Businesses like tax change but will it create jobs in Michigan as the burden shifts to individuals

Tommy Brann -- owner of Tommy Brann's Steakhouse and Grille near Grand Rapids and whose family owns restaurants in Muskegon, Portage, Northville and Macomb -- says Gov. Snyder has created an atmosphere of confidence in which job providers feel they are appreciated.

Rex Larsen | The Grand Rapids Press

Related stories:

-- Q&A with former State Treasurer Robert Kleine: Tax shift to individuals will hurt economy

-- Q&A with Lt. Gov. Brian Calley: New tax structure will make Michigan more competitive

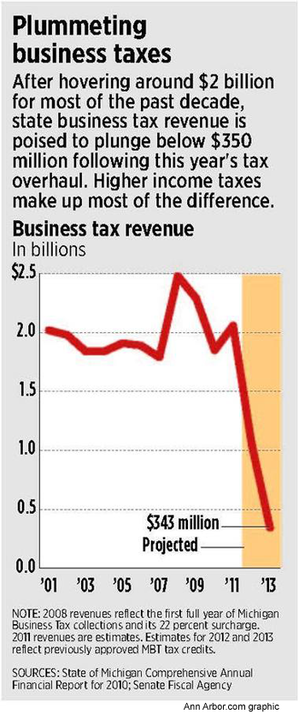

Inside 26 pages of a recent government report, one finds the true scale of Gov. Rick Snyder's business tax shift.

Next year, it will be half that much, a July 1 analysis by the Senate Fiscal Agency found. And the year after that, business tax receipts will fall to an estimated $343 million - an 83 percent drop from this year - as the full scope of the recent tax overhaul takes effect. That's less than taxes gained from cigarette and alcohol sales.

To be sure, the amount is driven down by $500 million in development incentives approved before Snyder even took office. Those credits will eventually expire over a number of years.

But the estimates illustrate the size of an overhaul Snyder and the Republican-controlled Legislature accomplished in less than five months.

It ends the Michigan Business Tax (MBT), criticized by some as a jobs killer almost since the day it was enacted in 2007. Starting next year the tax on corporate receipts and profits will be replaced with a flat 6 percent income tax only large corporations with shareholders will pay.

Nearly 100,000 businesses will no longer owe any state business taxes, a $1.6 billion cut the first full year even with the new corporate levy.

But a fundamental question remains. Will this create jobs?

Many small business owners say yes.

“This unleashes us,” said restaurant owner Tommy Brann, whose family operates nine restaurants, most in the Grand Rapids area but also Muskegon, Portage, Northville and Macomb.

Ending the MBT will save $46,000 a year, Brann said, money that likely will result in adding to the company’s 700 full and part-time workers.

“It’s a new atmosphere of confidence by a governor who appreciates job creators,” he said. “Michigan’s right back in the ballgame for us.”

Former state treasurer Robert Kleine is doubtful businesses will pour the extra cash into hiring. He noted a raft of tax benefits for individuals are being eliminated or reduced.

“This (business tax) money is less likely to end up back in the economy than the funds from the tax breaks for individuals that have been eliminated,” said Kleine, who served under former Gov. Jennifer Granholm.

Even some business leaders are skeptical.

“It might catch the attention of other businesses around the country and move us up a lot in the rankings of state business taxes, but I don’t think it will have that big of an impact” on job growth, said Charles Hadden, president of the 3,000-member Michigan Manufacturers Association.

How Michigan ranks

If Michigan’s new corporate-specific tax were in effect now, the state would rise to 13th in overall business tax climate and to 22nd in corporate taxes, the foundation said. Partnerships, sole proprietorships, “S” corporations and limited-liability corporations are exempt.

Still, rankings are relative.

“We’re in the middle on this,” Hadden said. “Half my members will pay less, 25 percent will pay about the same and 25 percent will be paying more — a lot more.”

Michigan automakers, which are leading a manufacturing-fueled economic recovery in the state, offer a mixed assessment of the tax overhaul’s potential impact.

General Motors Co. said it will see a “slight increase” in state business tax liability — it wouldn’t say how much more — but supports the move to a flat corporate income tax.

“A clear, straightforward corporate tax structure should help make the state a place where more companies want to invest and grow,” GM spokesman Jim Cain said.

Ford Motor Co. spokeswoman Marcey Evans said the automaker is analyzing the impact of the corporate income tax, but said Ford probably will pay more than before.

A bigger issue for Ford is the state’s personal property tax, which Evans called “the largest and most uncompetitive tax burden we and other manufacturers face in Michigan.”

Ford and other businesses pay widely varying local property taxes on machinery, furniture, tools and other equipment.

Those taxes could become an even bigger burden under the new corporate income tax. That’s because a 35 percent MBT credit on personal property taxes will be eliminated in the new tax structure.

There are signs those taxes may be next up for review.

The Snyder administration wants to take “a serious look” at the personal property tax later this year, spokesman Ken Silfven said.

“Whether that results in a call for a reduction or an outright elimination of the tax remains to be seen,” Silfven said. “There is no proposal at this time.”

Hadden said his members also want the personal property tax eliminated, calling the tax “the biggest detriment to investment in the state.”

But he said it will be difficult to end or even reduce because the tax provides about $1 billion a year for local governments, which are struggling to balance budgets in the face of declining real property tax revenues.

“It’s a big rock to push uphill,” Hadden said.

'A little bit more hiring'

Still, supporters of the corporate income tax say it will put Michigan on a stronger economic footing.

“I’m optimistic this will be a meaningful element in the recovery of the state,” said Mark Murray, president of Walker-based retail giant Meijer Inc.

Murray said Meijer will pay more under the new tax, although he wouldn’t divulge figures. The biggest benefit, he said, will be to small business owners who paid the MBT and also were taxed on business distributions to them on their personal income tax returns. “In a pretty direct sense, they are being double taxed,” he said.

Eliminating the MBT could give many small business owners as much as a 4 percent boost in their companies’ return on revenue, Murray said.

“People will make some more investments and do a little bit more hiring,” Murray said. A “little bit more hiring” could add up.

Snyder himself urged Small Business Association of Michigan members on June 23 to shout their successes, two days after signing the budget into law.

“Even if it’s one job, be proud of it,” Snyder said. “If you take 12,000 entities and you say one job, that’s a lot of jobs. And then you start saying it’s two jobs or three jobs.” Another issue with the MBT is its complexity. Businesses have long complained the tax was so convoluted even their accountants had trouble understanding it.

David Rhoa, president of Lake Michigan Mailers Inc., a document management company in Kalamazoo, said preparing MBT returns requires 80 hours a year of employee time.

The simplified corporate income tax “sends a message to businesses that this is a state that has a stable, predictable tax structure,” Rhoa said.

Lake Michigan Mailers, which has 56 employees, plans to hire two more full-time workers and a part-timer later this year. Rhoa attributed the hiring to improving business conditions and the anticipation of a better tax climate in the state next year.

The shift to individuals

While most business lobbying groups are cheering the business tax cut, one research organization says it might not do much to boost the overall economy.

In a new analysis of Snyder’s spending plan, the nonpartisan Citizens Research Council of Michigan said the economic benefit from the tax cut will be tempered by a $1.4 billion tax hike on individuals in its first full year.

Most of the additional revenue will come from a new tax on pensions and reductions in both the earned income tax credit for low-income families and the homestead property tax credit.

“The higher income tax collections will reduce disposal income for Michigan taxpayers,” the Citizens Research Council report said. “Lower disposable income will result in reduced consumption, a net negative for economic growth.”

Some argue that larger forces dictate Michigan’s fortunes.

“The economic realities of the past decade suggest that ... the link between business tax relief and Michigan’s economic activity is tenuous,” said Gary Olson, former Senate Fiscal Agency director and now a Public Sector Consultants analyst. His comments last March came as a poll showed public skepticism the savings wouldn’t be plowed into profits.

Snyder has repeatedly declined to predict how many jobs will be created by the business tax cut. But he called the new tax structure “a defining moment in Michigan’s turnaround” upon signing it into law on May 25.

“The current tax system is riddled with inequities that are hostile to job growth,” Snyder said. “Eliminating these longstanding barriers will level the playing field for taxpayers, encourage entrepreneurship and spur more investment in Michigan.”

Email Rick Haglund at haglund.rick@gmail.com.

Comments

Atticus F.

Mon, Jul 25, 2011 : 3:48 p.m.

Just because you offer a business money, does NOT mean they will hire people. Most will take the money as proffit and put it into offshore bank acounts, which in no way helps our economy. If Snyder is really that concerned about creating jobs (and not giving his buddys a tax break), he should be offering business a HIREING credit.

Roger Roth

Mon, Jul 25, 2011 : 2:28 p.m.

@clownfish writes,"How you can help Michigans economy....come on out....buy stuff.." In the words of my hero, John McEnroe, "You cannot be serious!!!" MI is far, far greater than Ann Arbor. No one has any money, clownfish. Trickle down saw to that. Now, the BIG THREE are negotiating new contracts which will include a lower entry level wage (in order to "be market" with our Asian brothers and sisters whose cost of living is considerably lower than ours) and a greater employee contribution to their health insurance (the government picks up that tab for many of our Asian brothers and sisters,) these, so auto cos. can continue to reap greater and greater profits resulting from your (if you're a taxpayer) bailout last year. Are you following Big Three profits since the bailout? And you want working Michiganders to run out and buy the state out of its economic disaster? Don't forget, Bush already has put the middle class on the hook for paying back trillions in Wall Street bailouts and two idiotic wars that continue with no resolution in sight. Where, I ask, is all this money coming from? Rick is going to bring jobs to MI. Fine. How much will they pay? Can an American worker make an American living on the wages from Rick's jobs? I doubt it; those kinds of jobs will still go to Asia. If they stayed here, corporate profits would go down. That won't happen. As Michael Zweig suggested, profit before social responsibility. I don't see the sense in any of this, and in keeping with my desire to be a life-long learner, I'm open for any enlightenment the Right might send my way that would help me make sense of it. Thank you and in the words of my other hero, ERMG, "Good Night and Good Luck."

clownfish

Mon, Jul 25, 2011 : 3:34 p.m.

Roger, Sorry I struck a nerve! Lots of people have money, just not working class folks. Drive by Zing Roadhouse and you will see loads of cash, nice shiny cars etc. The Mercedes dealership looks like they are doing well. I see tons of boats on the local lakes, new boats filled with $4/gal gas. If one does not have cash I would never suggest spending it on things frivolous. However, if you do have money, PLEASE come out to Chelsea and support local people! Many of us will be those that lost good paying jobs and are seeking a new way to earn a living by becoming entrepreneurs. That is my request to the people that have benefited from Voodoo Economics, PUT YOUR THEORY TO WORK!!! If you have gotten a tax break, SPEND the money locally! Create a job by hiring or buying from your neighbor. Stop buying imported Chinese crap and creating jobs in China.

clownfish

Mon, Jul 25, 2011 : 12:59 p.m.

How you can help Michigans economy....come on out....buy stuff.. <a href="http://annarbor.com/entertainment/chelseas-sounds-and-sights-festival-gearing-up-for-36th-summer-un/?cmpid=NL_DH_topicbox_headline">http://annarbor.com/entertainment/chelseas-sounds-and-sights-festival-gearing-up-for-36th-summer-un/?cmpid=NL_DH_topicbox_headline</a>

grye

Mon, Jul 25, 2011 : 12:38 p.m.

Interesting that it appears those complaining about the new tax structure for businesses would rather see businesses pay more in taxes and individuals less. Would this create a friendly environment for business to start up or come to Michigan? I think not. We need more businesses in Michigan to employ people here. We need business friendly policies that will promote new businesses and the relocation of businesses here to increase our job market. Without the businesses, will we have any tax base to speak of? Absolutely not. No jobs for people, no tax base, and then a complete collapse of the State of Michigan.

clownfish

Mon, Jul 25, 2011 : 12:57 p.m.

Taxes are but one equation when thinking of relocating. Workforce education/training is another. As we are cutting those two things, it may be a wash. Gov Snyder has focused almost entirely on cutting business taxes, I have heard him say little to nothing about our high drop-out rate or how to make higher education affordable for the unemployed or lower classes. If we have to import the new hires, the economic impact will be less than expected.

clownfish

Mon, Jul 25, 2011 : 12:35 p.m.

I think the real question is: will the new tax system attract new large business that will hire across the education field? If 12,000 companies hire 1 new person each, that is good news, but does not much for the 500k unemployed in Michigan. There is no question that the MBT needed to be changed, the other question is: will taxing customers create jobs? Will businesses LOWER their prices to reflect their newfound relief? If Stephen Landes is correct then this should be a result. Who is holding their breath that we citizens will now see a drop in costs at the stores?

Carole

Mon, Jul 25, 2011 : 12:32 p.m.

It behooves me that the state government intends to tax pensions, and do away with earned income and homestead credits that assist many individuals who are living paycheck to paycheck. And, indeed as one individual stated in a comment, business expenses, i.e. taxes owed to state are already included in the price of the product before purchase -- so will the prices be reduced to reflect the lower business taxes, hmmmm I wonder. One of the very easiest way to help Michigan grow is for all of us to buy Michigan made products -- I know they may be a tad more, but whenever possible in these hard times, when we can we should -- starting with local farmer markets where the price of fruits and veggies are considerable less than at the super market. Love Michigan -- and I would certainly wish that the government would take a closer to home to see where funding cuts could be made, i.e in the government itself. And, make a commitment to those in office to see where they can do some cutting in their own area.

YpsiGreen

Mon, Jul 25, 2011 : 12:20 p.m.

Yet another rousing job adding success: "Lake Michigan Mailers, which has 56 employees, plans to hire two more full-time workers and a part-timer later this year." Wow. ~2.5 jobs.

ssAA

Mon, Jul 25, 2011 : 5:24 p.m.

What if each of the 95,000 businesses that will not be subject to the new corporate tax add 2 more workers? WOW! ~ 180,000 jobs.

Greg Gunner

Mon, Jul 25, 2011 : 12:03 p.m.

$46,000! Let's see. You will want to keep a portion of that for yourself, afterall there's no use in hiring a new employee if it doesn't increase the bottom line. You keep half, leaving $23,000 for that new employee's wages and benefits. Let's see pay him or her minimum wage and offer a benefit program that the employee pays for themself. One minimum wage job has been created for someone who is still living with their parents. Afterall, you won't be buying a car and living out on your own at $23,000 per year. No new car + no new house + little disposable income leads to further weakening of the economy. But what the ****, you got your money and created a job that pays a non-livable salary. Is this the way it's supposed to work, Slick Rick?

demistify

Sun, Jul 24, 2011 : 8:29 p.m.

"Ending the MBT will save $46,000 a year, Brann said, money that likely will result in adding to the company's 700 full and part-time workers." For the wages and benefits of just how many workers will that $46,000 a year pay? Will it raise the payroll from 700 workers to 701? Mr. Brann is not cheering because of the miniscule effect on his business, he is cheering out of political partisanship.

Basic Bob

Sun, Jul 24, 2011 : 8:50 p.m.

In that case, I'm sure that his employees are relieved that they won't have to take a miniscule pay cut, miniscule increase in benefit cost, or miniscule increase in workload. Even a little bit matters when it comes out of _your_ paycheck.

Stephen Landes

Sun, Jul 24, 2011 : 6:57 p.m.

Once again the author's fundamental lack of understanding of the tax system leads to a misleading question. Businesses do not pay taxes -- business customers pay taxes that are collected and funneled through businesses. If you think that any business you deal with doesn't include the cost of taxes to government in the price of what you buy then you are as ignorant of business as Mr. Haglund. If a business needs to make a 10% return on investment for its owners (stockholders like many of you reading this comment) then they will make sure that their revenue (money from you) MINUS what they send to government achieves that number. Citizens: you have always carried the burden of all the costs of government whether you pay directly to a unit of government or you pay through increased prices when you buy any good. Do not confuse the desire to tax the high personal incomes of some business management folks with increasing the tax on yourselves by raising taxes on the actual business.

RayA2

Mon, Jul 25, 2011 : 4:39 p.m.

Stephen, Your view of the effects of corporate taxes is extremely distorted. Like all corporate expenses, Corporate owners have a choice of whether to pass taxes on to the consumer or not. Either way, they accept a lower return on their investment. Passing taxes directly on to the consumer reduces profits by reducing sales. Its a choice that business owners do not like to make and one they fight with all of their political power. The conservative idiots in the Supreme Court recently confirmed the existence of corporations as a single individual in their decision to allow corporations to make unlimited donations to political campaigns. Corporations should not be allowed to pick and choose their responsibilities to their country and state.

Brian M.

Sun, Jul 24, 2011 : 10:38 p.m.

People price on demand, not cost, unless you're talking about a commodity, and even then you're just figuring out if you can survive at the demanded price or not.

Sparty

Sun, Jul 24, 2011 : 6:54 p.m.

Yup, the business climate is so much improved under Synder: unemployment has climbed yet again under his administration. But at least some businesses will benefit. I'm sure there will some sporadic hires that would have happened anyway that they will shout from the hilltops but they won't replace all that will continue to be lost, all while personal taxes continue to rise. Trickle down, trickle down. Snyder will be gone soon enough, however.

Tom Wieder

Sun, Jul 24, 2011 : 6:54 p.m.

@gsorter - I don't get it. You're hiring 3 more engineers, because you "feel" better about Michigan's future. Are there presently customers for the goods or services that these 3 individuals will help to produce? If there are, what does it have to do with your feelings about Michigan's future? Wouldn't you do it anyway if current demand meant that you could make a profit by doing so? And, if there isn't demand for what they will produce, isn't it foolish to hire people now, because you "feel" things will get better? Let's assume that you need to ramp up employment in advance of demand that isn't there now, so that you're ready to capitalize on it when it occurs. Exactly what about the tax cuts for business convinces you that demand for what you sell will increase?

clownfish

Mon, Jul 25, 2011 : 12:28 p.m.

So Tom, you ARE hiring because of a feeling, not because you have more business now. As you have had federal tax breaks for 11 years, why did that not cause the same "feelings" and cause you to hire?

gsorter

Sun, Jul 24, 2011 : 11:38 p.m.

Tom, That is a fair question. We sell CAD software, and provide engineering consulting with that software. The hiring we are doing now is a function of how I feel future demand will shape up. With the old Michigan MBT, smal businesses like ours (15 employees, slim but steady profit margin) paid almost 15-20% of our income to the state, due to both the MBT and K1 income. I calculated that amount of money equals 4 months of an employee's cost I can now use that money towards the "float time" that it takes to get paid from our customers for 3 people, and can now hire 3 people without having to get a loan from the bank. I cannot get a decent interest rate at the bank, so the best use of that money is to hire more people. It isn't a political decision, but purely an analytical one. I wouldn't make that decision if I felt Michigan was still going down, and still not interested in small business success.

Basic Bob

Sun, Jul 24, 2011 : 10:01 p.m.

"Let's assume that you need to ramp up employment in advance of demand" Your assumption is false. Small businesses react to demand only after it appears, not because they are smarter, but because they must. Demand for _qualified_ engineers far exceeds the availability of experienced candidates. Many businesses are taking a hard look at green but inexperienced university graduates. This is a tremendous change that one does not see in other parts of the economy (like teaching).

gsorter

Sun, Jul 24, 2011 : 4:13 p.m.

No one has yet to explain to me how a 6% state tax in corporate income is UNFAIR? The only unfair thing I can think of is taxing money losing small businesses on revenue and not income, leading to more than 100% of an income tax. And yes, this will create jobs. I feel so much better about Michigan's future, I am hiring 3 engineers right now that I would not have 3 months ago. To prove it, here is the Michigan Works order number:Job Order: 3102082.

Ron Granger

Sun, Jul 24, 2011 : 2:53 p.m.

Granholm was a disaster. But there is no way this works. This Republican experiment is just a sell out to the wealthy, on the backs of the working class and poor. Michigan cannot endure this loss of tax revenue. Even if this worked after years and years, the people will not have the patience for it - heads will roll. If Snyder isn't gone in this recall, it'll be the next, or the one after that.

Basic Bob

Sun, Jul 24, 2011 : 4:50 p.m.

And the liberal solution: a sell out to union leaders, lawyers, and politicians living in their pseudo-Republican enclaves on the backs of the same working class and poor. Please offer me a choice and I will back you up.

AA

Sun, Jul 24, 2011 : 2:35 p.m.

I am very pleased with the way things are looking up, finally, in Michigan.

Mr. Ed

Sun, Jul 24, 2011 : 1:38 p.m.

I can't wait for the jobs to be created. I'm looking forward to 10 bucks per hour in our new economy. I should be able to buy a house and a new car on that right.

Basic Bob

Sun, Jul 24, 2011 : 4:48 p.m.

Better to stay on unemployment and working under the table, I suspect. The new economy is better than no economy.