a surprising minority of taxpayers overpay. Last I checked, it was 7% of people who file federal income tax. Similarly, I'm sure there are a lot of people in AA whose assessments are too high but who don't know or don't bother to do the research and file an appeal. I'm surprised the appeal rates aren't higher with the real estate market in the doldrums.