Commissioners want more information as county considers bond issue to cover retiree benefits

Washtenaw County Administrator Verna McDaniel conducts a public meeting on a proposed bond issue Thursday at the county's Learning Resource Center in Pittsfield Township.

Amy Biolchini | AnnArbor.com

McDaniel has responded in kind this month with several briefing sessions and the launch of a new website on the bond issue.

After the bond issue was introduced to the public May 2, a lack of complete information and desire for more public involvement caused the Board of Commissioners to pull the issue from its May 15 agenda.

Information has been trickling out since then, and most commissioners now have a better grasp of what’s at stake.

However, with little control over the county’s decision to issue millions of dollars in debt, public resistance has quietly been bubbling up.

Less debt than anticipated

Early reports indicate the amount Washtenaw County will need in order to cover its long-term retiree benefit debts will be substantially less than the $350 million initial estimate, McDaniel said this week.

McDaniel introduced the bond proposal to the Board of Commissioners this spring as a way for the county to pay off millions of dollars in debt incurred by two under-performing trust funds for retiree pension and health care benefits.

Though the county has been paying its required contribution to both trust funds each year, debt has continued to increase as the return on investment has been less than anticipated.

McDaniel claimed Tuesday that the bond issue would be tens of millions of dollars less than the $350 million figure, based on a report the county received from its actuary this week.

However, she would not elaborate as to what the more accurate figure is.

That announcement will likely come at the July 10 Board of Commissioners meeting — two days after county staff receives a highly anticipated actuarial report. A review by an independent consultant is also due at that time.

Here's how the bond proposal would work:

- The county would borrow a sum of money that it estimates, based on the most recent actuarial report, will fully fund its debts for current and future retiree pension and health care costs. That amount is estimated to be less than $350 million.

- The borrowed money would be invested by someone the county hires and according to a policy that the Board of Commissioners develops.

- An intermediary trust fund would be established to collect the return on investment from the bond, to be overseen by a board the Board of Commissioners would appoint. The bond proceeds will pay the county’s annual required contributions to its pension and health care funds.

- The county would be responsible for paying off the money it borrowed, plus interest. Funds for that will come from the county’s fringe benefit fund, which draws a set amount from the general fund and required employee contributions. The county could determine its own payment schedule.

The success of issuing bonds for the long-term debts would rely on the return on investment being greater than or at least the same as the rate at which the bond was purchased.

Should the bond proceeds not be large enough to cover the county’s annual required contribution, the county would have to allocate more money away from its operations to pay for that additional debt.

A public vote?

At the July 10 meeting, the commissioners will be faced with the same resolution at its back-to-back Ways and Means and regular meetings that would start the ball rolling on the bond issue process.

Should the resolution — a notice of intent to issue the bonds — be approved by the commissioners at both meetings, a 45-day referendum period will begin July 11.

During that period, the public has the opportunity to collect 15,000 signatures on a petition in order to place the bond issue on a ballot for voter approval.

Ann Arbor resident Doug Smith has begun organizing a group to begin collecting signatures as soon as the referendum period begins July 11.

He’s started a website — “Washtenaw Watchdogs” — and has eight volunteers who have pledged to help him collect signatures and canvass county residents door-to-door.

“The basic intent is that something this big ought to be up to the vote of the people,” Smith said. “I think the county and the county administrator are giving a rosy picture that I don’t think is anywhere near the truth.”

Smith said he’s confident that he’ll be able to raise 15,000 signatures in 45 days — but that he doubts he’ll be able to meet the Aug. 13 deadline to file language for the November ballot. The ballot issue would then appear before voters in February.

By February, the county will have had to approve its budget for 2014 — and McDaniel is counting on the bond issue to prevent significant operational cuts this budget cycle.

The bond issue does not require a vote of the people in order to move forward. The commissioners could place the item on the ballot ceremonially, but McDaniel is against the measure.

“Time is against us,” McDaniel said.

She said Thursday during a public briefing it would be too time-consuming for her staff to wait for a ballot initiative as they attempt to create a four-year budget for the first time this year.

The other option

In pursuit of long-term fiscal stability for Washtenaw County, McDaniel has also presented the commissioners with the task of switching from a two-year to a four-year budget cycle.

In the past five years, the county’s services have undergone significant operational budget cuts.

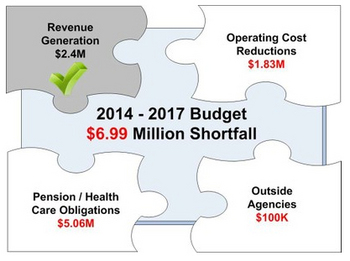

In a financial analysis presented to commissioners this spring, McDaniel stated that nearly $7 million in additional operational cuts are needed to ensure stability in the next four years.

The county administrator's proposal of how to eliminate $6.99 million from its budget for 2014-17.

Courtesy of Washtenaw County

The majority of that figure must be made in the first year of the four-year budget, said Kelly Belknap, the county’s finance director.

About $2.4 million of the $6.99 million has been accounted for through higher-than-expected revenues. McDaniel is banking on finding the vast majority of the $6.99 million through reductions in the county’s payments to its retiree health care and pension funds.

In 2012, Washtenaw County paid out a combined $20.6 million to cover its annual required contribution to the pension and health care funds — a figure that accounts for 10 percent of the county's general fund expenditures of $97.8 million and 20 percent of all expenditures, McDaniel said.

That payment is expected to rise to $22.3 million in 2013, and to be even higher in 2014 because the county has closed the pension and health care plan to employees and so it must pay off its debt on a more aggressive schedule, Belknap said.

Without issuing a bond for the estimated $340 million debt in the two funds, administrators claim they would have to divert more general fund revenue away from critical operations to pay off debt.

McDaniel, at the request of several commissioners, published the alternative scenario to bonding for the debt this week on a new website dedicated to the issue.

A number of discretionary services could be affected:

- A countywide road patrol staffed by 12 Washtenaw County Sheriff’s Office employees

- Senior nutrition programs expected to provide more than 156,000 meals this year, including to homebound individuals

- Washtenaw County Sheriff’s Office Community Corrections — including jail and prison diversion programs

- Probation services to supervise sentenced offenders in the community

- A Michigan State University Extension office

- The Maternal Infant Health Program to support pregnant women and infants on Medicaid

- Job training and placement for unemployed residents

- Affordable housing development

- Health care for 8,000 low-income, uninsured residents through the Washtenaw Health Plan

About 70 percent of the services the county funds are mandatory, while the remaining 30 percent of the services are funded by the state and federal government. The county contributes a small amount to funding those services in order to gain state and federal funding.

The county employs 1,350 people, 650 of whom are paid for by general fund dollars.

“I don’t think that just showing what would be cut is a compelling enough argument for bonding, but I think it gives context as to why bonding would be the least bad of the options,” said Commissioner Andy LaBarre, D-Ann Arbor.

LaBarre said that should the county choose to issue a bond for its debt, it doesn’t mean that “happy days are here again.”

“If we did the bonding, we’re going to have to remain in ‘lockdown mode’ for quite a while,” he said.

Board Chairman Yousef Rabhi, D-Ann Arbor, said being fiscally conservative in the future is a better alternative than having to make deep cuts in county services.

McDaniel said she believes all of the commissioners have taken the time to understand the intricacies of the bond issue — though “some are more passionate about it than others.”

“I think what they clearly understand is that the cuts will be extremely painful,” McDaniel said. “They’re going to look at that probably much more seriously — that if we have a strategy for making those cuts that we’re going to give that serious consideration.”

Releasing more information

The discretionary county services that would be on the line for cutting should the county not issue bonds were not made public until this week.

Andy LaBarre

The issue of bonding for long-term debts was first brought up during union contract negotiations in February, which were hastened in advance of the right-to-work implementation deadline. The measure was presented to the public for the first time May 2 and commissioners were supposed to vote on the issue May 15.

The board instead postponed the matter to allow more time for public engagement and education and to wait for a new actuarial report for a more accurate estimate of accrued debt.

Commissioners have urged the county administration to disseminate more information to the public since May.

“I specifically talked to Verna and said you need to have a press conference and a public presentation,” Rabhi said.

Rabhi acknowledged that some of the information could have been distributed sooner, but he said county administration has a demanding workload and are dealing with other issues.

“They got it out there at the time they could get it out there,” Rabhi said. “That’s what we’ve asked them to do. They’ve accomplished everything we’ve asked them to do … Overall, they did a good job.”

McDaniel said she directed her staff to develop a new webpage with the bond proposal information after she was asked by several commissioners.

She explained her reluctance to publish a list of discretionary services that could be cut, should the county decide against issuing bonds.

“When you do operational cuts in the organization for programs and services, it’s a process that takes a long time,” McDaniel said. “It takes coordinating and having conversations with key people in the organization … I don’t want to blindside anyone.”

Amy Biolchini covers Washtenaw County, health and environmental issues for AnnArbor.com. Reach her at (734) 623-2552, amybiolchini@annarbor.com or on Twitter.

Comments

PineyWoodsGuy

Tue, Jul 2, 2013 : 4:02 p.m.

Boys and Girls. Permit me to explain the plan. Today the stock market Dow-Jones average is the highest in American history. Would you go to the bank and borrow money to buy stock today? Think of it as a Cats and Rats plan. Borrow money at the bank to build a Cat Ranch. Next door you build a Rat Farm. Rats reproduce at a prodigious rate. Slaughter the rats and feed them to the cats. When the cats get fat, slaughter them and sell the skins to a clothing manufacturer in China. Feed the cat carcasses to the rats. Now! Get This: We feed the rats to the cats and the cats to the rats and we get the skins for free! Clever cat thinking! Really cunning rat thinking! Now boys and girls, tell me: Who are the cats and who are the rats down at the county building?

Judy

Tue, Jul 2, 2013 : 3:33 p.m.

Gee…Andy maybe you and your fellow board members should of had Administrator Verna McDaniel working on an actuarial report for a more accurate estimate of accrued debt in February instead of having her negotiate 5 and 10 year union contracts in advance of the right-to-work implementation deadline.

Judy

Tue, Jul 2, 2013 : 1:03 p.m.

So were are all the union supporters now? Nicholas Urfe, sh1, clownfish, It's hard to hide from facts, tartan8, Goofus, Sandy Castle, I told you 10 year contracts were going to come back a bit us in the butt. The Commissioners knew this was a problem back in February during union contract negotiations, which were hastened in advance of the right-to-work implementation deadline. Dan Smith, R-Northfield Township was the only dissenting vote of the Washtenaw County Board of Commissioners back in February. Besides the fact of how many Washtenaw County union employees are not Washtenaw County Tax payers! www.annarbor.com/.../washtenaw-county-takes-stance-against-right-to-work- legislation-with-unanswered-legal-questions/ annarbor.com/.../washtenaw-county-approves-10-year-union-contracts-one- week-before-right-to-work-implementation/

snoopdog

Tue, Jul 2, 2013 : 12:57 p.m.

" The county would be responsible for paying off the money it borrowed, plus interest". What they should say: "The taxpayers will be responsible for paying off the money the government hopes to borrow because of out of control spending and entitlements" I am tired of my hard earned money being used to fund union employees pensions and lifetime healthcare. I don't have a pension and will be on medicare if I am fortunate to make it to the age of 65. Tell me why it is fair to provide these ridiculous entitlements with my money? Good Day

Shawn Letwin

Tue, Jul 2, 2013 : 9:24 a.m.

For those interested in helping or signing the petition, hit the comment button on the Washtenaw Watchdog webpage and you can indicate your interest (plus adding your email address that is not made public for follow-up). Be the change you want to see...

snapshot

Tue, Jul 2, 2013 : 4:53 a.m.

McDaniel's website gives no information on how property owners are put at risk of increased taxes in the event of a default. That the current trust funds are underperforming and the intent is to invest bond funds at an expected positive return rate is CONTRADICTORY. What a crock. We borrow more money to invest in order to fund debt incurred by poor performing investments? Give me a break. This is a union influenced PONZI scheme that puts all property owners at risk for increased taxes. At the least it takes money from the general fund resulting in reduced services and safety to all property owners. This should be illegal to fund debt by incurring more debt. Commissioners will be catering only to the public unions so they garner votes and not fulfilling their fiduciary responsibility to the public good. This in not in the interest of the public, this is in the interest of public unions so that they may enjoy no reduction in benefits while the general public gets screwed. And the general public has NO say in the matter. This is reminiscent of the sylvan Township bond proposal that DOUBLED the property taxes because of its failure and leadership incompetence. Commissioners should be ashamed to even consider putting the public at risk for this kind of unethical behavior. Go back to unions and renegotiate their benefits. That they should not incur any risk is a crime.

paper fan

Mon, Jul 1, 2013 : 7:24 p.m.

Why do they (McDaniels and the BOC) always threaten to cut discretionary services in which the employees are lowest paid individuals in the county. Let's have the backbone to cut management and admin positions, they are ALL overpaid, and it's their pensions that cost the taxpayers the most money.

snoopdog

Tue, Jul 2, 2013 : 1:09 p.m.

Cut all their pay 10% and make them pay 40% of the healthcare and future pension benefits. I don't care if they are highly paid or not, you are not going to raise our taxes. Good Day

Judy

Mon, Jul 1, 2013 : 7:31 p.m.

Because they can! And fear works!

arborani

Mon, Jul 1, 2013 : 7:17 p.m.

"The borrowed money would be invested by someone the county hires and according to a policy that the Board of Commissioners develops." Oh. Dear. God.

trespass

Mon, Jul 1, 2013 : 6:18 p.m.

Putting the issue on the ballot will put a stop to the rush that Verna McDaniels is forcing on the Board of Commissioners. If it is on the ballot, the County will need to provide more justification and a better assessment of the risk. The plans so far are a combination of four things 1. Having a large presence at upcoming events such as the Ann Arbor Arts Fair and the Ypsilanti Heritage Festival. 2. Collecting signatures wherever there is a lot of foot traffic (e.g. the parking lots of big retail stores) 3. Soliciting business owner to collect signatures at their customer service counters. 4. Canvassing neighborhoods. I am already organizing our presence at the Arts Fair. The agenda published by Verna McDaniel says that the announcement will be made on July 11 if the Board approves the resolution at its July 10 meeting. That will be the start of our 45 days. I would also like to encourage as many people to attend the July 10 meeting as possible to express their concerns. That is also a good time for some of the volunteers to meet. It is possible that we can convince the Commissioners to put this issue on the ballot themselves if they find the same kind of sentiment at the meeting that is being expressed in these comments. Visit the website and make contact through the online contact form and we can have a discussion. The number of volunteers is now at 15 and I hope to try to recruit about 100 by July 10. www.washtenawwatchdogs.com

trespass

Mon, Jul 1, 2013 : 7:49 p.m.

@Judy- The problem with that is that we cannot start collecting signatures until they make the official announcement that they are going to sell the bonds. That won't occur until after the July 10 meeting of the Board.

Judy

Mon, Jul 1, 2013 : 7:29 p.m.

Any chance to start getting signatures at any of the 4th of July parades, wishful thinking.

JimmyD

Mon, Jul 1, 2013 : 6:14 p.m.

Notice the $6.99M budget gap? This is after lowering the prior years' $20m pension contributions to $17.5M (bond payment) for 2014. Doesn't that mean $2.5M has leaked from previous pension contributions back into operations? Just like the bad old days? Freeze the contributions at $20M and see what happens.

Jay Thomas

Mon, Jul 1, 2013 : 5:12 p.m.

Some of us don't want to gamble on the stock market with tax money. Give us the opportunity to vote on this matter directly. The county should also get out of the business of housing construction.

Greg

Mon, Jul 1, 2013 : 5:11 p.m.

Thanks Doug! But the website needs dates and locations where signatures are being collected. Regardless of the bond merits, someone needs to tell the county that retirees should be planned for, not considered as a sudden huge emergency commitment.

trespass

Mon, Jul 1, 2013 : 6:06 p.m.

The website is a work in process. I will include many more dates and plans for collecting the signatures as July 10 approaches. Right now I am concentrating on finding out how many people are interested in helping and I will organize some meetings soon.

Gemini27200

Mon, Jul 1, 2013 : 4:41 p.m.

Issuing bonds, with extensive fees to cover retirement obligations is very risky business. It's time to look at these platinum covered benefits. Thanks Washtenaw Watchdogs! At least the County discussion is open, and mostly in the public. Beware of your local communities....Pittsfield is quietly shoving a TIF through, by having quiet meetings in teh middle of the day when most of the public can't attend! Why can't we see any in-depth reporting on this topic?

Basic Bob

Tue, Jul 2, 2013 : 10:45 a.m.

It's a great time to start a Corridor Improvement Authority. Taxable value has not recovered and will climb as the local economy improves. The township is flush with money so they can afford to divert some tax revenue to their special project to create a $32-Million 4 lane boulevard from Upper Saline to Costco, paid for with federal congestion relief funds. Of course they will need to buy some airport land from the city, which can be used to leverage federal funding for the runway expansion. If you want to do something about congestion relief, take a look out the front windows of the township administration building. There is your problem.

ChicagoAtlanta

Mon, Jul 1, 2013 : 4:04 p.m.

Isn't this how the City of Detroit has failed? Do the people we elect have issues with management of the responsibilities we give them or is it that their hand is out for contributions from the unions? Pensions are not sustainable if you can work for 10 years and collect 40 years of cash. I cannot do it in the private sector and just because you collect garbage does not give you that right either.

Amy Biolchini

Tue, Jul 2, 2013 : 1:38 p.m.

The city of Detroit pursued this type of measure to pay off their debts but did not close their plans and did not borrow enough to cover the debt in the first place.

YouSaidWhat?

Mon, Jul 1, 2013 : 4:03 p.m.

1. Is Doug Smith or members of his family employed by the County? 2. Is Doug Smith related to Alma Wheeler Smith, Conan Smith, or Dan Smith? Can't tell the players without a scorecard.

DJBudSonic

Mon, Jul 1, 2013 : 6:51 p.m.

I think most assume you are not related to those folks, otherwise why would you oppose their plans? But then, Smith is an uncommon last name, surely you must be related *wink*.

trespass

Mon, Jul 1, 2013 : 6:02 p.m.

I am a retired professor of pathology from the University of Michigan. I am not employed by the County and I am not related to any other Smith's in the County (my family is from Iowa). My concerns are about good governance.

DJBudSonic

Mon, Jul 1, 2013 : 3:54 p.m.

The #1 reason to stay away from this scheme comes from Ms. McDaniel: "McDaniel introduced the bond proposal to the Board of Commissioners this spring as a way for the county to pay off millions of dollars in debt incurred by two under-performing trust funds for retiree pension and health care benefits." The debt they are seeking to pay off was the result of under-performing investments! Whether as a result of poor fund management, market exposure or any other reason, an investment did not live up to it's expectations. Why then would we try to solve the problem with another investment gamble? And leave the already heavily-taxed residents of Washtenaw county holding the bag? No, thanks. I fully support a referendum to put this scheme before the voters, sign me up.

MyOpinion

Mon, Jul 1, 2013 : 3:16 p.m.

Armentrout has given sage advice based on her understanding of county financing/governance. We now need some info on the bond market - Ranzini?

Roger Kuhlman

Mon, Jul 1, 2013 : 3:15 p.m.

Why is Washtenaw County government paying its employees lavish retirement benefits that their counterparts in the private sector do not get? Why did the Washtenaw County Board of Commissioners give their unionized employees recently a ten year extension of their contract when they knew they had a major problem covering the retirement benefits of their employees. There is no way we should raise taxes to cover this bond issue!

Amy Biolchini

Tue, Jul 2, 2013 : 1:37 p.m.

Raising taxes to cover the bond issue is not on the table at this time. The county is considering limited tax bonds, which do not require a vote of the people because they would be paid for using the county's operating millage -- of which it currently levies the maximum amount. There has been some light discussion of possibly asking the voters for a new millage to create a rainy day cushion should the market prove to be more volatile than expected -- but those are just ideas that have been floated at this time.

Larry Baird

Mon, Jul 1, 2013 : 2:23 p.m.

Fact check: - The current pension plan is NOT closed for existing employees (and new hires this year). The current defined benefit plans will continue to accrue additional years of service/benefits for all the current employees (including those hired this year), therefore continuing to increase the future benefit obligations (and possibly the size of future shortfalls if benefit obligations continue to grow faster than pension funds). - The plan closing only impacts those employees hired after 2013. Therefore the core dynamic of promised benefits rising faster than contributions, times the rate of return remains virtually unchanged for the current budgeted employee payroll. - The $340 million funding shortfall (amount to be updated) changes every year depending on the rate of return of the trusts. The dynamics that created this shortfall still exist and could therefore increase the size of the shortfall. In a falling market cycle, the bonding proposal could compound those losses. Instead of two underperforming trust, we now have three underperforming trust, plus the interest costs ($150 mm - initial proposal). Therefore, it would be inaccurate and misleading to say the bonding proposal "...will fully fund its debts for current and future retiree pension and health care costs." That statement should read "will fully fund the plan for the current year only, to be recalculated annually." Doug Smith, where do I sign up?

Carole

Mon, Jul 1, 2013 : 1:37 p.m.

Well., re: pension/health care for retirees. One way of helping out, would be to have all retirees pay a portion of their health care insurance. In the 2000, UM realized that it had a concern with continuing to support retirees 100%, held a major healthcare meeting with hundreds of retirees showing up -- insurance companies were available for all to talk with and in the end all of us retirees started paying a small amount. I had no problem with this and still don't. Maybe all the governments might wish to take a look at doing the same thing. One thing that has bothered me re: retiring folks from government is sometimes they only work for a few years, retire, get full pension and health care -- i.e. city administrator a few years ago. Used to have to work a long time to get full benefits. Hmmmmm. Just my thoughts.

Roger Kuhlman

Mon, Jul 1, 2013 : 3:20 p.m.

Why are Washtenaw County taxpayers paying for any of the healthcare benefits of its retired employees? Very few retired employees from private companies get healthcare coverage from their former employers these days. I know I do not.

tartan8

Mon, Jul 1, 2013 : 3:10 p.m.

Excellent suggestion! Over a year ago the county had 150 employees take a early retirement because a good many of them did not want to pay toward their health care coverage!! Now mind you these retirees are pre 65 retirees and the county is paying for full health care coverage not a complimentary coverage that a retiree would have at 65 due to Medicare coverage being the primary insurance coverage. As far as I'm concerned the county needs to send their pre 65 retirees to the insurance exchanges that are being put in place thru the ACA (Obamacare). We all need to understand that the days of free health care are over even for retirees. I know when I retire I will have to plan for my health care insurance costs and that's really okay with me!

a2huron

Mon, Jul 1, 2013 : 1:07 p.m.

Didn't Detroit pensions issue bonds for this same purpose? Emergency manager about to default on them 'cause they can't be afforded any more? How is that working out for them? Seems like Washtenaw should run - not walk - away from this time bomb.

JRW

Mon, Jul 1, 2013 : 1:07 p.m.

"The success of issuing bonds for the long-term debts would rely on the return on investment being greater than or at least the same as the rate at which the bond was purchased." This cannot be counted on. The bond market is imploding at this time, and interest rates are rising. Get a financial officer and investment officer who are professionals and who know how to navigate volatile investment markets over the long run. Investments of all types have risk, and taxpayers should not be on the hook in the future if "markets don't perform as expected." Markets cannot be predicted with certainty. Hire investment professionals who know what they are doing and get the public involved. Stop trying to keep this information under wraps.

JBK

Mon, Jul 1, 2013 : 1:05 p.m.

Can anyone say Detroit? This is playing out like a bad sequel.......... I checked out Doug's website and I did not see any contact information. I would assume that Doug would host a couple planning meetings to get this moving forward. Perhaps A2.com could publish this information and/or Doug will. I would like to get involved as I am sure 100s of other concerned citizens would as well........

trespass

Mon, Jul 1, 2013 : 5:57 p.m.

The website has an online form for volunteers to circulate petitions. If you respond with that form, I will get back to you by email. www.washtenawwatchdogs.com

Steve Hendel

Mon, Jul 1, 2013 : 1:05 p.m.

In 2012, Washtenaw County paid out a combined $20.6 million to cover its annual required contribution to the pension and health care funds — a figure that accounts for 10 percent of the county's general fund expenditures of $97.8 million and 20 percent of all expenditures, McDaniel said. Doesn't make sense. Are those % switched?

JRW

Mon, Jul 1, 2013 : 1:02 p.m.

"However, she would not elaborate as to what the more accurate figure is." Why not?

Sparty

Mon, Jul 1, 2013 : 4:48 p.m.

"That announcement will likely come at the July 10 Board of Commissioners meeting — two days after county staff receives a highly anticipated actuarial report. A review by an independent consultant is also due at that time."

Dog Guy

Mon, Jul 1, 2013 : 1 p.m.

I attribute the commissioners' clunky counterfeiting con job and sweetheart $Millions for friends to the malign influence of housing Kwame within Washtenaw County.

a2huron

Mon, Jul 1, 2013 : 1 p.m.

This is Exhibit A for the good ol' "kick the can down the road" example so hard decisions are left to the grand kids. Very pathetic. Nothing like telling commish's that the sky is falling if they don't do this now. Its the easy way out and the best way to force them into a decision. With no adequate alternatives. Meanwhile a lawyer and his daughter get to make out the best and the county's grand kids pay for it 10-fold later. To pay for employee benefits. This thing was on the fast track until media started to report on it and the public got more info. Still a lot more needs to be shared.

Vivienne Armentrout

Mon, Jul 1, 2013 : 12:17 p.m.

The scheme being promoted by Axe depends on the county's receiving investment income from the bond proceeds that are in excess of the interest the county will be paying on the bonds. In other words, it depends on a spread between interest paid and investment income. But interest rates are going up generally (markets have been responding to this) and in addition the market for municipal bonds has been suffering. See this recent New York Times story: http://dealbook.nytimes.com/2013/06/26/bill-for-public-projects-is-rising-and-pain-will-be-felt-for-years/?ref=municipalbonds&_r=0 Partly because some municipal bond issuers are in default or near default (Detroit comes to mind), these are no longer seen as the gold standard safe investment that they were. Buyers are more reluctant. That means that the county will likely have to pay much more interest than is being anticipated. Unfortunately, we will not know what the actual interest rate paid will be until the bonds are actually put up for auction. At that point, Axe's firm will have already collected its fees. I hope that the BOC will not jump off this cliff.

Barzoom

Mon, Jul 1, 2013 : 12:13 p.m.

This issue needs to be put to a vote by the public. The financial commitment is too large to be decided by just the county commissioners. Remember Sharon Township and Water Street in Ypsilanti. The taxpayers there have been forced to assume a huge tax burden due to poor decision making on the part of their officials.

Barzoom

Mon, Jul 1, 2013 : 8:33 p.m.

You're correct. I meant Sylvan Township.

Vivienne Armentrout

Mon, Jul 1, 2013 : 12:19 p.m.

I think you mean Sylvan Township. The county issued bonds to pay for a water utility there and both the county and the township have been stuck with costs that were supposed to be paid for by developers.

SonnyDog09

Mon, Jul 1, 2013 : 12:09 p.m.

Has this scheme ever worked before? Where else has it been implemented? I'd like to see data on the success/failure rate of this scheme when it has been implemented elsewhere.

ChicagoAtlanta

Mon, Jul 1, 2013 : 4:09 p.m.

DETROIT?

snark12

Mon, Jul 1, 2013 : 2:21 p.m.

To learn more about these types of programs, search Google for "pension obligation bonds". It has worked many times in the past but it's being considered more and more by municipalities across the country. I found a report from 2006 that cited 304 POB issues in 26 states in the previous decade. http://www.orrick.com/Events-and-Publications/Documents/247.pdf This scheme is not new and it has been successful for many local communities. But you can find many articles talking about the increased risks faced by both the local governments and they people who buy the bonds. http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a55YHbUZvMmQ The keys to success are 1) how low is the interest rate (which is still historically low but not as low as it was recently), 2) how long is the period to maturity, and 3) how well is the investment fund managed?

nekm1

Mon, Jul 1, 2013 : 12:02 p.m.

Just follow the money for answers. Who is making a quick buck here? At our kids expense down the road. How about weighing the morality of drowning our future generations in debt, to satisfy legacy costs? Can anyone say, "stop the insanity?"

Vivienne Armentrout

Mon, Jul 1, 2013 : 11:53 a.m.

This story is timely and appreciated. However, please note the following specifics that were not included: The BOC is being offered only ONE alternative to drastic cuts in programs. That is a bond issue that would be issued via John Axe of Axe & Ecklund (Grosse Pointe Farms legal firm), who has served as the county's bond counsel for decades. Axe receives hefty legal fees every time the county issues a bond, and this would be no exception. In addition, the proceeds from the bond would be invested with Municipal Financial Consultants Incorporated, of which John Axe was until recently the chairman. It is now run by his daughter, Meredith Shanle. She and her firm would also receive substantial fees. The amounts of the fees have been reported in the past, but our news outlets, including this one, need to update the figures. Axe is a very familiar figure and has in the past (wearing the MFCI hat) written informative papers for the benefit of commissioners. He is somewhat like your banker uncle who always understands the finances. But his influence is outsize in this matter. He was apparently the author of the state legislation which has made this particular bond issue legal. He and his daughter's firm are the ONLY consultants and alternative being offered to the commissioners. This leaves the public to be the only voices to argue the strategy. Clearly some of our inexperienced commissioners are being placed in an untenable position. They should not be given the choice of draconian cuts and this speculative, risky, long-term venture. Their best bet is to delay a decision and ask for another opinion from a different financial consultant, one that does not have substantial interest in the outcome.

PineyWoodsGuy

Tue, Jul 2, 2013 : 3:09 p.m.

Why is there no reporting of: 1. How much money Mr. Axe will be paid if the $350M bond issue is approved? Will he be paid hourly or will he, like real estate salespeople, be paid a per-cent of the $350M. 2. How much money will Ms. Axe (his daughter) be paid to "manage" the $350M?

snark12

Mon, Jul 1, 2013 : 2:05 p.m.

My understanding from pervious articles was that, if the bonding process were to proceed, an RFP process would be used to determine the financial planner used to administer the proceeds, not that it would go to MFCI directly.

a2huron

Mon, Jul 1, 2013 : 1:03 p.m.

Very insightful comments from an experienced community member. Thank you for staying on top of this Ms Armentrout. Something smells really bad here. Conflicts of interest. Disproportionate advantages to consultants. You name it.

The Picker

Mon, Jul 1, 2013 : 11:48 a.m.

The continued gaming of the Taxpayers !

Ken

Mon, Jul 1, 2013 : 11:37 a.m.

This is nothing but a robbing Peter to pay Paul scheme.

Stan Hyne

Wed, Jul 3, 2013 : 2:34 a.m.

Maybe the number of employees and supervisors should be cut enough to balance the budget. That is what a business would do.

snapshot

Tue, Jul 2, 2013 : 5:01 a.m.

They are robbing the general public to cater to special interest for votes. We need legislation similar to insider trading laws to prevent this undue union influence. Apparently unions don't care if kids go hungry and old people die as long as they can go to the doctor without a co pay.

DonBee

Mon, Jul 1, 2013 : 10:30 a.m.

The most troubling thing about this whole issue, is that the county agreed to 10 year, yes decade long, contracts - KNOWING that they had a $350 million dollar hole in the retiree plans. Worse yet, they knew that they had issues when they re-opened the pension plans to employees and are now hiring more people to fill vacant positions, rather than waiting until the plan closes in January (again - how long it will remain closed this time is anyone's guess). The lack of fiscal responsibility on the part of the Commissioners and the County staff is crazy. The ship is sinking... ...quick get more people on the ship ... ...now it is sinking faster... ...quick get more water... ...quick more people... ...more water... ...more people... ...more water... ...too late.

Shawn Letwin

Mon, Jul 1, 2013 : 10:24 a.m.

Count me in on helping to get signatures! It was just a few days ago that it was reported how the Ann Arbor area was paying for the sins of our fathers about stormwater runoff because they couldn't make the hard decisions and actions to support the future. Leaving the future generations saddled with even more debt to cover the malfeasance (completely wrongful) of our past and current government representatives with outrageous legacy costs is not what I will be a part of. Thank you to Doug Smith for taking the lead on this pivotal issue. To allow our government leaders (sic) to saddle us with hundreds of millions of dollars in debt to cover outrageous obligations for government employee benefits is not acceptable nor sustainable for the economic well being of this citizen nor the entire region. Be the change you want to see and be a Washtenaw Watchdog! Each of us doing what we can can collectively can make the difference.

Judy

Mon, Jul 1, 2013 : 7:12 p.m.

Yes, the unions will fight but look it the unions are not doing so well in Detroit now are they? Pennys on the dollar to suports in Detroit and union contracts, LOL. My husband and I am willing to sign the petition, also! Commissioner Andy LaBarre, D-Ann Arbor had no problem hastening union contract negotiations in February, in advance of the right-to-work implementation deadline when he knew about the long-term debts but the unions still got 5 and 10 year contracts.

ChicagoAtlanta

Mon, Jul 1, 2013 : 4:07 p.m.

Good Luck with your plans. Do not think for a moment the unions will not fight you to make this go through.

Basic Bob

Mon, Jul 1, 2013 : 10:13 a.m.

Who committed to pay this amount to the county's employees without having money to pay for it? It was not necessary to give employees $350M in benefits. They could have agreed to increase wages instead. If services must be cut to the bone, it should have been done earlier. Now they are looking at saving money by putting aside even less for retiree health care and pensions - increasing the debt further. Is it that hard to see where this is going? The commissioners need to wake up fast and get a handle on it.

snapshot

Tue, Jul 2, 2013 : 4:58 a.m.

The proper amount was funded....read the article and quit spreading untrue information. The problem is a poor return on investments which is what they are planning to do with the new bond money. The "problem" is that unions have imposed undue influence upon officials to inflate the benefits. Unions need to put some skin in the game and quit taking the general public to the financial cleaners. There are people who can't buy food and the unions are giving nothing to earn their keep. And elected officials are catering to their needs to gain votes. It should be a crime just like insider trading.

ChicagoAtlanta

Mon, Jul 1, 2013 : 4:05 p.m.

You know where it is going - the same place as the city of Detroit. Let's borrow to keep the unions happy. To heck with the taxpayers services.

Goober

Mon, Jul 1, 2013 : 3:52 p.m.

And, the government leaders get re-elected in spite of these fiascos. Go figure!

GoNavy

Mon, Jul 1, 2013 : 11:31 a.m.

It can be quite a vicious circle. Elected and appointed officials fail to put required amounts of money aside, making budget numbers look better. Better budget numbers prompt public employees to demand more benefits, which are granted. Those elected officials (and their appointees) continue to defer paying appropriate amounts into retirement plans...they cycle continues.