Breaking down the AATA's proposed countywide transit tax and the $7.7M it could raise

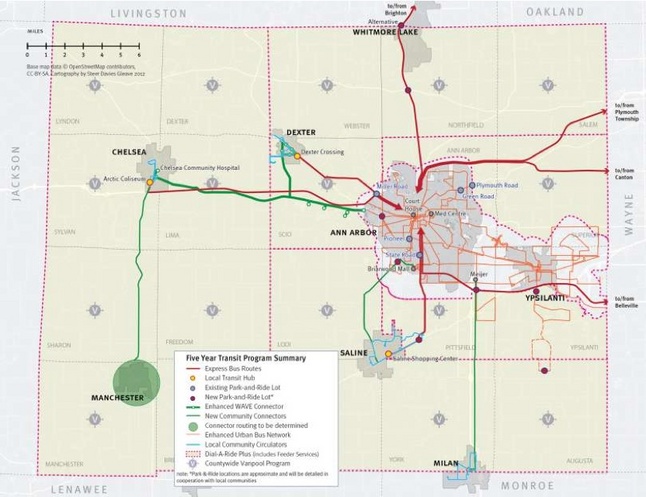

A visual summary of the Ann Arbor Transportation Authority's five-year countywide transit plan and the services that could be funded by a new 0.584-mill levy. Go here to download the full plan.

Courtesy of AATA

According to an AnnArbor.com analysis, property owners in Ann Arbor could end up paying about a third of that — an extra $2.6 million per year — if the new tax is approved.

That would come on top of the more than $9.1 million Ann Arbor taxpayers already pay annually to fund the AATA under the city's 2.056-mill transit tax.

The city's existing millage would remain in place to help fund a new countywide transit authority called the Washtenaw Ride, which would replace the AATA.

One of the AATA's new AirRide buses passes by Ann Arbor city hall on a recent evening. The authority is getting a jump-start on expanding transit services with its new shuttles to the Detroit Metro Airport.

Ryan J. Stanton | AnnArbor.com

The overall revenue projections are calculated by taking the taxable value for all real property in the county — without counting personal property — and multiplying by 0.000584.

The county's taxable value is a little more than $13 billion right now, and AATA officials are assuming a figure of $13.3 billion for 2013 when the tax would be levied for the first time.

But that's assuming all municipalities in the county participate. Each one will be given a chance to opt out of the new countywide system before the tax is put up to a vote — possibly as soon as May.

Six townships — Bridgewater, Northfield, Salem, Saline, Sharon and Sylvan — already have chosen not to participate in discussions. If those six townships aren't included in the countywide system, that's a loss of more than $580,000 in revenue based on the current taxable values.

AATA CEO Michael Ford noted last month Superior Township also has inquired about opting out of the countywide millage and instead continuing to purchase transit services via contract. Superior's fixed-route bus service would increase by about 200 percent under the countywide plan.

Ford said one of the significant policy issues yet to be decided is how to deal with purchase-of-service agreements with communities that choose to opt out of the new authority.

AATA spokeswoman Mary Stasiak said the intention from the beginning has been to create a plan that responds to the mobility needs of the entire county. She said AATA officials realize certain areas of the county are more ready than others to recognize and respond to those needs.

"The five-year transit program is fully scalable depending on who wants to join and start getting service on the street for the people who need it," she said. "Obviously, for those communities who do not join at the time of incorporation, they will not be contributing local dollars to the system."

In addition, Stasiak said, those that chose not to participate will not receive the services, which will reduce the cost of program implementation.

The AATA's newly released countywide transit plan includes projected operating and capital expenses that total nearly $223 million over a five-year period. The five-year expenditures would be offset by an estimated $184.2 million in revenue, resulting in a gap of $38.8 million.

A millage raising a little more than $7.7 million a year could fill that gap, and the AATA is counting on county voters to approve it. They're also considering bus fare increases.

Like residents in Ann Arbor, Ypsilanti voters would be asked to pay an additional tax on top of their current transit levy, kicking in about an extra $160,000 a year.

A nearly 1-mill transit tax that Ypsilanti voters approved in 2010 would continue to fund the new countywide authority. The tax brings in a little less than $300,000 a year.

Ypsilanti Mayor Paul Schreiber told AnnArbor.com in June he's confident voters in his city will support a countywide transit tax.

Based on current taxable values, Pittsfield Township property owners would pay nearly $900,000 under the proposed tax, Scio Township property owners would pay nearly $700,000 and Ypsilanti Township property owners would pay more than $600,000.

Saline property owners would pay nearly $200,000, Chelsea property owners would pay nearly $120,000, and Milan property owners (those in the county) would pay nearly $40,000.

Stasiak said it's for Milan officials to decide whether they want to give their citizens in Monroe County the opportunity to vote on expanding public transit. She noted Milan passed a resolution recently promising to bring south Milan into the authority if the rest of Milan chooses to participate.

An AATA bus rolls down Liberty Street in downtown Ann Arbor. The fare for trips within the city could go up from $1.50 to $2 under the proposed plan.

Ryan J. Stanton | AnnArbor.com

Broken down further, about two-thirds of the money from Ann Arbor taxpayers would come from residential properties, while the rest would come from businesses.

Ann Arbor resident Vivienne Armentrout, a local blogger who has been skeptical of AATA's plans, said she hasn't had time to fully digest all 200-plus pages of the five-year plan report that came out earlier this week.

"I did look at it and one thing I noticed is that it contains no commuter rail or connector components," she said. "The map seems not to look at those. If that is correct, then it sounds as if they are following, to some extent, the recommendations of the financial task force, which said the commuter rail and the connector study should be outside of this."

Armentrout said it's an overstatement to say she's opposed to the plan, but she still has a lot of questions, including about the governance model. The way it's proposed now, there would be a 15-member board and Ann Arbor would have seven seats at the table.

"I really have to look at this new plan," Armentrout said. "I'm not against transit. I have concerns. The governance issue is one of my concerns and I want to see how the finances pan out."

In addition to the new tax, the AATA's five-year plan assumes the adoption of a new fare structure that increases fare revenues by 12 percent.

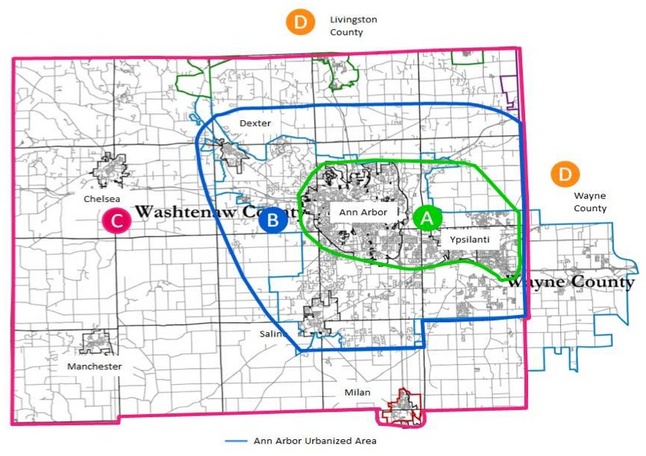

The plan recommends creating four fare zones. Zone A would cover Ann Arbor and Ypsilanti, including the existing urban fixed-route service area. Zone B extends just outside of the core urban area. Zone C covers most of western Washtenaw County, as well as the northernmost and southernmost portions of the county. Zone D includes Livingston and Wayne counties.

Trips within A or B would go up from $1.50 to $2, with evening tickets costing $3, weekly tickets costing $18 and 30-day flex passes going up from $58 to $65.

Trips from A to B or B to C would go up from $2 to $2.50, with evening tickets costing $3, weekly tickets costing $21 and 30-day flex passes costing $75. The same prices apply for trips within C.

Trips from A to C would cost $3, with evening tickets costing $3, weekly tickets costing $24 and 30-day flex passes costing $85.

Prices for express bus services are even higher, ranging from $5 within the core urban area to $7.50 for trips outside the county.

These fare zones are proposed in the AATA's newly released five-year plan.

Courtesy of AATA

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's email newsletters.

Comments

Kami Meader

Tue, Sep 11, 2012 : 3:43 p.m.

Stop pushing your agenda using my tax money! $58 a year isn't a drop in the bucket, it can pay for a new outfit, a chance for my child to play a sport, or a tank of gas for my family to enjoy a weekend trip. I'm tired of other people trying to spend my money. If 6 townships don't even want buses, maybe you don't need to expand. These other areas are mostly rural. If someone needs a bus then they need to move into the city or use the park and ride.

Alex Brown

Tue, Sep 11, 2012 : 11:13 a.m.

Something smells fishy. If you compare the map and what is implied to be the "Core Urban Area" - I say implied since "Zone B" is explicitly described as being "Just outside the core Urban Area" - it disagrees with what the U.S. Department of Transportation considers the Ann Arbor Federal Urban Aid Area. See the map at URL: http://www.semcog.org/uploadedFiles/Data_and_Maps/Map_library/FAUB00_Asize.pdf There are Federal dollars coming in representing that area. I see a LOT, the majority, of the area that fraudulently RECEIVES NO SERVICES which this funding is supposed to provide.

Alex Brown

Tue, Sep 11, 2012 : 11:15 a.m.

I'll try splitting it on to two lines http://www.semcog.org/uploadedFiles/Data_and_Maps/ Map_library/FAUB00_Asize.pdf

Alex Brown

Tue, Sep 11, 2012 : 11:14 a.m.

somehow the link got truncated http://www.semcog.org/uploadedFiles/Data_and_Maps/Map_library/FAUB00_Asize.pdf

Brad

Mon, Sep 10, 2012 : 1:20 p.m.

More busses on the road in AA to clog up our new three-lane "road diet specials". Perfect.

TooT

Mon, Sep 10, 2012 : 4:57 a.m.

My Ypsi township property value does nothing but fall and I'm suppose to vote to give away more of my money for a service I have never used? And while we are on the subject why would I want more of these buses on the road driven by incompetent drivers that don't have a clue what they are doing? Instead of more buses how about some classes for the drivers? I VOTE NO!!

Joe Hood

Mon, Sep 10, 2012 : 3:38 a.m.

Funny, every time one of these AATA expansion stories get posted, the majority of the comments are against the expansion. Couldn't some of this money we're blowing into the environment, in the way of 4 mile a gallon buses, be used to create more bike trails? Think about it, how would you go about biking from downtown to Meijer or Target? Take a good hard look at the condition of the pavement of Ann Arbor Saline road over I94 and tell me that more busses will fix that?

mtlaurel

Mon, Sep 10, 2012 : 2:46 a.m.

What is a mobility need? These areas have satellite centers thru the Univ and St Joes for health care. They have local retail/food and services. They want to do what?,please, that we have to fork out the money to run the Ann Arbor bus everywhere.

Ellis Sams

Mon, Sep 10, 2012 : 12:02 a.m.

So, if we defeat this, the cost of a bus ride remains $1.50. However, if we approve this we pay an additional 0.6 mil and the cost of a bus ride increases to $2.00. I can see why the mayor and city council find this so appealing. It defies logic.

Ron Granger

Sun, Sep 9, 2012 : 10:26 p.m.

Are Ann Arbor taxpayers getting credit for their tremendous investment and contribution of the buses? If so, how? Shouldn't fares be cheaper for Ann Arbor residents who bought the buses?

braggslaw

Sun, Sep 9, 2012 : 8:42 p.m.

Why don't they extend the bus routes to Hawaii... it will end up being used about the same amount. I would rather take the money and invest in a matter-energy transportation device.

a2grateful

Sun, Sep 9, 2012 : 6:34 p.m.

As a city resident, please remind me how this benefits me and other residents. . . 1) We receive a tax increase so our neighbors ride the busses we bought and owned. . . 2) Then, we receive a fee increase for fares, riding our own busses, with no improvement in service in the city. . . What? Where is the win-win incentive in this proposal for city residents?

Ryan J. Stanton

Mon, Sep 10, 2012 : 12:45 a.m.

It's linked to in the lede of the story

a2grateful

Sun, Sep 9, 2012 : 8:58 p.m.

Please share link. . .

Ryan J. Stanton

Sun, Sep 9, 2012 : 8:37 p.m.

From my last story: The plan proposes an array of public transit improvements throughout the county, including a 56 percent increase in service hours in Ann Arbor and Ypsilanti, more frequent service, more routes and fewer transfers, more affordable fare choices, and extended weekend and late-night service.

Ron Granger

Sun, Sep 9, 2012 : 5:10 p.m.

It is absurd that a trip within the city of Ann Arbor costs as much as a trip from Ypsi to Ann Arbor - $2 during the day and $3 at night. That is Ann Arbor subsidizing Ypsi, and the rest of the county. We need to focus on reasonable bus service *within* Ann Arbor. $2 and $3 are too much for short distance bus service within Ann Arbor. It should not cost that much for good bus servince within our city. This plan over-reaches and it disadvantages Ann Arbor taxpayers.

annarboral

Sun, Sep 9, 2012 : 3:55 p.m.

There is absolutely no need for any tax increase. It's simple really. Let the people who want to use bus servicv pay the full cost of bus service. Why should I have to subsidize someone elses transportaion?

jackson72

Sun, Sep 9, 2012 : 3:50 p.m.

My concern is that they're going to try to quietly sneak this through in a May election vote when turnout is light like the schools do with their millages. This will not pass if it's during a November election cycle when most voters go to the polls.

braggslaw

Sun, Sep 9, 2012 : 8:44 p.m.

Jackson, You are dead on... they will try to sneak it through when people are not looking..

RUKiddingMe

Sun, Sep 9, 2012 : 3:56 p.m.

That is likely the case. Our only defense against that is to tell as many people as we know to tell as many people as THEY know to be sure to vote against it. If it passes, it's only the fault of people who didn't know about it or didn't vote. Plus the criminal and/or negligent nature of those trying to GET it passed; they know as well as we do that there's no justification for it.

brimble

Sun, Sep 9, 2012 : 3:48 p.m.

Perhaps AnnArbor.com could perform a comprehensive look at existing tax rates each inside the cities of Ann Arbor and Ypsilanti, and in the surrounding townships, and then review the total of 'new' or renewed-by-ballot taxes approved in the last five years, and those proposed for ballot questions in the next year or two. A little for the greenbelt, a little for school technology, a little for art, a little for the libraries, a little for AATA: to borrow a phrase, 'a mill here and a mill there, and pretty soon you're talking about real money.' We do have real needs, but we are not having any public discussion about our shared priorities. Instead, tax proposals come to the ballot in every 'off-season' election so that a small minority may make all of us pay more with no recognition of the long-term or unintended consequences.

Vivienne Armentrout

Sun, Sep 9, 2012 : 5:26 p.m.

Yes, you are right, it takes some work and analysis. I had to spend some time studying it myself. I didn't mean to imply that a summary and overview by a reporter or anyone might not be helpful. I just meant that the information is available to the public. Regarding Ann Arbor Public Schools, recall that the school district is larger than the city and it includes some portions of townships.

RUKiddingMe

Sun, Sep 9, 2012 : 4:37 p.m.

Ms. Armentrout, I appreciate your link, and your posts that attempt to educate; this link, owever, is not very intuitive, and does not show the kind of snowballing (or not) of property taxes over the course of time. While I am a proponent of people taking the time to educate themselves (if there's actually a question about whether or not something is a good idea, which is less frequent than most people would think), it would be newsworthy, I think, to give people a summarized analysis. I looked at this PDF for several minutes, and don't understand, for instance, why, under "Ann Arbor Public Schols" there's a section for "Ann Arbor," then a section for "Ann Arbor City" and another for "Ann Arbor township." Is the First Ann Arbor a total of the next 2? The rightmost columns that specify "bond" vs "election" is also not intuitive to me. It's possible that I'd be able to figure it out given time, but it's definitely not a concise, summarized, compared and contrasted story for easy public digestion.

Vivienne Armentrout

Sun, Sep 9, 2012 : 4:20 p.m.

There is no need for reporters to do this work. The County Equalization Department already has. (It does not include prospective ballot issues or duration, just current tax millages). See the Apportionment Report http://www.ewashtenaw.org/government/departments/equalization/2011%20Apportionment%20Report%2012_7_2011.pdf You'll find some of the contrasts interesting.

RUKiddingMe

Sun, Sep 9, 2012 : 4:02 p.m.

A2.com, or especially Ryan Stanton, this would be some great reporting. If even JUST for page hits (which would be a disappointing motivation, of course, but hey; it's the 10s, right?), you've seen the type of responde you've been getting on millage-related stories. Brimble's idea is an excellent one, and something the community can really benefit from seeing.

music to my ear

Sun, Sep 9, 2012 : 3:23 p.m.

no comment

Jeffersonian Liberal

Sun, Sep 9, 2012 : 2:26 p.m.

The Progressives will always have a good reason to confiscate yet more of what we don't have. Since we have already cut our household budgets to the bone to pay our utility bills and pay for the $4 gas that doesn't leave anything for your third world mass transit. Incidentally, the reason we can barely afford to heat our houses and drive our cars is because these are the same people that stand in the way of us developing our own natural resources. Please confine your lunacy to the peoples republic and leave us the hell alone.

Dog Guy

Sun, Sep 9, 2012 : 2:13 p.m.

The Great Helmsman has decreed, "Let a hundred tax foreclosures blossom together!"

dotdash

Sun, Sep 9, 2012 : 2:13 p.m.

I'm very uncomfortable about turning over taxing authority and decision making to a county-level organization, given what happened with It-takes-a-millage education vote. What if AA wanted even better public transportation in the future, but the outlying areas didn't? What if AA wanted a light rail around town? Someone correct me, but it sounds as if that would have to be voted on by a board on which AA would have minority representation. Given the rest of the county's higher resistance to taxes for the public good, our hands would be tied, yet again.

Ken

Sun, Sep 9, 2012 : 2:07 p.m.

My concern is that the proposed millage is way too low. With the amount of service that AATA proposes I just do not see how this millage will be sustainable. If you recall prior to the millage in Ypsi being payed to the AATA; it was determined that the millage was unable to support current service levels. Will the "Washtenaw Ride" board come back for additional money next year making the same claim, or threatening service cuts? Another grey area not addressed; will the new Authority still offer POSA's to those Communities opting out? If so, what is the point of taxing everyone if they still allow POSA's? Too many unanswered questions, way too much ability for a new Taxing Authority to grab additional money.

RUKiddingMe

Sun, Sep 9, 2012 : 2:19 p.m.

"Will the "Washtenaw Ride" board come back for additional money next year making the same claim, or threatening service cuts?" Of COURSE. And be clear on this: they wouldn't have to threaten anything; they would just raise the tax, and they would NOT need anyone's vote to do it.

Brad

Sun, Sep 9, 2012 : 1:52 p.m.

And it won't "raise" $7.7 million, it will simply take $7.7 million from the taxpayers. It isn't like it's a bake sale.

Michigan Reader

Sun, Sep 9, 2012 : 1:40 p.m.

The various governments in Washtenaw County are nickel and diming the residents to death. Half a mill here (it's only one tank of gas) one mill there, and it all adds up. I'm voting NO to all millage increases this November.

G. Orwell

Sun, Sep 9, 2012 : 1:36 p.m.

Don't need it and don't want it. What is wrong with the existing system? Why do bureaucrats always want to build empires for themselves?

DonBee

Sun, Sep 9, 2012 : 1:08 p.m.

Sorry - I have read the final plan and the ability to change the tax without a vote is a clear NO from me.

Linda Peck

Sun, Sep 9, 2012 : 12:52 p.m.

Would this bill allow the county to tax residents without their approval in the future for this system? Is that rolled into this proposal? WOW! That would be a "no" vote from me, then. Also, with talks of a rail system to connect the communities, would we really want to have buses, too? The vision of more big buses coming in and out of town is not pretty. I would rather hear train whistles, especially if they blow them softly.

davecj

Sun, Sep 9, 2012 : 12:48 p.m.

That's an additional $58 for the owner of a $200,000 home in Ann Arbor. We already pay $200, so it is a 25% increase in our AATA millage!

motorcycleminer

Sun, Sep 9, 2012 : 12:44 p.m.

Burden on the many for the benifit of a few...just like DC ...11-6-12

A2comments

Sun, Sep 9, 2012 : 11:55 a.m.

Glad to see that Superior is likely opting out.

RUKiddingMe

Sun, Sep 9, 2012 : 10:57 a.m.

"...$58 per year, which they argue is about the same as a tank of gas." What kind of argument is that? And $116 would be TWO tanks of gas. And $29 would be half a tank. Any time someone's justification for an additional tax is a comparison to something else that could be purchased with the money, that usually means they have no OTHER justification for it. Trying to insinuate that it's a small amount of money is not a good argument, and it basically proves that they have no other data to back it up. A nickel's a really small amount too, but I still don't throw them out my window while driving down the street. Everyone needs to very proactively tell their friends, coworkers, and family to vote against this. You let them establish this new millage, and this new organization that will have the power to levy property tax millages without a vote, and it you will regret it. In additon to all the logical and financial reasons NOT to do this, it's extremely UN-green to drive more buses around that people are not going to ride. Which reminds me; does anyone know what they plan to do if it turns out their buses are never more than 2/5 full? Does anyone at A2.com know that? Has anyone asked Mr. Ford? THEY HAVE SHOWN NO CONSISTENT OR RELIABLE NEED FOR THIS EXPANSION OF TRANSPORTATION. One piece of data they use to JUSTIFY it is an increase of 100% along a well-established popluar route, which results in a 14% ridership increase; they DOUBLED the service, and got a 14% increase; that's the backing data they use. That and the fact that your property tax increase will buy a tank of gas. I'll take the gas, thanks. They are relying once again on an apathetic response by voters to steal and waste more of your money; PLEASE don't let them continue to get away with this.

Carl

Sun, Sep 16, 2012 : 4:03 p.m.

I respect your opinion, but I don't think you hve the right to be wrong. Under the Headlee Amendment to the Michigan Constution from 1977, this statement is not possible, "..this new organization that will have the power to levy property tax millages without a vote..." Under Headlee, all property taxes require a vote of the people who will be taxed.

Brad

Sun, Sep 9, 2012 : 12:28 p.m.

That would be ANOTHER tank of gas on top of the 4+ "tank equivalents" that I already pay for an AATA that I use not at all. It's already one of the largest single items on my property tax bill. No thanks.

Vivienne Armentrout

Sun, Sep 9, 2012 : 10:46 a.m.

I'd like readers to understand that I did not contact AnnArbor.com to offer my opinions about the plan. As I stated in the quote, I haven't had time to review the final plan at any depth. I don't know why I was the only individual interviewed for this story, apart from AATA staff. A point about governance: it is unclear how the new authority board's membership will be adjusted to allow for nonparticipation by different parts of the county. For example, the Northeast District consists of Northfield, Salem, Superior and Ann Arbor Townships. Northfield and Salem have already pulled out and Superior is considering its options. Will that district still be entitled to a full seat on the board? There does not seem to be any provision for this circumstance, yet the county Board of Commissioners amended the Articles of Incorporation to require a 4/5 majority of the board to change many policies. This gives an outsize influence to districts that may not be participating in the millage. Those who are interested in reading my past posts on the subject should go to http://localannarbor.wordpress.com/the-transportation-page/, where they are listed.