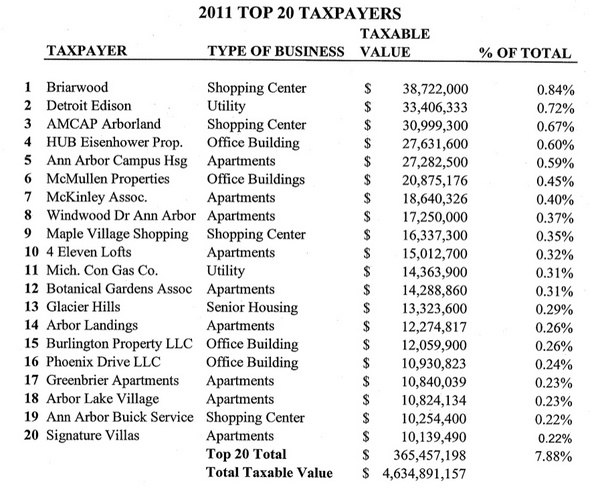

Top 20: Ann Arbor taxpayers in 2011

The start of the year is tax season in the Ann Arbor assessor's office, where David Petrak and his staff are working on the 2012 assessments for property in the city limits.

By early March, property owners in Ann Arbor will receive any changes to their taxable values, which in turn will affect the amount they'll be taxed.

Those notices should go out during the first week of March, Petrak said.

I've wondered recently how the city's tax base will fare this year, after two recent stories: the top-of-market apartment sales for two of the top 20 taxpayers in the city and the weekend's coverage of the 5-year anniversary of Pfizer announcing it would close its Ann Arbor campus.

It can take a while for taxable values to catch up with market values, but by 2011 the city was in the midst of a revenue post-recession value drop: Total property tax revenues in 2011 came in at $78.6 million, which was down $3.4 million — or 4.2 percent — from $82.1 million the year before.

How this year looks should help the city define its recovery. AnnArbor.com will have more coverage of this during the spring and beyond.

In the meantime, I thought I'd share list of the top 20 taxpayers in the city - and the link to the top 20 taxpayers going back to 2001.

In 2011, the top 20 taxpayers accounted for 7.88 percent of the city's taxable value - or $365,457,198 of the city's overall $4.6 billion in taxable value.

That compares with 2010, when the top 20 represented 8.17 percent of the city's tax base - or $383,476,379.

What's changed? Retail values, for one, due presumably to lower sales and higher vacancies. Two of the top three had value drops: Briarwood lost almost $3 million in taxable value, while Arborland lost about $4.5 million. Another retail center - Maple Village - lost $2.8 million in taxable value. And Ann Arbor Buick Service - known more commonly as Huron Village - lost about $400,000 in taxable value.

A full half of the list represents housing, and many stayed about the same. Drops were reported for Windemere and Lake Village, the two that just sold (and likely will see a higher assessment based on that). Small jumps were seen at Ann Arbor Campus Housing, McKinley, Greenbriar. Small drops include Glacier Hills.

Office buildings fared well: the former 777 Building on Eisenhower was the top of that sector on the list at $27,631,600, showing a value jump from its sale out of the Transwestern portfolio. The McMullen portfolio also shows a $130,000 value jump.

The biggest office drop is also predictable: Phoenix Drive LLC went from $14,064,609 in taxable value to $10,930,823. The former Borders headquarters had been devalued by vacancy before the company complete abandoned the building as part of its bankruptcy in 2011.

Here's the list of the largest taxpayers in 2011. For comparison, here's the historical list going back to 2001.

Source: City of Ann Arbor

Comments

JAM2

Tue, Jan 31, 2012 : 5:16 p.m.

Note that when you combine MichCon and Detroit Edison, as they are both owned by DTE Energy, DTE is by far the largest tax payer in the city...which is the case in a lot of communities since they own so much taxable infrastructure... Worth noting since activist groups like to say that DTE doesn't pay any taxes...they do, just all local and state at this point (which is arguabley better for our communities).

Steve Pierce

Tue, Jan 31, 2012 : 1:42 a.m.

Paula wrote: "The biggest office drop is also predictable: Phoenix Drive LLC went from $14,064,609 in taxable value to $10,930,823. The former Borders headquarters had been devalued by vacancy before the company complete abandoned the building as part of its bankruptcy in 2011." Wow, who knew a vacant building has a lower taxable value. Don't tell the Ypsi assessors that. - Steve

George

Mon, Jan 30, 2012 : 9:46 p.m.

Um and churches should all be paying. They all benifit from the services

Thomas Cook

Mon, Jan 30, 2012 : 9:45 p.m.

What's really telling is the millions lost with Pfizer - that's a lot of taxable value that isn't coming back, probably ever, in any form.

Jeremy Peters

Mon, Jan 30, 2012 : 9:29 p.m.

U of M is a constitutional (State of Michigan constitution) entity, meaning that it has eminent domain, and is not subject to local taxation. Whether or not you support it, get your facts straight before you complain. :)

xmo

Mon, Jan 30, 2012 : 5:51 p.m.

I love capitalism and the revenue it Generates!

B2Pilot

Mon, Jan 30, 2012 : 5:31 p.m.

A couple of points; The University is the only draw to A2, without A2 is another 4 corners on the map The University staff and students is keeping the downtown somewhat afloat, without either A2 is done. The University keeps raising tuition and raising rates yearly on employee parking and benefits The city has not attracted a high end employer in years !! Do not start talking of instilling a tax on the few occupants left in the down town here that cannot afford to live in A2

Seasoned Cit

Mon, Jan 30, 2012 : 4:02 p.m.

Let's not forget that many of those folks paying rent in those housing units are students or employees of the UM. Yes the UM doesn't pay property tax but their employees seem to be indirectly contributing a lot to the local property taxes.

smokeblwr

Mon, Jan 30, 2012 : 6:15 p.m.

I would guess a majority of UM employees live outside the city. UM salaries are low compared to private industry and Ann Arbor is an expensive place to live, so most prof-MD types will find it tough to live here. Why do you think US23 is jammed every night as people leave town to head back home?

BobbyJohn

Mon, Jan 30, 2012 : 5:24 p.m.

A specious argument Employees of all private businesses also pay taxes, but so do their employers. And since UM owns nearly 1/2 of the property in city limits, the city taxpayers have to pay a disproportionate amount of taxes

Hot Sam

Mon, Jan 30, 2012 : 3:34 p.m.

I would be curious to learn what is actually paid...after breaks and other adjustments...

glimmertwin

Mon, Jan 30, 2012 : 3:15 p.m.

UM tuition keeps rising yet I don't see them paying anything. The tax system sure is fair, isn't it?

5c0++ H4d13y

Mon, Jan 30, 2012 : 7:47 p.m.

So if they did start paying taxes how do you think they would pay for those taxes?

Pablo

Mon, Jan 30, 2012 : 2:32 p.m.

It would be interesting to see the top residentials' values, as well.

Marshall Applewhite

Mon, Jan 30, 2012 : 6:07 p.m.

That is searchable.....

InsideTheHall

Mon, Jan 30, 2012 : 1:47 p.m.

Paula, can you do a follow and show the major categories by percentage for the entire tax base. That will most likely show we look like Italy a service-quasi public economy where we trade dollars amongst each other with no real opportunity for capital formation to occur.

racerx

Mon, Jan 30, 2012 : 1:11 p.m.

Seems pretty sad that the highest taxpayers are retail and apartment rental companies. Gee, this sure bolsters the argument for taxing employees who work in the city. Unless I've totally mis-read this, all it would take is another recession for the economy to tank whereas 2/3 of our national economy is dependent upon consumer spending, and for people to move out of Ann Arbor. Then the city will be back where it was financially.

ToddAustin

Mon, Jan 30, 2012 : 2:05 p.m.

I make the opposite conclusion. Retail and apartment complexes aren't going anywhere, even in a downturn. If you make yourself dependent upon income taxes, when the employment level drops off, so does the cash flow to support essential services.

sloppySam

Mon, Jan 30, 2012 : 12:44 p.m.

so sad to lose Border's Books, isn't it? Ann Arbor is one of the few places that a job hunt isn't an impossible chore, but things are still on the downturn.. grease up skid row!