Costs for repairs will go up if Michigan lawmakers don't fix our roads

How hard is it to understand the problem with Michigan roads? Our roads are in terrible shape, it’s going to take billions of dollars to fix them, and we don’t have the money.

Really, it’s as simple as that. Our elected officials have known that for years, and have failed abysmally in their responsibility to address it.

Recently though, we’re hearing noises in Lansing that 2012 might be the year when the Legislature finally takes action. Understanding that talk is cheap, and that fixing roads isn’t, we hope this is more than posturing. It’s time to make hard decisions about how new revenue will be raised to address the estimated $22 billion shortfall we face in order to get our roads and bridges in adequate condition over the next 12 years.

File photo | AnnArbor.com

Last week, a package of bills aimed at raising the money to fix our roads was introduced with bi-partisan support that included state Rep. Rick Olson, a Republican who represents a portion of our readership area. Olson was among a group of lawmakers who issued a report last November that estimated Michigan would need to generate an additional $1.4 billion a year in revenue to put its roads and bridges in good shape in the coming years, a figure that would rise to $2.3 billion a year by 2023.

(To download a PDF of the Michigan Roads Crisis report, click here.)

The report documents what everyone in Michigan knows all too well. Our roads are in bad shape and deteriorating rapidly, while the amount being spent on them is woefully insufficient. That reality has been well-documented since 2008, when the state released a report by the Transportation Funding Task Force, often referred to as TF2, which did an excellent job of laying out the problems and analyzing possible solutions. And all we’ve done since then is lose ground as the Legislature failed to act.

It’s too early to pass judgment on the package of bills introduced last week, or even to predict how it will advance through the legislative process -- if it moves at all. We look forward to fully reviewing the bills and editorializing on them in more detail in the near future.

But even at this early stage in the debate, it’s clear there are tough issues the Legislature will have to tackle. The first is that there’s no solution that doesn’t involve a tax increase. The idea of raising taxes has been anathema to Republicans, but in this case they’re going to have to accept that reality as part of the solution.

The bills call for raising the current 19-cent-a-gallon tax on gas to 28.3 cents per gallon at the wholesale level, while also raising the registration fee on vehicles by an average of about $60 a year. Generally speaking, we’re supportive of looking to sources of revenue that are closely associated with use of roads, and both the gas tax and auto registrations fit that description.

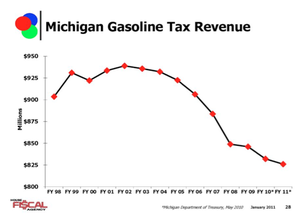

Road repairs in Michigan are funded primarily through gas tax revenue, and that revenue has fallen sharply in recent years because of the poor economy, people making fewer trips and more fuel-efficient automobiles.

Source: Michigan Department of Treasury

The governor raised other interesting issues in his State of the State, including suggestions that more road money be directed to areas where the need is greater because traffic volumes are higher. And any comprehensive plan to fix Michigan roads must include strategies that use the money efficiently, and appropriate standards for rebuilding roads so that the repairs last. Nothing frustrates motorists more than seeing roads begin to crumble again a short time after they’ve been resurfaced.

One of Gov. Snyder’s recurring themes is that the state must stop putting off action on issues that need to be addressed. He likes to refer to it as “kicking the can down the road.’’ The governor’s State of the State message and this package of bills have put the issue of roads squarely in front of the Legislature. Our fear is that lawmakers will try to duck the issue because it’s an election year. Michigan can’t afford that. The longer we defer on repairing our roads, the more it will cost to do the job. You can’t keep kicking the can down the road when the road is already riddled with potholes and getting worse by the day.

(This editorial was published in today's paper and reflects the opinion of the Editorial Board at AnnArbor.com.)

Comments

hank

Sun, Jan 29, 2012 : 11:19 p.m.

I think if everyone sold their cars and used public transportation the republicans would have a walking tax.

Tony Dearing

Sun, Jan 29, 2012 : 7:08 p.m.

For those who have been asking why are roads have fallen into such disrepair, I've added a graphic to the editorial showing how sharply gas tax revenue has declined in recent years. Revenue from the gas tax is the primary source of road repairs, and it's been declining because of the poor economy, people driving less, and more fuel-efficient autos.

Jim Walker

Mon, Jan 30, 2012 : 2:48 p.m.

The other big problem is the fixed gas tax, not indexed to inflation, so the purchasing power has steadily declined. This affects both Michigan and Federal gas taxes.

Silly Sally

Mon, Jan 30, 2012 : 10:53 a.m.

While it was nice to have the tax chart, why have it so small that it is hard to read, even after copying to my hard drive. It is only 77 kb in size. Why not make it larger so the numbers are more legible?

hank

Sun, Jan 29, 2012 : 6:43 p.m.

If Granholm would have raised gas tax and fees the republicans would have screamed bloody murder.

EyeHeartA2

Sun, Jan 29, 2012 : 7:42 p.m.

If my grandmother had wheels, she would have been a trolley

hank

Sun, Jan 29, 2012 : 6:41 p.m.

Doggone those tax and spend republicans are at it again. What happened to the surplus Synder was so proud of? Use that to pay for roads. People making 10 to 12 dollars an hour can't afford an increase at the pump to get to work. Use some common sense.

EyeHeartA2

Sun, Jan 29, 2012 : 7:45 p.m.

Sorry to sully the issue with facts, but the surplus is about .4 billion, per the article, which you might try skimming, we are in need of 1.4B. Plus the surplus has been binned 3 times over already. Usually for education. You're not anti-education are you?

Sallyxyz

Sun, Jan 29, 2012 : 6:23 p.m.

Roads have not been maintained over the last couple decades. Why did this happen? Was the money earmarked for road repair used for other things? Was the road repair that was done of very poor quality? If so, don't expect current taxpayers to fork over money for the state government's mistakes. Let's hear how the state got to this point first. A 60% increase for current drivers on registrations is NOT the answer, nor is raising the tax on gasoline. Drivers will pay more at the pump under that scenario, be sure of that. The current drivers did not make the choices that led to the poor conditions of the roads due to maintenance that was not done in the past. Let's have a clear explanation of why the roads were not maintained over the last 10-20 years.

Berda Green

Sun, Jan 29, 2012 : 6 p.m.

true

Townie

Sun, Jan 29, 2012 : 5:42 p.m.

Funny but no mention of the $1.8 billion we gave away to businesses so they would 'create jobs' (of course, we are told by Rick Olson that there's no way to count those jobs...) and now we don't have any money to repair our roads? Now it's up to the little people to pay for the roads? What about the businesses who got the $1.8 billion whose trucks, etc. do most of the damage? Ah. I forgot -- they have lobbyists and fact free Republicans to protest their interests. The little people don't have big lobbyists. Ask Rick Olson if he got any Maroun bridge money for his campaign and how he's voted on the new bridge. Money talks and the rest of us walk. Tony; check that and report back please. Come on Tony -- what about the $1.8 billion? Where did it go and isn't that one reason we don't have any money? Why is that continually ignored? Doesn't fit the pre-defined story line?

Tony Dearing

Sun, Jan 29, 2012 : 6:15 p.m.

We've been pretty vocal on business taxes in a couple of recent editorials, saying that we haven't seen evidence that business tax cuts create jobs, and arguing instead for more spending on priorities like education. <a href="http://www.annarbor.com/news/opinion/cutting-business-taxes-will-only-hurt-michigan-not-bring-in-jobs/">http://www.annarbor.com/news/opinion/cutting-business-taxes-will-only-hurt-michigan-not-bring-in-jobs/</a> <a href="http://www.annarbor.com/news/lawmakers-take-the-debt-off-students-shoulders-find-other-ways-to-fund-the-state/">http://www.annarbor.com/news/lawmakers-take-the-debt-off-students-shoulders-find-other-ways-to-fund-the-state/</a> In the case of roads, we would argue that funding should come from the users of roads. A number of commenters are in favor of higher gas taxes rather than higher registration fees, and that's going to be an important discussion to have.

Jim Walker

Sun, Jan 29, 2012 : 4:39 p.m.

The correct way to raise these funds is to raise the gas tax and index it to inflation so it remains at an appropriate level versus the costs of building and maintaining roads. AND we need to retain the constitutional requirement that at least 90% of the funds collected from owners of cars and trucks go to ROADS. It would be totally wrong to steal more than 10% of the taxes from car drivers to pay for public transit systems that the car drivers rarely or never use. Robbing Peter to pay Paul is morally wrong. If Ann Arbor and Washtenaw County, or Lansing and Ingham County, or X city and Y County, want to have better public transit and the voters agree to pay for it from General Funds their citizens pay - that is perfectly fine. It is also correct that most of the increased taxes for drivers come from fuel taxes, NOT registration fees. It is wrong to give the same tax bill to an elderly retired person who drives 3,000 miles per year, versus an average working person who drives 15,000 miles per year, versus a salesperson who drives 35,000 miles per year on their job. Note also that using fuel taxes gives a clear incentive to use more fuel efficient vehicles. And be VERY careful of supporting any sort of new tax to be paid on a per mile basis. You WILL get double dipped to also pay the gas taxes. Any new per mile system WILL be very costly to install to have GPS systems in every car. And you WILL lose all hope of privacy for where you travel. James C. Walker, National Motorists Association, <a href="http://www.motorists.org," rel='nofollow'>www.motorists.org,</a> Ann Arbor, MI

johnnya2

Mon, Jan 30, 2012 : 4:01 a.m.

Wait, so the bus that pays those taxes should get nothing? RIDICULOUS. Your "plan" is the status quo that has failed MISERABLY for the last two decades. Should an all electric vehicle that uses the roads be exempt from paying for the road? I think yes, you obviously think not. Is it fair that a bicyclist that uses the road not pay as well. Public transportation is the way to SAVE the roads, and giving money to them HELPS keep our roads lasting longer. It is this short sighted NARROW view from a group that is in and of itself a selfish group that does not care about society, only their "right" to drive any way they see fit.

Superior Twp voter

Sun, Jan 29, 2012 : 4:35 p.m.

Steadfastly against any increase in vehicle registration fee(s). Already pay much more in sales tax when an expensive vehicle is purchased - then to have to pay much more EACH year the vehicle is registered? Repeat tax on already taxed item. Think about a sports car, driven seven months of the year....... is it fair to tax it all year when it is stored winter months? It's nothing to see sports cars taxed (whoops, I mean registered) at $1.00 per day. Already out of control. Watch as owners title/register their expensive vehicles out-of-state! Right now, a car costing $350 per year to register in Michigan can be registered in Ohio for $38.00.

rosewater

Sun, Jan 29, 2012 : 3:53 p.m.

Toll roads and taxes on the Michigan tourist industry

bart

Sun, Jan 29, 2012 : 3:35 p.m.

Just fix the roads. Whatever it takes, we'll pay for it. I already have one car I cannot drive because it needs the entire front suspension rebuilt. We all knew this day was coming by delaying repairs until most gravel roads are in better shape than the paved ones. Some of our roads are starting to look like the surface of the moon, and many have more patches on them than original road surface.

Sparty

Sun, Jan 29, 2012 : 3:29 p.m.

Do businesses not use the roads? How about having them return some of the $1.8 billion in tax relief Snyder gave them ?

Richard Wickboldt

Sun, Jan 29, 2012 : 2:40 p.m.

The infrastructure here in Michigan and the Nation as a whole is in very bad shape. Most of us have seen the reports on news programs and some of the hourly programs. We shouldn't be surprised. Money is what fixes the problem that's for sure. But right now we as a nation and state are broke! By the tune of close to 16 Trillion $$$ and growing at the national level. So we all should prepare to pay much more in fees, taxes and the like to pay what is needed to be fixed; the many years ahead. We should also be prepared for the devaluation (inflation) of money to pay off the 16 Trillion$$$. This devaluation/inflation will also require higher taxes still for the needed repairs. It will not be long before we are picketing at our very expensive new city hall to demand we stop paying for art out of our capital funds; and want the Green Belt tax eliminated. Between the road tax, vehicle fees and a few millages proposed in the last six weeks. Alone this will be increase in tax of a couple percent!

johnnya2

Sun, Jan 29, 2012 : 2:29 p.m.

I propose we dump the fuel tax and charge a fee based on the number of miles driven each year. Those that drive fewer miles pay less (since they do less damage to roads) and those that drive more miles pay more. This should be on a sliding scale based on the weight of the vehicle, so the trucks who really destroy the roads pay more per mile than the person driving the Mini Cooper

hank

Mon, Jan 30, 2012 : 5:14 p.m.

Great Idea but how would we get tax revenue from tourists and people passing through. Any Ideas?

johnnya2

Sun, Jan 29, 2012 : 10:33 p.m.

You go to Sec of State with the vehicle and they check mileage between each registration. You make any tampering with an odometer a very large fine with a felony in much the same way you would treat a fuel station that did not pay it's fuel tax.The black box will be a requirement in cars after September 2012.

justcurious

Sun, Jan 29, 2012 : 4:43 p.m.

How would that be policed?

Silly Sally

Sun, Jan 29, 2012 : 2:20 p.m.

How much does the trucking Industry pay to legislators each year in campaign donations, to both sides of the aisle, to buy influence them so they can keep the 160,000 pound weight limit that is double that of all other states? No other state has 42 wheel gravel trains; most have just 18 wheelers. What is going on? Why are we pounding our roads to DEATH?

justcurious

Sun, Jan 29, 2012 : 4:53 p.m.

<a href="http://michigan.gov/mdot/0,1607,7-151-14013-28111--F,00.html" rel='nofollow'>http://michigan.gov/mdot/0,1607,7-151-14013-28111--F,00.html</a>

Fred Crothers

Sun, Jan 29, 2012 : 1:37 p.m.

You know with ALL the traffic coming and going from our "vacation" spot ALL year around why not have our major freeways with toll booths? Seems to me when I or any of the millions of vehicles go over the Big Mac bridge we are paying a toll to keep it repaired!!?? Gee what a concept! Many states have toll roads just for that reason!! How far can you go on I80 with out paying a toll? HMMMMMM!!! OH I forgot we need a new bridge to Canada BEFORE we can take care of our MICHIGAN roads! With as many miles as each legislator drives to get to Lansing you'd think they just MIGHT feel the holes they fall into and out of! OH sorry I forgot they are too busy riding in the back seat of the limo WE provide for their trip!!

Mr. Ed

Sun, Jan 29, 2012 : 1:27 p.m.

I agree with Tony.

Silly Sally

Sun, Jan 29, 2012 : 1:12 p.m.

Truck weight limits that are double that of other states? Our roads are in terrible shape. Gas and especially diesel taxes need to be raised. The only question is by how much. We already have some of the highest taxes in the nation, but the poorest quality roads. Why? Is it due to deferred maintenance? Far too often roads need to be totally rebuilt, not just resurfaced. We cannot blame the weather, since next door in Ohio; their roads are is such better condition. Could it be the heavy weight limits that are twice that of any other state? I have often wondered if the trucking industry has politicians in its pocket and that is why they al say "no, the weight limits cause no damage" while other state have weigh stations to prevent over weight trucks from ruining roads.

justcurious

Sun, Jan 29, 2012 : 4:53 p.m.

I'm not championing the MDOT, but this is their take on truck weight limits. <a href="http://michigan.gov/mdot/0,1607,7-151-14013-28111--F,00.html" rel='nofollow'>http://michigan.gov/mdot/0,1607,7-151-14013-28111--F,00.html</a>

Jim Osborn

Sun, Jan 29, 2012 : 1:09 p.m.

I have 2 cars, a nice one and an old winter truck, now I am to pay as lot more even though I do not drive twice as much as someone who has just one?

u812

Sun, Jan 29, 2012 : 12:56 p.m.

yes the roads are in bad shape. just about everyone is doing more with less. Do not expect those that are left michigan to fully pay for something in a short amount of time because the Can has been kicked down the road soo longg. the Governor can do better then raising car registration 60 PERCENT. I know of nothing that jumps that high, maybe 5 percent this year and next and so on, Personally I like to see this capped at $30 dollars on a family vehicle i.e.(Oregon). Yes I'd like the roads repaired,it would be nice to see it in my lifetime,although there is a Depression going on in Michigan and money is scarce. Snyder can and should consider having everyone contribute, maybe raising the gas tax 40 cents a gallon & installing toll roads like other states,or the best solution may be to raise the sales tax a penny.

1bit

Sun, Jan 29, 2012 : 9:24 p.m.

Not the place, Sparty, to talk about the double taxation on small businesses that ended. But, to your point, any business that uses the roads would already pay for fuel and registration costs.

Sparty

Sun, Jan 29, 2012 : 3:28 p.m.

Do businesses not use the roads? How about having them return some of the $1.8 billion in tax relief Snyder gave them ?

Brad

Sun, Jan 29, 2012 : 12:50 p.m.

Yep, nary a mention of the sad state of Ann Arbor's streets. Is it just me, or does it seem like if the mayor and city council had their own publication it would look just like this?

DonBee

Sun, Jan 29, 2012 : 12:49 p.m.

New cars are now on average 2 times as efficient as the last time gas taxes were increased. So each penny of gas tax has to cover twice the number of road miles as it used to. I am not a big fan of higher taxes, but this is one I support. I would suggest that increases in registrations be based not on sale price or blue book, but rather on the gross vehicle weight, that way, heavy vehicles pay more. Truckers will claim they already do. Like it or not for at least the next 40 years cars and roads are important to Michigan. How we tax or do not tax electric vehicles is something that still needs to be worked out. They use roads too.

a2grateful

Sun, Jan 29, 2012 : 12:32 p.m.

"Our roads are in terrible shape, it's going to take billions of dollars to fix them, and we don't have the money." Except in Ann Arbor, where road maintenance money has been, and continues to be, stockpiled to pay for something else. Our street millage funds are not being spent for our streets. So the story here is quite different, and fascinating. Roads are crumbling before or eyes, among the worst in the state, while our tax collections among the highest in the state. How will our surplus actually be spent? Repurposing of millage-dedicated funds is a likely answer. Street and H20 funds pay for art. H20 funds pay for pavement. Park millage funds pay for a new transit center on parkland rezoned and repurposed for parking. What will Ann Arbor's street funds pay for? Ann Arbor's road story is quite different from the rest of the state: High taxes collected and stockpiled by dedicated millage are longer being spent for legally defined purpose. The crashing of car and truck suspensions we hear and feel on our roads, might really just be the disintegration of our Ann Arbor City Government. Some might call repurposing of dedicated assets creative financing. Others might call it criminal. Only a lawsuit or criminal charges will tell the true story about Ann Arbor's crumbling problem.