New report says city income taxes work best in smaller cities, are less reliable than property taxes

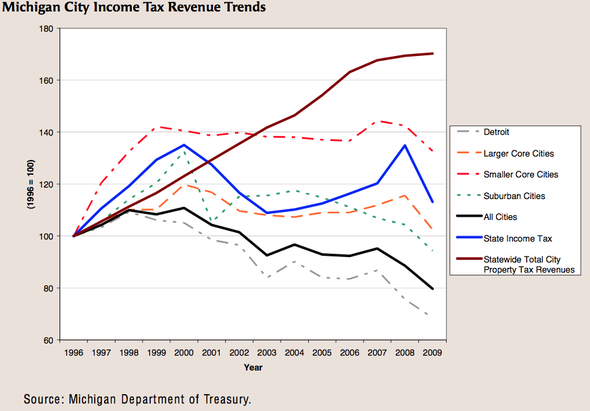

This chart is included in a new report by the Citizens Research Council of Michigan. It shows income tax revenues are less stable when the economy fluctuates, while property tax revenues tend to always see moderate, consistent growth.

A new study by a Michigan-based research group says city income taxes appear to have worked best for smaller core cities, while many larger cities haven't seen the same success.

Among the report's findings is that city income taxes "pale in comparison" to property taxes in terms of revenue productivity and financial stability.

The 10-page report from the nonprofit Citizens Research Council of Michigan comes as many communities across Michigan — including Ann Arbor — are considering city income taxes to close multimillion-dollar budget shortfalls.

For a city like Ann Arbor, which would have to eliminate its general operating millage to implement a city income tax, the report seems to make a case against such a move.

"Income tax revenues are much more cyclical than property tax revenues, varying with growth and contraction in the economy," the report states. "Although a new city income tax may provide an infusion of revenues to support service provision, the fluctuations in revenues make it difficult to finance ongoing services at constant levels."

Even with the recent drop in property values, property tax revenues have been minimally impacted compared to the sometimes severe declines in income tax revenues, CRC found.

The idea of an income tax in Ann Arbor has been discussed many times over the years; it was twice rejected by voters years ago. City officials began reconsidering the idea after the University of Michigan purchased the former Pfizer campus, taking it off the tax rolls.

Mayor John Hieftje said the latest report from CRC reaffirms his thinking that a city income tax may not be the right move for Ann Arbor.

Mayor John Hieftje said the latest report from the Citizens Research Council of Michigan reaffirms his thinking that a city income tax may not be right for Ann Arbor.

Ryan J. Stanton | AnnArbor.com

"I see a lot of problems with it," he said. "I look at the experience of other cities, and Grand Rapids lost something like 14 percent of their income tax revenue over the last couple of years. When you have a big recession, property tax revenues might dip 2 to 4 percent, but they don't drop 14 percent like you saw in Grand Rapids."

CRC notes its study looks at two distinct periods: before and after 2001. When economic growth was occurring in Michigan from 1996 to 2001, income tax revenues in most cities trended upward as personal income grew by 23 percent. After the recession hit, most communities — except smaller core cities — saw income tax revenues drop off.

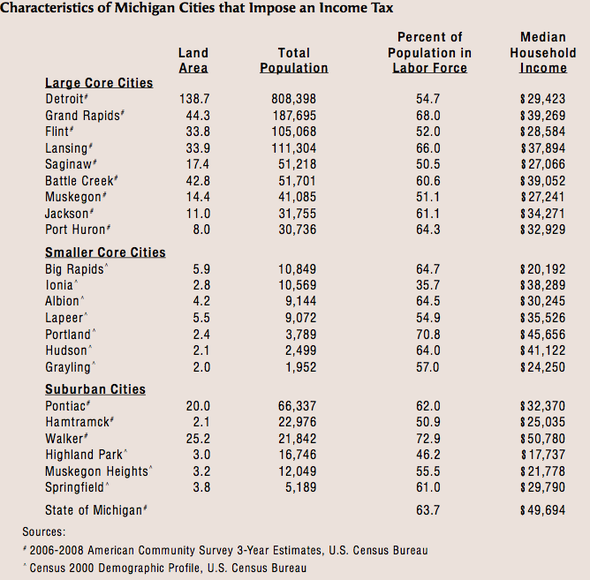

CRC's analysis found local income taxes have worked best for smaller cities that serve as employment hubs in their regions and have populations of about 2,000 to 11,000. Examples include Big Rapids, Ionia, Albion, Lapeer, Portland, Hudson and Grayling.

Larger core cities with an income tax — like Battle Creek, Flint, Grand Rapids, Jackson, Lansing, Muskegon and Saginaw — have fared better than Detroit, which has done extremely poorly. But those core cities still lag behind the state income tax in terms of revenue productivity.

Since 1964, Michigan law has authorized cities to impose local income taxes as an alternative, or supplement, to property taxes. Today, 22 of Michigan's 279 cities levy a local income tax.

Other local governments — including counties, villages, townships and school districts — are precluded from levying an income tax. Because of that, the report says one of the negatives of imposing a city income tax is the potential to create disincentives for people to live or work in communities where they know their earnings will be skimmed.

"The higher tax burdens can create incentives for people to locate and find jobs in cities or townships that do not levy a local income tax," the report states. "It also creates incentives for corporations to locate in cities without city income taxes."

RELATED CONTENT

Another downside is the need to create a new layer of bureaucracy to administer an income tax, which is an ongoing activity. It also places a new burden on those who have to file returns.

The last Michigan city to impose an income tax was Ionia in 1994. Since then, other cities have tried to get voters to approve an income tax, but those measures have failed.

Among the 22 cities with an income tax, five are home to higher education institutions for which the cities receive little direct benefit from property taxation.

Eric Lupher, CRC's director of local affairs, said the fact that Ann Arbor is home to the University of Michigan is perhaps the city's biggest reason to consider an income tax. He said income taxes tend to work better in cities where economic conditions are stable and where there is a large amount of tax-exempt property, such as government offices.

"Ann Arbor is in a unique position. They're the seat of government for Washtenaw County, so there are a number of factors that line up," Lupher said.

Lupher said a city income tax has worked particularly well for the city of Walker, a suburb of Grand Rapids that is home to Meijer Inc. corporate headquarters.

"They chose to rely mostly on the income tax. It's worked well for them," he said. "It's a nice place to live, the income tax is a healthy source of revenue and things are working well."

CRC's report found city income tax revenues have reflected not only economic fluctuations, but also out-migration and loss of income in the state’s largest core cities.

"The fact that city income tax revenues, as a whole, have not done as well as state income tax revenues may reflect the makeup of the larger cities that levy this tax," it states. "Several of the cities in the state that are suffering the greatest economic decline levy city income taxes."

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529.

Comments

John Q

Wed, Feb 2, 2011 : 11:55 p.m.

It's only the conservative drones telling the working and middle class that they have to continue to sacrifice to maintain tax cuts for the wealthy.

AlphaAlpha

Wed, Feb 2, 2011 : 2:53 a.m.

"Austerity only exists among the working and middle class and in the minds of conservative drones who insist that these groups suffer while the weathly amass even more wealth." Yup. It's naive to think 'conservative drones'; the big corporations donate freely to both parties, drones of each party think their party is different, and better, than the other; they are not. E.g., in nearly all respects, Obama = W. Especially with respect to Wall Street bankers, and the war complex, but many others. Unfortunately, the major economic events are largely set in motion, and there is little to change them except at the margins. In the bigger context, major wars generally follow depressions; that's another story... On the bright side, after the eventual bottom, perhaps 2016-2021, there are, indeed, better days ahead.

John Q

Tue, Feb 1, 2011 : 1:46 a.m.

Age of Austerity? US corporations are reporting record profits. Wall Street bankers are taking home billions in bonues? Austerity only exists among the working and middle class and in the minds of conservative drones who insist that these groups suffer while the weathly amass even more wealth.

AlphaAlpha

Tue, Feb 1, 2011 : 1:06 a.m.

Taxpayer value: a new paradigm for our new Age of Austerity.

John Q

Mon, Jan 31, 2011 : 2:18 p.m.

"The process of increasing tax revenue is made politically feasible by taxing people who can't vote, that is, commuters." You mean like anyone else who pays taxes in communities where they don't live? Owners of cottages up north don't get to vote on tax increases on second homes or cottages. Nor do people who own property anywhere outside of the community they live. If you want to vote on taxes in community, you need to live there.

Stuart Brown

Mon, Jan 31, 2011 : 3:08 a.m.

The city wants an income tax to increase revenue not to replace property taxes with income taxes. The process of increasing tax revenue is made politically feasible by taxing people who can't vote, that is, commuters. The commuters get taxed by paying parking tickets and speeding tickets already for the great roads Ann Arbor provides. Renters will get hit hard by this tax increase since landlords will probably not pass the tax savings from reduced property taxes on and by the fact they probably do not itemize their taxes to get the deduction. Roughly 1/4 of the property taxes are refunded by the Federal Income Tax to home owners.

Joel A. Levitt

Sun, Jan 30, 2011 : 11:28 p.m.

The stability of Michigan property tax revenues is most probably due to the averaging effect of our three year valuation process. One third of Ann Arbor properties are still evaluated based on the 2007 market. The graphs in this article do not yet reflect the effect of a prolonged slump such as we are now experiencing, but they soon will, due to the increasing number of foreclosures and seizures as more people are unemployed and can't afford to pay their property taxes. In any event, Ann Arbor needs more money, and as is pointed out in this article, "Since 1964, Michigan law has authorized cities to impose local income taxes as an alternative, or SUPPLEMENT, to property taxes (emphasis added). " Increasing property tax rates will only accelerate the rates of foreclosures and walk-aways.

Tony Livingston

Sun, Jan 30, 2011 : 9:54 p.m.

This is just another excuse not to make the tax system fair. The property owners bear the whole burden for everyone who uses the city. They think businesses will move to the townships? What about homeowners? The migration to township subdivisions started years ago and the number 1 reason is a much lower property tax. Why pay Ann Arbor taxes when you can live in the township and spend your time in the city with no financial contribution whatsoever?

Ernie

Sun, Jan 30, 2011 : 9:16 p.m.

I love Ann Arbor. I live here, I work here (two jobs) and I plan to stay. Its a great city with a lot to offer. I don't mind paying taxes for all the great things I use here: the parks, the police force, the streets, the schools, buses, and everything in this extremely great city. But guess what? A lot of people use this city as well, on a daily basis. Driving around Ann Arbor after normal business hours is great, there is little congestion on the road, and quite frankly its wonderful, but during normal business hours this city is stressed with an incredibly high volume of commuters. These commuters use our parks, our police force, our streets, and many additional resources. Much of this is picked up by those who live in this city with property taxes far exceeding the average for similar homes in the general area. Now I understand what this article argues, but I have to say that a city tax is not unreasonable. Those working and commuting here should pay some of their share as well. I understand that the businesses these individuals work for also pay their share of the taxes, but why can't commuters as well? Why should the burden fall solely on businesses and homeowners? I'm not arguing to lower property taxes just to be replaced by a city tax, but rather this as a suggestion: perhaps the future could see both property taxes as well as a city tax instead of rapidly growing property taxes. Perhaps this could prevent layoffs and salary reductions of our brave firefighters or our police officers who already do so much to keep us safe. Perhaps this will help keep our roads usable and devoid of potholes. Don't commuters use these services? Is asking them to help finance what they use (and what makes this city wonderful) ridiculous? Absolutely not.

dotdash

Sun, Jan 30, 2011 : 6:35 p.m.

If we need more money, let's just raise more taxes the same way we have in the past. If we feel that the change to a city income tax would be the way to go philosophically, then let's do that, but in a tax-revenue neutral way. Let's not get the two mixed up or we'll make some bad decisions. At the bottom, though, it sounds as if the real problem is that Ann Arbor didn't store up grain during the seven good years to make it through the seven lean years. Where was Joseph? (hey, it's Sunday...)

AA

Sun, Jan 30, 2011 : 6:21 p.m.

Take more of my hard earned money, I will make you spend twice as much in return.

Joel Batterman

Sun, Jan 30, 2011 : 5:56 p.m.

Imagine that UM has offshored its campuses to Hong Kong and Mexico. Pheasants roam the former Diag, now a prairie, making their nests in the Graduate Library stacks, whose contents have been hauled off for fuel by squatters in abandoned Burns Park homes. This is the economic reality that most Michigan cities contend with. It is not the economic reality in Ann Arbor, whose base is higher ed. Comparisons which don't account for this fact are of rather limited utility. Despite the unfortunate suburbanization of some UM facilities (East Medical Center), the University's investments in Ann Arbor are about as fixed as they come.

Mark

Sun, Jan 30, 2011 : 3:03 p.m.

Ooh, the University "ain't going nowhere". Don't be so sure. The University may not be able to leave Ann Arbor tomorrow, but it can choose to place new facilities and administrative operations in the townships. The University could use the income tax as a way to bargain with its unions to move certain operations into the townships. GM wasn't going nowhere, either.

Cash

Sun, Jan 30, 2011 : 3:55 p.m.

Again, no comparison. Apples and oranges. UM does not equate to GM in any way.

average joe

Sun, Jan 30, 2011 : 2:12 p.m.

I agree with stunhsif about the U/M- they are here to stay. Since the people in charge of the U/M continue to remove property from the tax rolls & reduce the city's take by way of property taxes, maybe the city needs to start taxing those people more through perhaps a graduated income tax method. (Higher salary= higher tax rate) The city needs to send the highly paid U/M administrators a message that they need to stop removing parcels from the tax rolls, or we'll 'get you where it hurts'.

KJMClark

Sun, Jan 30, 2011 : 1:59 p.m.

Cash is right. How many layoffs were there at the UofM in the past two years? Comparing Ann Arbor to industrial cities in Michigan is comparing apples and oranges. In this respect, we have more in common with Albion than Grand Rapids. This is a constant looking-backward problem with Michigan. "Looking at cities funded by heavy-industry jobs, it makes little sense for Ann Arbor to adopt an income tax." Except that Ann Arbor doesn't have any heavy industry, and that's a very old-economy way of looking at the situation. And the property tax argument is also hilarious. Looking back at a time when property taxes only went up, they conclude it doesn't make sense to tax income. Except that it should be obvious that property taxes *don't* always go up, and they're probably going to continue heading down for a few more years, even after income starts heading back up. And give some more thought to the property tax. In the rest of these industrial cities, when your major industry expands, that increases the property tax revenue. In Ann Arbor, when the major employer expands, we *lose* property taxes. It's more like comparing turnips and oranges.

stunhsif

Sun, Jan 30, 2011 : 1:34 p.m.

Above article states: ""The higher tax burdens can create incentives for people to locate and find jobs in cities or townships that do not levy a local income tax," the report states. "It also creates incentives for corporations to locate in cities without city income taxes." Cash beat me to the punch but Ann Arbor has a massive university that "ain't going nowhere". Their employees also,, "ain't going nowhere". Revenue from an income tax would not fluctaute nearly as much as in other Michigan cities. Smaller employers for certain would entertain moving outside city limits. We don't need more taxes, we need reductions in spending. When is government going to learn to live within its means ?

Halter

Sun, Jan 30, 2011 : 1:33 p.m.

Interesting article -- and largely a recreation of the same wheel that researchers find over and over again...But good to see an update. For the most part, it's a logical explanation for what will otherwise be a popular decision: if the income tax proposal is put on the ballot, it will go down in flames just like every other time here in Ann Arbor. Might as well save the energy, money, and effort and just eliminate that option now. It won't be popularly supported. It's not even worth further discussion except for esoteric reasons.

cinnabar7071

Sun, Jan 30, 2011 : 12:55 p.m.

"Perhaps it's time for our local workers to become more competitive?" Or perhaps we could just put chains on them, and not pay them anything. Or we could continue to take care of our employees stop blaming them for poor leadership.

AlphaAlpha

Sun, Jan 30, 2011 : 12:50 p.m.

It's helpful that income numbers are included above. Remember: 'Household Income" is total income, wages plus benefits, for the whole house; i.e., the total for all members of the household. As the typical MI household is ~2.5 people, personal income is about 40% of household income. Recall, average total annual compensation cost for Ann Arbor city employees is about $104,000. Each. Perhaps it's time for our local workers to become more competitive? Perhaps it's time to increase the value delivered to taxpayers?

johnnya2

Mon, Jan 31, 2011 : 12:21 a.m.

" 'Household Income" is total income, wages plus benefits, for the whole house;" You are either ill-informed, uneducated or a downright liar. Household income does NOT include benefits, but don;t let the facts get int he way of your argument. It never stops the anti-union tax crowd anyway.

AlphaAlpha

Sun, Jan 30, 2011 : 12:41 p.m.

Having a university is only one factor in the equation; Ann Arbor does, in fact, have much in common with other Michigan communities. Expanding the comparatives to other states would necessitate examining many additional state-to- state variables, a task which is likely not necessary, nor reliably accurate.

Cash

Sun, Jan 30, 2011 : 2:24 p.m.

"Having a university is only one factor in the equation" It is the only material factor. You've got thousands of people (students living within city boundaries, staff and faculty and all related support) requiring city services but not paying property tax. That's the single most material factor here.

Cash

Sun, Jan 30, 2011 : 11:54 a.m.

In order to review income tax results that could be similar to Ann Arbor, you would look at cities such as Columbus Ohio and the Borough of State College Pa....not Grand Rapids. Ann Arbor and GR have nothing in common other than they are within the same state boundaries. You need to compare municipalities supporting a major university, and it's students, faculty and staff. I'm not for or against Ann Arbor income tax, I just don't see the value of a comparison to cities not supporting a major university.

AMOC

Sun, Jan 30, 2011 : 4:25 p.m.

Cash - The vast majority of UM students contribute to property taxes in Ann Arbor because they pay rent and their landlords pay property taxes. Students who live off-campus are also major users of AATA bus service, ling sufficient ridership to support much more extensive mass transit in AA than in other cities of its size. Were you aware that the UM Outpatient facility was located in Ann Arbor Twp, beyond the reach of a city income tax? How many of UM's health care professionals will re-define their primary work site to the outpatient clinic if an income tax is enacted? Most of them? All of them? And how many smaller employers with lots of choices will move (or establish new firms) in the townships to escape the income tax? Most of them, I think. What does that mean for AA SPARK and similar business incubators?

Cash

Sun, Jan 30, 2011 : 2:22 p.m.

Yes Ryan but NO comparison to the relationship between U of Michigan and Ann Arbor. The sheer impact of U of M on Ann Arbor is not the same as GR. The majority of U of M student LIVE in AA and require services from the city.

Ryan J. Stanton

Sun, Jan 30, 2011 : 2:08 p.m.

Read the "education" section here: <a href="http://en.wikipedia.org/wiki/Grand_Rapids,_Michigan" rel='nofollow'>http://en.wikipedia.org/wiki/Grand_Rapids,_Michigan</a> Grand Rapids is home to several colleges and universities, and has a growing health care industry.