Michigan senator promises teacher pension reform bill will pass in August after second no-vote night

Michigan Senate Majority Leader Randy Richardville is “confident” the teacher pension reform bill will pass Aug. 15, an MLive.com article stated, after another no-vote in the Senate Wednesday.

The Senate took up the topic of reforming the Michigan Public School Employee Retirement System (MPSERS) for a second time. But once again, the compromise plan that passed 57-47 in the House of Representatives in June, divided the Senate Republicans.

The Senate was supposed to vote on the reform legislation in June as well. However, Richardsville, R-Monroe, can't string together enough votes to support the bill, legislators say.

MLive.com reported the sticking point appears to be a portion of the compromise that would move new teachers to a 401(k) pension plan.

“I think that you can take it to the bank that this reform will be voted on on Aug. 15,” Richardville said in the MLive.com article. “I’ll stay as long as we need to to get it done on that date.”

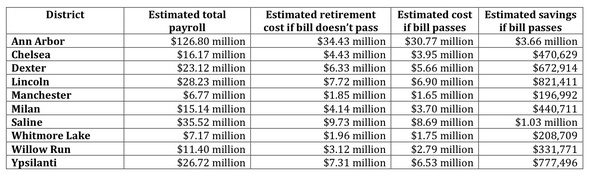

The teacher pension reform bill would prevent the retirement contribution rate for school districts from increasing from 24.4 percent of districts' total payroll to 27.37 percent in 2012-13 and 31.21 percent in 2013-14.

Read the complete MLive.com article here.

The chart below shows the financial impact to Washtenaw County school districts.

Previous coverage: Washtenaw County lawmakers divided on public school employee pension reform

Staff reporter Danielle Arndt covers K-12 education for AnnArbor.com. Follow her on Twitter @DanielleArndt or email her at daniellearndt@annarbor.com.

Comments

harry

Fri, Jul 20, 2012 : 4:31 p.m.

ok then

Royalprince

Fri, Jul 20, 2012 : 1:12 p.m.

I don't trust anything Randy Richardville says, because he is Rethug! The Rethugs in the Legislature and the Governor's House stole our Homestead Property Tax Credit from us last year!!!!!

harry

Fri, Jul 20, 2012 : 6:40 p.m.

Whats a rethugs?

Somargie

Fri, Jul 20, 2012 : 2:56 a.m.

Politicians that vote for their own salary increases, lifetime pensions, tax breaks for themselves while saying everybody else makes too much money, pensions need reform, health care, denied political discourse, don't follow the constitution of the state... is not to be believed or taken serious...

Jay Thomas

Thu, Jul 19, 2012 : 9:16 p.m.

401k's will put teachers in the same boat as the rest of us. I understand they don't want to be in that boat... boat's can capsize. That's too bad, because there is no reason for the public to guarantee its employees a ride free of bumps through life when we don't have that ourselves. There is also no reason teachers should be retiring at young ages required for physically demanding public service work like police or firefighters.

sh1

Fri, Jul 20, 2012 : 3:24 a.m.

Teachers typically retire in their 60's, so I don't think you need to worry.

leaguebus

Thu, Jul 19, 2012 : 8:03 p.m.

Hey Randy, you need to starve out those pesky Union teachers that have retired. We know its their fault that they are in the position that they are in. Keep giving mindless tax breaks to businesses and taking away from educators. That is a great policy to balance the budget today, but tomorrow when no one wants to build a business here because of our terrible educational system and no educated workers, good luck. They should cut your pension every time a retired teacher has their pension cut.

Ron Granger

Thu, Jul 19, 2012 : 6:57 p.m.

@outdoor6709: "We all want the security of a defined benefit pension plan with annual cost of living increases, but why is it the public sector should get this great benefit, when the people paying the tax bill, does not have the same perk?" Just because predatory companies like Bain Capital have a business model of performing hostile takeovers of those companies and raiding those fat pension funds, does not mean public servants should be denied their benefits. The country gets run into the ground by Wall Street greed, and now the worker-class-bees are left fighting for scraps, at each others throats over who is entitled to the larger piece of crust. Meanwhile, Wall Street collects their bonuses and bailouts, and laughs.

leaguebus

Thu, Jul 19, 2012 : 8:09 p.m.

The Wall Street greed and its bought and paid for politicians is fueled by misguided middle class voters who have no healthcare but hate Obamacare. Eventually they will wake up, hopefully before the next election.

tom swift jr.

Thu, Jul 19, 2012 : 3:46 p.m.

It is amusing that they use the word "reform" to describe what they are doing. I'm considering going into the bank this afternoon and "reforming" it, I'm guessing that would be perfectly legal.

Lac Court Orilles

Thu, Jul 19, 2012 : 2:56 p.m.

Always self-serving Senator Richardville voted himself lifetime health care benefits with a 10% co-pay and now he feels that teachers need to sacrifice more and have their co-pays doubled even after he socked them with the pension tax earlier. Richardville feels that teachers should live in less while he and his cronies gets more. Politics to him is no longer about serving the general welfare; it's about giving his business supporters an 85% tax cut. As for me, I will be glad when his term expires.

DonBee

Thu, Jul 19, 2012 : 3:10 p.m.

http://www.mlive.com/lansing-news/index.ssf/2011/10/lifetime_lawmaker_benefits_ban.html

braggslaw

Thu, Jul 19, 2012 : 1:56 p.m.

Wow, the idea that pension funds are somehow isolated from bonds, stock, wall street etc. is laughable. Pension funds are managed by financial analysts who invest in the same things as...wait...Wall street, The difference is that the unions want insurance in case their pension funds are mis-managed to insure they get a payout on the backs of the taxpayers. The present public pension fund is unsustainable and broken. Govt. was not created to give jobs to public workers and unions. When more than half a budget is for entitlements such as pensions, the system is broken.

bobslowson

Thu, Jul 19, 2012 : 12:56 p.m.

I wouldn't trust anything coming out of Richardville's mouth

Dusky

Thu, Jul 19, 2012 : 12:44 p.m.

This reform bill should never pass......it is wrong, wrong, wrong. Promises have been made and broken to these people. And after this bill, there will be many others.....all public state employees are going to receive the same unfair treatment....firemen, policemen, etc. It definitely isn't going to stop with teachers. The state is determined to get control of money that does not belong to them at the expense (for a start) of the teachers. The Republicans backing this bill should be ashamed of themselves.....not proud of broken promises and lies they have told to the public....but they seem to have no shame at all when it comes to the treatment of Michigan's working class....and never have.

Mike

Thu, Jul 19, 2012 : 8:41 p.m.

It's a lot more profitable to get on the multitude of government programs and let someone else work...............

Billy Bob Schwartz

Thu, Jul 19, 2012 : 4:24 p.m.

DonBee...I would advise that kindergartener to start looking for a better future and avoid teaching, a message that many talented youmg people are getting these days. For all the aggravation, the teacher is the bad guy and should pay for the rich to get richer. And isn't it interesting how, after doing what they can to ruin our public education system, the teacuppers have discover money lying around and need to decide where to spend it?

DonBee

Thu, Jul 19, 2012 : 3:08 p.m.

Dusky - the 401K retirement plan is for people who are becoming teachers for the first time. If you have a pension plan, you get to keep it. There is no promise to people who are not yet teachers right? Or is that kindergardener who thinks they want to be a teacher already promised a pension?

Mike

Thu, Jul 19, 2012 : 2:33 p.m.

There is no more money Dusky.......you can stick your head in the sand and claim there is but there isn't.......sorry to burst your bubble.

sh1

Thu, Jul 19, 2012 : 12:34 p.m.

One point that usually doesn't get covered is that over decades teachers have elected in their contracts to either take no pay increase or a very small one in order to keep their retirement money intact. I'd hate to see these sacrifices made for long-term planning over short-term eroded.

Mike

Thu, Jul 19, 2012 : 8:45 p.m.

We don't get to "elect" in our contracts whether we will "take" a pay raise or not because most of our employers don't have an unlimited amount of funds courtesy of the US tax payer.

misicilian

Thu, Jul 19, 2012 : 6:12 p.m.

SonnyDog, Step increases only occur in the first 8-12 years of teaching depending on the district. More than 50% of new teachers quit in the first 5 years even with the "cushy pension" and "only working 9 months a year ." Makes you wonder..........

SonnyDog09

Thu, Jul 19, 2012 : 4:29 p.m.

Do you not consider annual "step increases" to be a pay increase? Seems to me they got the best of both worlds: annual increases, work 9 months out of the year and a cushy pension.

harry

Thu, Jul 19, 2012 : 3:50 p.m.

The question that is looming.....How do we continue to pay for the pensions. Raising taxes is not an option.

outdoor6709

Thu, Jul 19, 2012 : 12:10 p.m.

Hate to inform all of you who think this is driven by the evil Wall Street, but the current public/teacher pension fund and most private pension funds are invested in Wall Street. We all want the security of a defined benefit pension plan with annual cost of living increases, but why is it the public sector should get this great benefit, when the people paying the tax bill, does not have the same perk? DIA, masss transit, better roads, public art,new bridge to Canada, Federal government and other groups all want to raise taxes to fund their projects. At what point does the taxes make it impossible to provide for ourselves. Maybe that is the plan, make us all dependant of Government handouts.

Mike

Thu, Jul 19, 2012 : 8:43 p.m.

Don't try to confuse people with facts.............

Floyd

Thu, Jul 19, 2012 : 12:01 p.m.

Income inequality has been rising in the United States for the past 30 years, and last year, the top One Percent claimed a quarter of all national income - the largest share for the rich since 1928 (2012, Center on Budget and Policy Priorities, a non-partisan group). Our far-right legislators would like us to believe that teachers are sucking away the money, but that is a lie they are happy to peddle for their wealthy benefactors. There is plenty of money "in the system," but it is being siphoned to the top One Percent. Teachers are not our problem, folks. The club of entitled, well-connected millionaires and billionaires we are feeding with outrageous tax policy is our problem.

Arborcomment

Fri, Jul 20, 2012 : 12:10 a.m.

Ray, then I suggest you read this article and get back to us: http://www.washingtonpost.com/opinions/americas-mobility-scorecard/2012/07/18/gJQAOnJftW_story.html Basically blows your tired class warfare argument out of the water. Stop blaming your parents for your plight, it's not their fault.

RayA2

Thu, Jul 19, 2012 : 9:03 p.m.

Its a classic psychological blunder, and I believe the height of narcism, to assume that your achievements came because you worked hard, and anyone who did not get the same results, did not work as hard. Who your parents are is far more important than how hard you work.

lynel

Thu, Jul 19, 2012 : 8:27 p.m.

DonBee - You're good with facts and numbers, can you find out the percentage of AAPS teachers that retire at 47? You seem to be saying the rest retire at 55, exactly what percent retire at 55?

grye

Thu, Jul 19, 2012 : 5:35 p.m.

RayA2: It is interesting how the bottom 99%, 95%, whatever, can sit around and complain about the top 1% without trying to do anything to improve their position. Why go to college and work hard, come up with great ideas, market yourself and your products to become successful. Better to sit back, complain about those that have, and collect govt provided funds. Get up and do something. Strive to be in the 1%. Even if you make it to the 5 or 10%, you'll be better off.

RayA2

Thu, Jul 19, 2012 : 4:35 p.m.

What Floyd wrote is spot on. Anyone who uses their anecdotal, Horatio Alger stories of certain people working 80 hours a week to achieve their place in the 1% as a defense of our class based ecomony doesn't get it. The majority of wealth in this country is inherited wealth. The U.S. has become a country of birthright wealth and democracy no longer exists. The really sad thing is that so many are duped into thinking this is a good thing by the constant, unrelenting media promotion of power as the right of the born wealthy.

DonBee

Thu, Jul 19, 2012 : 3:06 p.m.

Floyd - 2 income AAPS teacher household at the top of the step table makes more than $200K a year. That puts them in the top 5 percent of household income (top 2% actually). Retirement starts at 47 (if you know how to do it and plan well) for some and 55 for the rest. The pension funds are under funded by 45 billion - capping the pay in rate will make the underfunding much worse over time. The real answer is to raise the retirement age for the program to a minimum of 60, let teachers rotate into administrative positions if they can't handle a classroom anymore. One of my best teachers in high school was 72 and another was in her late 60s. They both knew how to teach and get the most out of students.

Mike

Thu, Jul 19, 2012 : 2:29 p.m.

Instead of complaining about what many doctors make (top 1%) why don't you go to school for most of your life, work 80 hours per week, and carry the burden of having peoples lives in your hands. Here are the IRS statistics for July 2011 Top 1% $343,927.00 or more per year Top 5% $154,643.00 or more per year (most two income teacher families) Top 10% $112,124.00 or more per year These statistics are for one tax return so they may include single and married. You are being sold a bill of good by the POTUS using earnings to divide us all. The problem is much bigger than the 1% er's. By the time you figure it out it will be too late.....................

BornNRaised

Thu, Jul 19, 2012 : 11:51 a.m.

401K are a huge push by Wall Street. Doesn't really matter if you like unions or not. Bottom line is that wall street makes HUGE gains from workers when they get to play with their money. Private sector bankers hate pensions. They have no control over that money. Those are the same parties that have huge control over government. They lost money tons of money, then on the backs of workers, we bailed them out. They were told to offer loans to help people after getting huge bailouts... good luck trying to get one of the 'affordable home loans'. Now they want pension money and rather than directly saying it, use politicians to get it.

BornNRaised

Fri, Jul 20, 2012 : 12:07 a.m.

Pensions are managed by professionals. Typically in less aggressive funds. 401Ks are managed by YOU. Most people go for the gold and manage aggressively. That's where wall street makes all the gains. Sorry for my comment about they have 'no control' over pensions. They make much larger profits from 401Ks banking on the aggressiveness of individuals. That fact has been reported numerous time on CNN. I love all the people telling me I'm wrong after watching the report. LOL!

Jay Thomas

Thu, Jul 19, 2012 : 9:10 p.m.

Pension funds represent a HUGE portion of the stock market. Something like 40%! Shows you who has the money in today's America. Between that and the 20% of the market that is owned by foundations and charities you have the majority of the stock market!! Whenever I see union bosses attacking the people who manage their money I have to laugh it is so disingenuous.

leaguebus

Thu, Jul 19, 2012 : 6:13 p.m.

The University uses TIAA-CREF which has historically had the lowest overhead of any of the Mutual Funds in the country. Plus, we can put money into Fidelity if we don't like TIAA for some reason. Michigan could easily adopt this model for its teachers.

katmando

Thu, Jul 19, 2012 : 4:10 p.m.

5 years my 401k has gone up 3% and management fees(tax) eats up half of that.

harry

Thu, Jul 19, 2012 : 3:48 p.m.

Don Bee you are correct. BornNraised - I am not sure who is telling you this but they are wrong.

DonBee

Thu, Jul 19, 2012 : 3:02 p.m.

BornNRaised - Almost ALL of the pension funds are invested in stocks, bonds and real estate. There is very little difference to Wall Street whether you have a 401K or a Pension, they get their cut.

Mike

Thu, Jul 19, 2012 : 2:18 p.m.

You have a system that is currently unsustainable. Too much promised and not enough tax payer dollars to pay for it. That's one reason most have a 401K. You can claim all of the anti-worker conspiracy theories you want but it won't change the facts. It sucks, that much I will agree with. But to pretend that it's just a matter of taxing some businesses or raising the taxes on the rich shows you don't have a grasp on the real financial problems that not only the teachers faces but every public sector employee past and present who was made these promises. This country has passed the point of no return on it's own debt and can only do so much more with "stimulus" to prop up the eventual outcome. Making some tough changes now may save part of the pensions but eventually just lik ethe stock market and housing we will have the bubble burst.