Ann Arbor officials look to reduce tax breaks for new Washtenaw Avenue shopping center project

A map of the proposed Arbor Hills Crossing shopping center on Ann Arbor's east side, across the street from Whole Foods, at the corner of Platt and Washtenaw.

Before Monday's meeting, a draft proposal of $7.9 million in tax-increment financing assistance on the Arbor Hills Crossing project already had been scaled down to $7.3 million, including $5.9 million reimbursable to the developer for environmental cleanup costs and other eligible activities spelled out in a proposed brownfield plan.

But committee members decided after hearing a presentation from City Treasurer Matt Horning that even that deal may be too sweet on the developer.

Two of the three members of the committee — Stephen Kunselman and Marcia Higgins — were present. They sent the developer and city staff back to the drawing board to work up a revised brownfield TIF plan with further reduced numbers.

"It does seem like you guys are asking for a lot," Kunselman said, suggesting the developer look at cutting some expenses out of the plan.

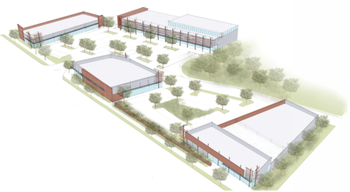

A conceptual look at the Arbor Hills Crossing project.

A brownfield property is one in which site conditions present an obstacle to redevelopment. In Michigan, that can include properties that are contaminated, blighted or functionally obsolete.

Through tax-increment financing, no existing taxes are abated. However, the incremental increases in tax revenues that result from improvements to a property are channeled back to the developer to help cover costs and incentivize the development.

"Our primary goal in granting brownfield TIF credits is that we make an otherwise financially unfeasible project feasible, so that we can clean up contaminated soils and that sort of thing," Horning said, explaining his reason behind the $150,000 cap.

"We look at the internal rate of return to the developer," he added, "and if we think that the tax-increment financing is going to create a rate of return higher than what would normally be expected in the market, we'll suggest that we reduce the amount of capture so that the rate of return is more acceptable and eases the burden on taxpayers."

Ann Arbor real estate owner and developer Campus Realty is partnering with Chicago-based North Shore Properties Group on the project.

Arthur Siegal, an attorney representing the developer, said both sides will have to run the numbers and see what's possible at the reduced capture rate.

"We need to obviously evaluate some of the information that was presented for the first time today and make sure that we're all talking apples to apples," he said after the meeting. "The project is something I think everybody is in favor of — we didn't hear anything to the contrary today about that. But we obviously want to make sure we're following both state, county and city requirements to make sure the project gets done as best as possible."

The project still should be doable, Siegal said.

"It's just going to be a little harder," he said.

The eligible activities that the developer of Arbor Hills Crossing is asking for assistance on include environmental site assessments, preparation of the brownfield plan, public infrastructure improvements, lead and asbestos abatement, site preparation and other work.

The 7.22-acre property the developer argues is eligible for brownfield assistance is situated on the south side of Washtenaw Avenue between Platt Road and South Huron Parkway. The developer proposes a contemporary multi-story retail and commercial development that requires demolition of existing structures and development of four new buildings.

The overall project totals 90,700 square feet.

Matt Naud, the city's environmental coordinator, said there's no denying the proposed location of the development is "a complicated, messy site." He said he couldn't say how capping the TIF capture at $150,000 might impact the ability to effectively clean it.

Stephen Kunselman

Horning noted the developer is up to date on paying taxes, so there are no issues there. He also agreed the property is environmentally contaminated and has blight issues.

During Monday's meeting, representatives of environmental consultant AKT Peerless went into more detail about some of the obstacles to redevelopment on the property.

The brownfield plan notes that a company called Fisca Oil operated a gas station on a portion of the property between 1971 and 1990.

The AKT Peerless representatives said there is some contamination, including low concentrations of petroleum compounds, left behind from underground storage tanks that were removed about two decades ago.

The brownfield plan also claims several hazardous substances, including lead and chromium, were detected in the soil and groundwater on the portion of the property where an auto dealership once stood until recent years.

The AKT Peerless representatives acknowledged the readings barely exceed the state cleanup criteria. Still, they estimated about 2,500 cubic yards of contaminated soil would have to be removed from the site at a cost of potentially hundreds of thousands of dollars.

Other items on the eligible activities list include a rain garden, dewatering and vapor barriers with passive venting for two buildings.

About $777,000 in public infrastructure improvements also are listed, including upgrades to Washtenaw Avenue and Platt Road, a new traffic signal and crosswalks, residential sewer disconnects, a retaining wall and utilities. Site and building demolition is another $609,000.

City Planner Jill Thacher, the city's historic preservation coordinator, said the project could go before the Ann Arbor City Council by the end of August at the earliest, but it's likely to take longer than that to resolve some of the outstanding issues. That includes discussions with the state about a new traffic signal.

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's e-mail newsletters.

Comments

nemo

Tue, Jun 28, 2011 : 8:13 p.m.

When I moved a few years back, the city was only too happy to pay for removing the eight infected ash trees the previous owner forgot to disclose; and cover all the costs of replacing the orangeburg sewer pipe that did not NEED replacing, but made the place radioactive should I choose to sell; and replace all the sidewalk slabs they didn't like — in my dreams. Guess I'll have to start telling people I'm a *developer* so the government will give me all the lollypops.

nemo

Tue, Jun 28, 2011 : 11:09 p.m.

So true, John B.

John B.

Tue, Jun 28, 2011 : 10:55 p.m.

Sounds like you needed a better home inspector when you bought your home....

Macabre Sunset

Tue, Jun 28, 2011 : 7:47 p.m.

We wouldn't need tax breaks if we had a tax structure more friendly to business. We act as if the people who provide jobs are evil.

Christopher LeClair

Tue, Jun 28, 2011 : 6:38 p.m.

I know many of you do not support business tax breaks at all but we honestly need to seek common ground. Perhaps the deal is still a bit too sweet, but to eliminate tax breaks entirely is a bit extreme. This looks like a great project that will bring some life to this blighted area. It has been sitting there far too long.

EcoRonE

Tue, Jun 28, 2011 : 5:17 p.m.

The tax agreement basically plows a portion of the taxes back into site area improvements instead of sending those monies into the AA general fund. As a neighbor to the development, I'm all in favor of that site receiving some improvement. The city is doing due diligence on the proposed improvements and their costs. I hope bus service support is factored in so we don't have a situation like that at Arborland. Many people living south of this development can walk to the shopping center and many will welcome a crosswalk to catch the #4 bus downtown, to shop at Whole Foods and other stores, and to (eventually) walk along the south side of Washtenaw on a sidewalk from the Rec Center at Platt to Yost. I hope the TIF includes completing the sidewalk on the east side of Platt and bike lanes on Platt also. I go downtown for entertainment. I shop and recreate in this area. It's time the city invested a little in the infrastructure and a TIF is a great way to do that. The development along Jackson Road used a TIF and this area of Washtenaw is more worthy because of the higher residential density in the area.

Wolf's Bane

Tue, Jun 28, 2011 : 5:05 p.m.

What? Over 33% of the project is dedicated to surface parking? That is mad! Build a 3 deck parking structure and condense the development by allowing for better drainage and save more of the greenery!

lumberg48108

Tue, Jun 28, 2011 : 3:59 p.m.

@Craig Lounsbury I cant tell if you are joking or being serious!! You think 4-6 minutes to exit a parking lot is acceptable? You must REALLY want to overpay for your soy milk! I can get out of Briarwood in seconds ... Arborland perhaps a MINUTE ...this is not the mall of america; its a small strip size mall and its oversaturated and traffic is crazy and the intersection is traffic-intense as-is

mtlaurel

Tue, Jun 28, 2011 : 3:42 p.m.

it is actually a poorly designed "strip mall'. As one who avoids downtown now because of congestion and a few other reasons....Westgate and Plymouth Rd malls have suddenly become quite user friendly and pleasant. You can park and walk up and down a "stretch" of these linear malls...Westgate in particular with a lib branch and various"lite" eating/coffee/snack venues along with an upgraded Krogers-with seating inside is a destination of sorts. This Washtenaw Ave plan does not allow for strolling"up and down"-the buildings are diagonal and across parking lots from one another. I can't fathom why i would go there-enter one building for something-and out into the parking lot and get into the car and go over to a different building-is there even a sidewalk that connects this-lots surround all the buildings so there is no sense" of walking "along" the retail area. Are we trying to redesign malls here? The true mall concept is valid and has stood the test of time-malls went out of favor as people wanted their downtowns back...but now with downtowns struggling and case in point AnnArbor giving it's downtown to student unit developers, the strip mall will have a renaissance-but this is more like a commercial retail park. Poor design-won't make it.

Joel Batterman

Wed, Jun 29, 2011 : 2:28 p.m.

Indeed, this design is out of step with the vision to make Washtenaw - the region's biggest transit corridor - a place that's more pleasant and more suitable for all kinds of transportation, and that accommodates residents as well as retail stores. The placement of buildings along the street seems to be the only concession to pedestrians. Why we still tolerate this obsolete 1950s-style development, at one of Ann Arbor's most important intersections, is beyond me. Let's see some housing mixed in with decent public space.

Wolf's Bane

Tue, Jun 28, 2011 : 5:07 p.m.

Agreed. It is a horrible design. Look at the poor use of land and all that asphalt for parking.

lumberg48108

Tue, Jun 28, 2011 : 4:02 p.m.

You actually wrote it better than i ever could ... its a mess!

Vivienne Armentrout

Tue, Jun 28, 2011 : 3:10 p.m.

There are several issues that impinge on this discussion. According to a recent story on AA.com <a href="http://www.annarbor.com/news/planning-commissioners-offer-initial-feedback-on-new-shopping-center-proposed-on-ann-arbors-east-sid/,">http://www.annarbor.com/news/planning-commissioners-offer-initial-feedback-on-new-shopping-center-proposed-on-ann-arbors-east-sid/,</a> some planning commissioners were unhappy with this development because it is not dense enough. After pushing through the revisions for Area, Height and Placement regulations so that no height limit exists in many cases (thank you, Marcia Higgins), the density ideologues are disappointed at receiving a standard shopping center proposal. The development is also in the Reimagining Washtenaw planning area. <a href="http://www.washtenawavenue.org/home" rel='nofollow'>http://www.washtenawavenue.org/home</a> where proponents hope to have a high-density development under the auspices of a corridor authority similar to a DDA, where TIF funds are funneled to the authority, not to developers. The AATA Smart Growth plan cites TIF funds from Washtenaw as part of its funding stream for transit to Ypsilanti. This current proposal would block such opportunities on this parcel for the near future.

Steve Hendel

Tue, Jun 28, 2011 : 2:40 p.m.

Brownfield tax credits for contamination cleanup are reasonable, because it is difficult if not impossible to nail down responsibility for the contamination; in this case, for instance, the Fisca station closed over 20 years ago. Do they still exist? Even if they do, would there be anything like a statute of limitations on culpability for the contamination? The EPA has had some success with the Superfund concept, which has some similarity to Brownfield. It's when you get into using Brownfield credits to deal with obsolescence and blight that there is, IMHO, a problem. Number one, it's difficult to quantify such things and put a price tag on them; it would be natural for a developer to push the envelope on this one. Number two, blight and obsolescence (unlike contamination) are factors anyone developing such a property might face. Why this earns them the right to dip into public funds to remediate such conditions is beyond me.

deb

Tue, Jun 28, 2011 : 2:37 p.m.

This a private developer trying to do something that will benefit that area of the city. I am not sure how I feel about the issue in this particular case. However, I can say that the city once again seems to be doing a lot of double dealing type action. This article combined with other articles on the fuller road/ u of m parking structure exemplifies this. Here we are talking about taking away tax breaks, last week the council voted for over a $1 million dollar project to relocate sewer and water lines to the parking structure area. I have to question why the council did not ask the U for any money to help with the relocation costs. Additionally, the city is basically donating the land to the project. The information that I have received is that the U will get 77% of the parking spots and the city 23% and they will split construction costs by the same percentages. Yet the council did not negotiate/approach the U about the pre-construction costs such as the relocation of those sewer/water lines? Maybe the U should have paid for 77% of those, since they have never, nor ever will, pay taxes supporting the sewer and water systems of Ann Arbor. This an example of the city needlessly spending money to help the U, an entity that has more then enough money of its own, and not helping a private developer who will actually pay taxes in the future. Our city government plays favorites (the U, zingermans) handing them sweet hart deals, and does not care about its constituents or where the taxpayer money goes. Or does not have enough sense to make good business decisions.

deb

Tue, Jun 28, 2011 : 2:52 p.m.

We make new developments pay for putting in city water hookups, why not the U?

Steve Hendel

Tue, Jun 28, 2011 : 2:45 p.m.

Flash: water and sewer are not tax-supported, but are funded by user charges. If anything, the opposite of what you claim is true; the City has had a long history of indirectly pillaging enterprise-type activities like water and sewer to subsidize the General Fund.

lumberg48108

Tue, Jun 28, 2011 : 1:17 p.m.

forget tax breaks and make that area a park i wont drive to Whole Foods now cause it takes me 10 minutes to park and 10 minutes to get out of the lot - the lot is too small and there are not enough exits. Try leaving and going east during lunch hour! the area is the most congested in washtenaw county - no matter the time of day. Traffice is backed up forever and a light turns green and u dont move --- its insane I am all for growth but if they build more at this insane innersection, I wont be shopping anywhere on either side of the street and I will avoid washtenaw and Huron Parkway all the time; hurting other businesses sometimes, less is more

Craig Lounsbury

Tue, Jun 28, 2011 : 2:12 p.m.

If you want I can give you parking and exiting lessons from Whole Foods. I doubt it ever takes me more than 3-4 minutes to park and not more than 4-6 minutes to exit.

Linda Peck

Tue, Jun 28, 2011 : 12:58 p.m.

Can developers afford the tax costs? Can taxpayers afford the tax costs? Someone has to pay the bills! I am for NO tax breaks and let business develop in an organic way - let consumer demand determine what is profitable. Why do some businesses get breaks and not others? I think we know some of the answers to that question. Can the Washtenaw corridor support yet another shopping mall? Why is government involved in private business at all?

xmo

Tue, Jun 28, 2011 : 12:51 p.m.

We would not have be having talking about this if the City, State and Federal government didn't have a number of "GREEN LAWS" that make real estate development very expensive! "there's no denying the proposed location of the development is "a complicated, messy site." " What the developer wants is for the City to share some of its pain while they turn this property into a higher tax property. The taxes will remain at the current levels and not increase for a while (20 years) even after the development is done and the property is worth more they hope! What do the residents of Ann Arbor want? This undeveloped land or something that will bring in more tax dollars later and provide more services for its residents? Build baby Build!

Wolf's Bane

Tue, Jun 28, 2011 : 5:06 p.m.

Please. Without adequate green laws we'd be living in a sewer.

Mike

Tue, Jun 28, 2011 : 12:37 p.m.

How much tax revenue is it generating now? Ann Arbor seems to be good at killing real estate deals and they might just pull it off again. This will create jobs (good for Obama) and those people will pay taxes (good for the rest of us taxpayers), and a blighted eyesore leading to our broken bridge by Michigan Stadium will be eliminated. I'd say mess around with the developer until he walks. If you wait long enough trees will grow there and it will become a forest again...........then we can purchase it with our "green belt" tax dollars.

DBH

Tue, Jun 28, 2011 : 7:56 p.m.

Not an English teacher, no. Just someone who has an interest in language and its idiosyncrasies. Although it is common to say (or write) "could care less" when "couldn't care less" is what actually is meant, I find it very odd how that has worked its way into common parlance when the statements in fact mean just the opposite of each other and yet are used synonymously.

tdw

Tue, Jun 28, 2011 : 6:39 p.m.

I just wrote it like I would've said it.I had to read it a few times but I got it now.Do you happen to be a English teacher by chance ? ( suddenly I fell like I'm back in grade school )

DBH

Tue, Jun 28, 2011 : 5:23 p.m.

tdw - You "...could care less..." or you COULDN'T care less? The context of your remark implies the latter, contrary to what you typed.

tdw

Tue, Jun 28, 2011 : 4:29 p.m.

I was under the impression that " green belt " dollars were not spent for property in Ann Arbor just outside the city.I could be wrong and could care less cause I don't live in Ann Arbor that's just what I thought

clownfish

Tue, Jun 28, 2011 : 12:34 p.m.

How about this: The former owners of the property pick up the tab for environmental clean -up. "personal responsibility".

Mike K

Tue, Jun 28, 2011 : 12:04 p.m.

Belboz for mayor! I look forward to hearing more from you.

belboz

Tue, Jun 28, 2011 : 10:22 a.m.

How about eliminate them completely...... .. Ann Arbor certainly seems to be developing a reputation of approving wasteful use of taxpayer money. Ala... Zingerman's getting $1 million for a burnt house redevelopment. More of my beef can be thoroughly enjoyed at.... <a href="http://www.annarbor.com/community/community_wall/ann_arbor_isnt_overrated_-_but_its_getting_there/">http://www.annarbor.com/community/community_wall/ann_arbor_isnt_overrated_-_but_its_getting_there/</a> Ann Arbor Isn't Overrated, But Its Getting There....

belboz

Tue, Jun 28, 2011 : 8:48 p.m.

Obviously, you do not know of Detroit's tearing down of thousands of buildings. Obviously, your comparison of Downtown Ann Arbor to that of Detroit is Rotten Apples to Oranges. Obviously, the U can unfortunately buy anything they want. Indirectly, it helps property values because it takes capacity off the market. I'm not that concerned with them. We get no tax dollars for the parks, the schools, etc. Obviously, you like the word obviously. Seriously, blunt force tactics of trying to persuade people is quite a put off and minimizes anything intelligent that might have been said. It indicates you're unable to formulate a clear argument, so you have to say it louder.

johnnya2

Tue, Jun 28, 2011 : 8:05 p.m.

You can't recoup what you MIGHT have had. The city will continue to get what they currently get whether it is improved or not. That property actually goes DOWN in value over the time it is undeveloped which will actually means a reduction in tax revenues. In fact, there is a great example of a property worth less today than it was when it actually had tenants. It is called Georgetown Mall. 1. You don't seem to get that nobody is SPENDING a dime. They are allowing them a chance to develop a property without a huge tax hit. By they way, if your property goes up in value 100% a year with ZERO improvements you do realize you currently receive a tax break? Check out the Headlee Amendment. Why should a person who bought 50 years ago, and got the benefit of the increased property value receive a tax break determined by the rate of inflation, not the value of their home. 2. Zingerman's would be under ZERO obligation to sell anything. They could leave the burned out house sit there for 100 years, and not improve the area. You want proof. Take a drive through Detroit or Ypsilanti some time and tell me how that is working. If you want Ann Arbor to look like those towns, you should just move there. 3. You obviously know nothing of how property taxes to home owners have limited increases and are determined. Of course there is an easy solution to shut up fools like you. The U can buy the property and it will completely fall off the tax roles FOREVER. The U can turn it into ANYTHING it wants.

belboz

Tue, Jun 28, 2011 : 1:09 p.m.

This is one of those things I COMPLETELY understand. 1. You are punishing the people who already own properties and work hard to maintain them. If the market need for the improvements were so great, then it would justify building without the tax breaks. Instead, you want to spend tax dollars so other existing businesses suffer? 2. Brownfield is being completely abused. Yes. I would rather the property that burnt next to Zingerman's sit. Then, Zingerman's would have to sell it. Then, someone else would buy it and put a houese on it. Zingerman's would have executed their plan with or without the tax breaks. Please. 3. Your philosophy of "no new taxes for making things nicer" is wonderful. Every single homeowner would love that philosophy. I would. Sadly, it isn't how the state assessment system works, nor the city tax system. When I add $100,000 to my house, I get the tax bill. If you don't like it, don't spend it. Don't buy it. Don't improve it. Frankly, the lot looks better now than when the car dealership was on it. I enjoy the open space. The city can always condemn it if it gets too bad. Quit giving in to the threat of -"I'll just leave it..." If it gets dangerous or obscene, bulldoze it.

Brad

Tue, Jun 28, 2011 : 12:57 p.m.

So how many years on the tax rolls will it take to recoup our $1M? Do the math.

johnnya2

Tue, Jun 28, 2011 : 12:16 p.m.

This is one of those things that you obviously do not understand. The taxes could be paid as is now and leave the area a blighted mess (and it is a mess), or we can have a developer put in a new development which will keep paying the same taxes they are today. This is what these credits are. Basically telling a developer, if you clean up an area and make it nice again, you will not be hit with higher property taxes immediately because you made it nicer. I guess you prefer that the burnt house sit there and become a danger to the community, rather than Zingerman's fixing it, and putting it back on the tax rolls.