What Ann Arbor property owners can expect when they open their summer tax bills today

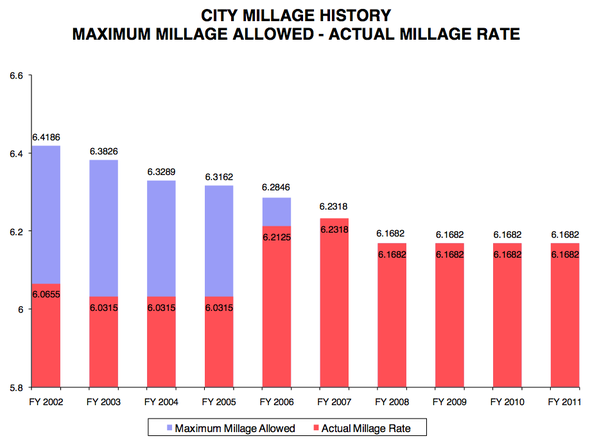

This chart shows trends in the city of Ann Arbor's general operating millage over the last several years. For many years, the city didn't levy the maximum amount allowed under state law, but that's no longer the case.

The total taxable value of all property in the city has gone down about 1.2 percent from last year, said City Treasurer Matt Horning.

The city's millage rate also has dropped in the last year.

"The average taxpayer is going to see a very minor decrease, but it all depends on the situation," Horning said. "It will vary by neighborhood."

Based on numbers from the treasurer's office, the city expects to take in about $76.4 million in city government tax revenues this summer, including $28.6 million for general operations, $5.3 million for parks, $9.3 million for streets, $11.4 million for solid waste, $693,000 for debt service, $9.5 million for employee benefits and $9.5 million for public transit services.

Including education millages, county taxes and other special assessments, the treasurer's office expects about $202.4 million to be paid by the owners of 37,537 parcels in Ann Arbor. That compares to about $193.8 million from 35,320 parcels in the summer of 2006.

Taxes are due by July 31.

The city's total direct tax rate has fallen about 3.85 percent over the last decade. The total amount of taxes being levied on properties in Ann Arbor this year is 16.47 mills, down from 16.82 mills last year. The 0.35-mill decrease from last year directly corresponds with a drop in the city's debt service levy, which went from 0.5 mills to 0.15 mills.

Tom Crawford

Ryan J. Stanton | AnnArbor.com

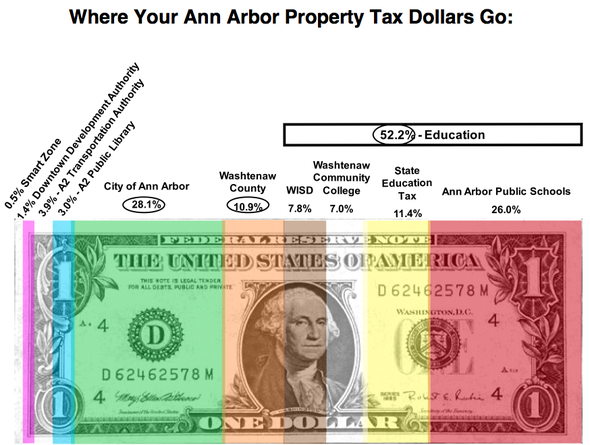

For every dollar in taxes paid by an Ann Arbor property owner, 28 cents go to fund city services, 52 cents go to education, 11 cents go to Washtenaw County government, 3 cents go to libraries and 4 cents go to public transit. Smaller amounts go to other organizations.

Original tax roll numbers for 2011 show a taxable value of $4.64 billion in Ann Arbor — down from the $4.7 billion on last year's original roll, which ended up being lowered to $4.68 billion after Board of Review, State Tax Commission and Michigan Tax Tribunal decisions. By comparison, the adjusted taxable value in 2006 was $4.57 billion.

City records show total city property tax collections in Ann Arbor actually grew from $54.1 million to $81.9 million from 2001 to 2010, but growth has slowed in the last few years.

Tax revenues netted by the city's general fund in the previous three years remained stagnant at about $51.2 million, records show. The adopted city budget for 2010-11 estimated general fund tax revenues would go down to about $49.4 million. For the new fiscal year starting today, the city predicts general fund tax revenues dropping further to $49 million.

The city's last audit showed the total taxable value in Ann Arbor grew from $3.2 billion to $4.89 billion from 2001 to 2009, and then ticked down for the first time in 2010 to $4.86 billion. Horning said on Thursday that the numbers cited in the audit actually are from the previous calendar year — so the $4.86 billion listed for 2010 is really the taxable value for 2009.

Whether an individual's taxes go up or down depends on a property's taxable value and assessed value. Areas that see a decrease in market value will see a decrease in assessed value, but that doesn't always cause a decrease in taxable value or property taxes.

However, properties that have a taxable value that is close to the assessed value and are located in a declining market could see a decline in taxable value and property taxes.

The Consumer Price Index, a measure of inflation, for the 2011 taxable value in Michigan is 1.7 percent. That means a property owner’s taxable value will have increased by 1.7 percent this year unless the property’s assessed value is lower than the taxable value.

Summer taxes are collected from July 1 through July 31 without interest or penalty. Property owners who haven't received a tax bill by July 7 can call 734-994-2833. Ann Arbor taxpayers also can make payments online at www.a2gov.org/taxpayment.

There also is a drive-up drop box at the northeast corner of Fifth Avenue and Ann Street, in addition to a box in the entrance of the Ann Arbor Municipal Center, 301 E. Huron St.

Payments postmarked or received on or after Aug. 1 will be assessed a 1 percent late charge. Payments received Sept. 1 through Dec. 31 will be assessed a 5 percent late charge.

Summer tax payments received in January 2012 will be assessed a 6 percent late charge, and summer tax payments received in February 2012 will be assessed a 7 percent late charge.

If payment is not received before March 1, 2012, all unpaid summer and winter real property taxes will be turned over to the county treasurer as delinquent. The city treasurer collects delinquent business personal property taxes.

This is a chart included in the city's budget book, showing where each tax dollar an Ann Arbor resident pays goes. Most of it goes to education.

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's e-mail newsletters.

Comments

Ken Fink

Sat, Jul 2, 2011 : 2:33 p.m.

A small gripe that I have is the 'ADMIN FEE' on the property tax. The fee of $50 on my $5000 bill is not large but it seems like a double charge and a way to squeeze more money out of property taxes. I am paying $772 for city operating expenses, doesn't that cover the treasurer's office? How could it cost $50 to administer my tax bill when I am paying electronically? If my taxes were $10,000 would my admin fee be $100? Does the cost of administering this property tax notice go up in proportion to the size of the bill? None of this makes any sense.

Basic Bob

Sat, Jul 2, 2011 : 12:05 p.m.

They can only live with what they have, in the future it might improve, but it also could stay the same or get worse. IMO, this is not a principle widely accepted in government. The city was encouraged by years of rising tax revenue. Even with Prop A limiting the amount the city could increase taxes on held property, the real estate folks kept the city in business with each sale leading to revaluation of the property. That way tax revenues could rise somewhere between actual cost of living and the housing bubble. Now with millages capped and property values tanking, sales of property are infrequent and revaluation may actually get them less revenue. The city has kept the taxable property value artificially bubble-high in order to live as large as they did a few years ago. If they were to actually set assessed value to the present street value, they would be hurting in a big way.

Amber Miller

Sat, Jul 2, 2011 : 3:03 a.m.

Hi Ryan, I think that the explanation for the tax dollar graphic may be a bit misleading. The DDA and the Smart Zone only capture an increment of the total taxes captured within the DDA District (not City wide). So, to say "each tax dollar an Ann Arbor resident pays" is a bit of an overstatement, especially considering most of the properties within the district are commercial. Perhaps it would be more accurate to say that the chart represents the proportion of the total tax capture each entity receives?

aanative

Fri, Jul 1, 2011 : 4:16 p.m.

"$9.3 million for streets,...$9.5 million for employee benefits and $9.5 million for public transit services." Remember that next time you complain about the road conditions, or laying off public workers: we pay more for employee benefits and the AATA than for road repair!

Mike K

Fri, Jul 1, 2011 : 4:07 p.m.

Our summer tax bills are out? The liberals are having a party!! My company went from 24 pay periods to 26 with July being a month I get three checks. I should just have them direct deposit that last one in the city's account lol. I have to laugh at that graph... I'd sure like to have my property tax follow that graph lol. Check out your history here - <a href="https://is.bsasoftware.com/bsa.is/TaxServices/ServiceTaxSearch.aspx?i=3&appid=1&unit=283" rel='nofollow'>https://is.bsasoftware.com/bsa.is/TaxServices/ServiceTaxSearch.aspx?i=3&appid=1&unit=283</a>

Mike K

Fri, Jul 1, 2011 : 4:09 p.m.

I fibbed. They are down $200 from last year, but have been "consistent" for the last 4 years.

Brent Lofgren

Fri, Jul 1, 2011 : 3:40 p.m.

Can anyone tell me why hotel taxes can only be used for tourist promotion, rather than a wide range of city services? Ann Arbor has one of the lowest hotel tax rates in Michigan (I used to have a source for this, but it seems to have evaporated from the web), but significant demand for hotel space, especially during U of M football games and Art Fairs, but also throughout the year for various reasons. Yes, the hotels pay some property tax, but they house a lot of people who jam up the city streets that my taxes pay for on football Saturdays, so why not get some more money out of them? I haven't done the math, so I don't know how much money this might add up to, but one thing that seems like an unnecessary impediment is simply the idea that hotel tax can't be used for anything but tourist promotion--something that is not necessary to fill up the hotels, streets, restaurants, and stores on football Saturdays.

Brent Lofgren

Fri, Jul 15, 2011 : 5:45 p.m.

Thanks. This is an update to the information on which I was basing my previous comment. However, the third "whereas" on p. 2 of this act of the Washtenaw Commissioners seems to say that the money is still used for tourism and convention promotion, for which the need is sort of dubious, rather than for more general purposes in our strained city and county budgets.

Vivienne Armentrout

Fri, Jul 1, 2011 : 5:59 p.m.

Some of the increased hotel tax is now collected by the county for its use. It is under a county ordinance. <a href="http://www.ewashtenaw.org/government/boc/agenda/bd/year_2008/2008-12-03bd/2008-12-03bd21.pdf" rel='nofollow'>http://www.ewashtenaw.org/government/boc/agenda/bd/year_2008/2008-12-03bd/2008-12-03bd21.pdf</a>

Gardener1

Fri, Jul 1, 2011 : 2:31 p.m.

Do you think the WISD at 7.8% is a good value? I think there needs to be more accountability. The salaries are higher and it is a layer of school bureaucracy. When people have done all the complaining about AAPS teacher benefits, have they looked at the WISD? A while ago there was a millage to build a wonderful facility at WISD. Then WISD decided to move some of the children to AAPS classrooms and lease the space to a charter school. How many Ann Arbor people are aware of this? When WISD took over the busses for the county, an article stated that the bus supervisor would get more pay than the previous AAPS bus supervisor because they have a higher salary scale. We just renewed a small millage to WISD for special education services. Where does the rest of the 7.8% go. Are we getting value for our tax dollars?

walker101

Fri, Jul 1, 2011 : 2:17 p.m.

Along with the decrease of taxes come along the decrease of services, it's a matter of time when you'll start paying more for less "The People's Republic of Ann Arbor" motto.

NorthMaple

Fri, Jul 1, 2011 : 1:12 p.m.

Absolutely right, Brad. I would gladly pay more to continue the excellent service that is the AADL.

Joe Kidd

Fri, Jul 1, 2011 : 5:02 p.m.

Isn't the AADL funded as a special district and its taxes are decided by ballot measures? That means the folks who voted for it are in favor and agree to the tax.

Technojunkie

Fri, Jul 1, 2011 : 2:09 p.m.

Feel free to write them a check.

Go Blue

Fri, Jul 1, 2011 : 12:53 p.m.

Ann Arbor taxpayers will see a slight decrease. When many county taxpayers have seen decreases for the past several years, Saline continues to increase SEV in a declining market. Are all the jurisdictions in the county miscalulating or is Saline because homes in Saline are not appreciating in value but declining? SEV typically does not match the reality of the market and is inflated. What gives with that?

YpsiLivin

Fri, Jul 1, 2011 : 5:05 p.m.

Taxable value and the State Equalized Value used to be linked. Proposal A unlinked them, so SEVs rose freely, while the rise in TV was capped. The SEV is probably decreasing on Saline properties as it is everywhere else, but as long as the SEV exceeds the TV, property taxes will go up regardless of what the market is doing. Nobody complained about this when their property values shot up, but their taxes didn't. This is just the other side of the coin.

Joe Kidd

Fri, Jul 1, 2011 : 5 p.m.

Someone noted above that sometimes assessments are generous. I understand that if you do not agree with your assessment, you can appeal that, but you may have to wait in line for some time.

WhyCan'tWeBeFriends

Fri, Jul 1, 2011 : 4:04 p.m.

"SEV typically does not match the reality of the market" - you said it all right there Go Blue. It can go both ways though. If you want to have some fun, go look at your township or city's assessor site and compare your property assessment to your neighbors'. Don't worry about their taxable value - that is tied to when they purchased, not today's value. Why the city wasn't taxing at a rate the law allows, per the chart in this article, just baffles me. I suspect those at the higher end were getting the benefit of that just due to sticker shock and perhaps influence, but I might be wrong.

Brad

Fri, Jul 1, 2011 : 11:38 a.m.

Best deal: A2 public library - 3% Worst deal (tie): AATA - 3.9% & DDA - 1.4% That's over 5% of your tax bill. Think about it.

John B.

Fri, Jul 1, 2011 : 7:54 p.m.

"I don't mind them using it -- I just get tired of footing the majority of the bill for it." Um, that's why it is called Public Transit. Kind of like Public Schools, and so on. I wish I didn't have to pay for the Bush tax cuts for the super-rich or for two wars, but we can't pick and choose which portion of our taxes to pay or not (well, unless we want to end up doing time for it, I suppose...).

Brad

Fri, Jul 1, 2011 : 1:31 p.m.

I don't mind them using it -- I just get tired of footing the majority of the bill for it.

Jon Saalberg

Fri, Jul 1, 2011 : 1:02 p.m.

"Worst deal (tie): AATA - 3.9%" - based on what? Thousands of people use this valuable mass transit source every day. On the other hand, the DDA hasn't shown itself to be of much use at all, unless chasing away out-of-towners with outrageous parking rates, and aiding and abetting the construction of unneeded parking structures count as accomplishments.

DennisP

Fri, Jul 1, 2011 : 11:25 a.m.

I believe the State Education Fund is an equalization fund of 6 mils that is intended to equalize per student funding. Prior to Proposal A passing as a Constitutional amendment in the 1990s, school funding was, indeed, entirely local. This created per student disparities in the amount a district would get based upon the disparities in property valuation among communities. So, the per pupil average in Bloomfield Township for instance was much higher than in Willow Run for example. There were no schools of choice then either so Proposal A remedied the disparity by putting school funding in the hands of the State and redistributing it based on per pupil funding. As always some special interests (Dearborn, Birmingham, and a few others) were able to get some exemptions allowing them to add some funds to the amount allocated per pupil. But, overall, it's relatively uniform. That's why annual headcounts in schools now are such important days and they ask that parents bring their kids in on those days--especially in Detroit where they'll even offer incentives. Proposal A also served to prohibit localities from accelerating property value appreciation as a backdoor way of raising property taxes after the Headlee Amendment required all localities to put millage increases to a vote and limited the total mils that could be taxed. To get around Headlee, many communities became awfully generous with property values using questionable appraising methods. It was pushing people out of homes, purchased and rental, because of skyrocketing property taxes with no accountability.

YpsiLivin

Fri, Jul 1, 2011 : 4:53 p.m.

Right. The Legislature never saw fit to include a "sunset" provision for the hold-harmless money, so the whole equalization strategy never ended up being very equal. The funding disparity between the hold-harmless crowd and everyone else is smaller now than it was initially but there's still a difference. There are actually 50+ hold harmless districts. You can find the list at: <a href="http://www.michigan.gov/documents/fy94millhhdsec22a_11738_7.pdf" rel='nofollow'>http://www.michigan.gov/documents/fy94millhhdsec22a_11738_7.pdf</a>

DennisP

Fri, Jul 1, 2011 : 2:09 p.m.

I didn't have the list YpsiLivin so I didn't want to make any assertions without facts. Thanks for the clarification. I didn't realize there were as many as 40 such districts. Good to know that too. Still, overall, the idea is that most school districts are supposed to be equalized. I just wanted Silly Sally to know why her idea was not the current law. It was the law but that changed.

YpsiLivin

Fri, Jul 1, 2011 : 11:43 a.m.

"As always some special interests (Dearborn, Birmingham, and a few others) were able to get some exemptions ..." DennisP, if you seek a special interest, look about you. Ann Arbor is one of those 40 "hold harmless" districts.

Silly Sally

Fri, Jul 1, 2011 : 11:01 a.m.

There is something wrong with the part that is called, "State Education Tax". Property owners in Ann Arbor should not be funding schools in other parts of the state. These recipients should receive their funding from either their own local property taxes or from general state income taxes. Likewise, the Downtown Development Auth. is over funded and not even elected, but appointed by elected city officials.

dotdash

Fri, Jul 1, 2011 : 11:09 p.m.

I moved from a state in which schools were funded by local property taxes and the resulting inequity between districts was large -- and struck down by the courts. I think it's important to consider that we all have an interest in educating all the children in the state, not just in our own district.

DonBee

Fri, Jul 1, 2011 : 2:08 p.m.

Silly Sally - If you do some research you will find that several states allowed local funding of schools and ended up with discrimination lawsuits for funding differences between rich and poor districts. The changes in Michigan to funding were about 6 months ahead of an NAACP lawsuit. If we go back, we will see lawsuits filed very quickly and lose. Equitable funding of schools has been decided in court. We as a state either do it or face the music of a Federal Court. I suspect with all the extras that some districts have gotten from local and ISD millages that the lawsuits may still be filed and won.

Basic Bob

Fri, Jul 1, 2011 : 1:48 p.m.

I disagree. Public education should be public, not just if you can afford it.

Alan Goldsmith

Fri, Jul 1, 2011 : 10:46 a.m.

I think in journalism school they call this burying the lede? "City records show total city property tax collections in Ann Arbor actually grew from $54.1 million to $81.9 million from 2001 to 2010, but growth has slowed in the last few years."