Highlights of Ann Arbor's latest audit: City's bonded debt drops, $1.6M surplus shown in general fund

The city of Ann Arbor receives a new audit report each year — a lengthy document that provides an in-depth look at city hall's finances and how it performed the year before.

The latest audit shows the city's general fund, which pays for basic services like police and fire protection, had a $1.6 million surplus for the fiscal year ending June, 30, 2012.

That left the general fund with unassigned cash reserves equal to 19 percent of the total general fund budget, which is considered healthy.

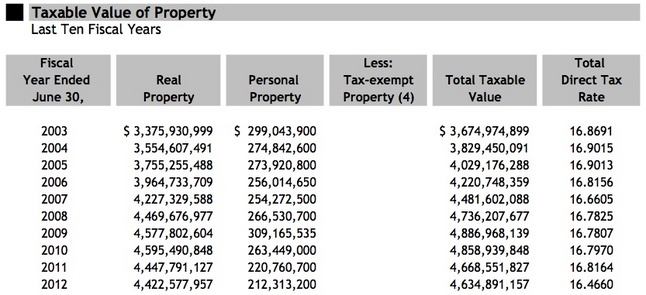

The audit shows the city took in $192.1 million in revenue from governmental and business-type activities, while it spent $155.3 million, leaving positive balances in all major categories.

Revenues up

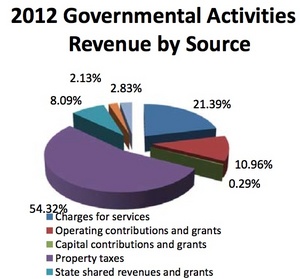

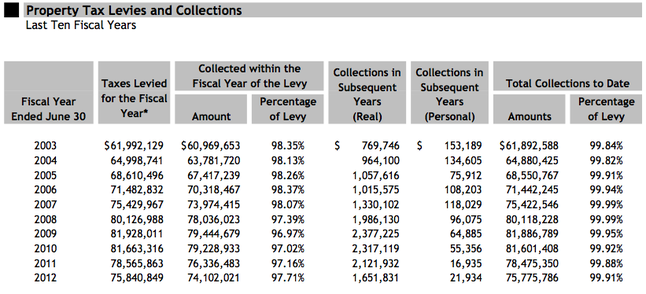

- Overall revenues were up $2.5 million or 1.3 percent from the year before, even though property tax revenues dropped by $2.1 million or 2.7 percent.

- Contributing to the city's positive financial performance was a one-time influx of $3.2 million from the sale of city-owned property at First and Washington.

- Revenues included $83.3 million in charges for services, $76.5 million in property taxes, $13.2 million in operating grants, $1.6 million in capital grants, $9.7 million in state-shared revenue and grants, $3.8 million in investment income and $3.9 million in other revenue, including the $3.2 million property sale.

City of Ann Arbor

Spending cuts

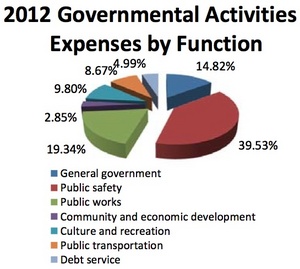

- Overall spending decreased by $5.1 million or 3.2 percent.

- Public safety costs dropped 3.3 percent to $40.6 million. Public works costs dropped 2.8 percent to $19.9 million. Community and economic development costs dropped 22 percent to $2.9 million.

- Solid waste costs dropped 15.7 percent to $11.6 million. Airport costs dropped 23.6 percent to $568,629. Golf course costs dropped 5.8 percent to $1.6 million.

- Water costs dropped 2 percent to $17 million. Public transportation costs dropped 4.8 percent to $8.9 million. Debt service costs dropped 2.3 percent to $5.1 million.

Spending increases

- Stormwater costs went up 9.9 percent to $4.3 million. Sewer costs went up 0.9 percent to $14.6 million. Culture and recreation costs went up 1.4 percent to $10.1 million.

- General government costs went up 3 percent to $15.2 million.

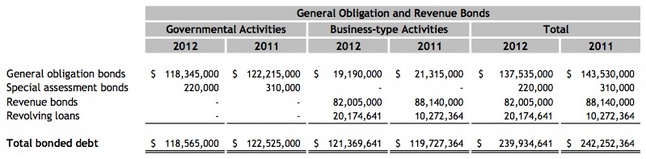

Bond debt drops

- The city's total bonded debt decreased by $2.3 million or about 1 percent, going from $242.3 million to $240 million.

- Of the total outstanding bonded debt, $118.6 million is backed by the full faith and credit of the city. The remainder of the city's debt represents bonds secured solely by specified revenue sources such as revenue bonds and revolving loans.

- State law limits the amount of the general obligation debt a governmental entity can issue to 10 percent of its total assessed valuation. The current debt limit for the city is $526.8 million, which is significantly in excess of the city's outstanding general obligation debt.

Longterm liabilities

- As of June 30, 2012, the city's pension plan was 82.7 percent funded (compared to 88 percent the year before). The liability for benefits was $496.8 million ($481.3 million the year before) and the value of assets was $410.7 million ($423.7 million the year before), resulting in an unfunded liability of $86.1 million ($57.6 million the year before).

- The city's annual required contribution for the pension plan was $9.4 million and the city's actual contribution was $10.5 million (111 percent). Employees contribute 5 percent or 6 percent of their annual pay depending on the employee group. The city's required contribution was $7.6 million in 2010 and $8.7 million in 2011, and the city contributed 100 percent both of those years.

- As of June 30, 2012, the retiree health care plan was 35.1 percent funded (compared to 34.2 percent the year before). The liability for benefits was $249.8 million ($241.1 million the year before) and the value of assets was $87.7 million ($82.4 million the year before), resulting in an unfunded liability of $162.2 million ($158.7 million the year before).

- The city contributed $11.1 million to the retiree health care plan, including $8.9 million for current premiums (56 percent of total health care premiums) and $2.2 million to pre-fund benefits.

- The annual payroll of active employees covered by the city's pension and retiree health care plans was $44 million.

Other highlights

- The city's net assets increased by $36.8 million primarily due to increases in capital assets.

- Charges for services increased roughly 5 percent largely due to an increased volume of fire inspections, building permits and hydropower services, as well as new fees for enhancements to the Argo Liveries.

- The city's assets exceed liabilities by more than $1 billion. Of that amount, $867.8 million is invested in capital assets, $88.5 million is restricted for specific purposes, and $73.5 million is unrestricted.

- The unrestricted balance includes $23.9 million in governmental activities and $49.5 million in business-type activities.

- The general fund has a $14.1 million unassigned fund balance.

- The street repair fund balance ($25 million) decreased by $4.2 million due to planned use of fund balance for construction projects, including funds set aside for the Stadium bridges project that were repurposed after state and federal grant funding was received.

- Unrestricted net assets of the water, sewer, stormwater, parking system, market, golf courses, solid waste and airport at the end of the year amounted to $49.5 million. All funds had an increase in net assets for the year totaling $16.6 million.

- The city's investments included $89.1 million in U.S. treasuries, $83.3 million in U.S. agencies and $11.9 million in money market accounts for a total of $184.2 million.

City of Ann Arbor

A look a the city's bonded debt as reported in the latest audit.

City of Ann Arbor

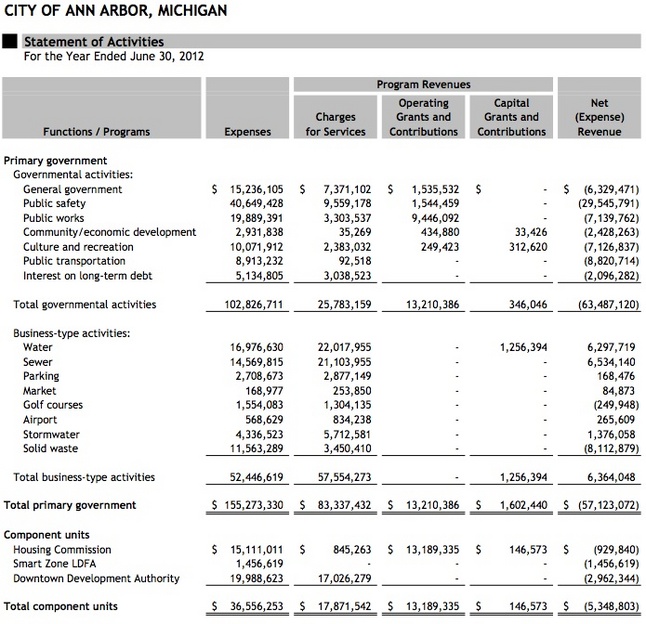

A chart from the audit showing a history of tax collections in Ann Arbor.

City of Ann Arbor

An indication of the city's tax base showing property wealthy in Ann Arbor.

City of Ann Arbor

Notes from the auditor

As part of its audit of the city's finances, the Rehmann accounting firm noted the following concerns about the city's internal controls and recommended they be addressed.

- Instances where an employee's time input did not bear evidence of direct supervisor review and approval as required by the city's policies and procedures.

- Three instances where an employee was requesting and receiving mileage reimbursements while also receiving a vehicle allowance.

- Three instances ranging in dollar amount from $3,000 to $44,000 where a family member of a city employee had a contract with the city to provide goods or services.

Other recommendations from auditor

- The city should review its internal audit procedure and determine if it would be more effective if the internal auditor reported directly to the audit committee instead of the chief financial officer.

- The city should consider enhancing information technology controls for four reasons: Passwords are not required to be changed at regular intervals. The city does not have a disaster recovery plan. A backup and data retention policy does not exist and backups are not tested. And employees are not required to lock computer screens when leaving their work stations.

The city's response

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's email newsletters.

Comments

Linda Peck

Tue, Jan 29, 2013 : 10:54 p.m.

Whether or not this is good news or bad news, I cannot tell, not being expert in deciphering financial documents, but I believe I am overtaxed as a property owner, as I look around at other towns and do a comparison of services and facilities that the City provides, not including UofM's significant offerings.

Mike

Tue, Jan 29, 2013 : 8:34 p.m.

Steven Ranzini for Mayor!

Mike

Tue, Jan 29, 2013 : 8:29 p.m.

•As of June 30, 2012, the city's pension plan was 82.7 percent funded (compared to 88 percent the year before). This is the real upcoming problem.............unfunded pensions. Not just in Ann Arbor but everywhere in the country at every level of government. Social security is already well beyond that as far as being underfunded..........

Tom Whitaker

Tue, Jan 29, 2013 : 7:05 p.m.

"Contributing to the city's positive financial performance was a one-time influx of $3.2 million from the sale of city-owned property at First and Washington." I recall that the proceeds from the sale of the property at First and Washington were already committed to partially pay for the City Hall expansion project via a rather complicated financing scheme. In fact, the delays in the closing of the sale caused the City to have to borrow money from itself in order to keep up with the bond payments. I'm not an accountant, but the impression given here is that the sale of the property somehow created a windfall, when in fact, the money was already spent. Also, as soon as the parking structure portion of the First and Washington project is completed, it will be turned over to the DDA who must then start making payments on $9 million worth of bonds to pay for its construction. The City is ultimately responsible for the DDA's debt.

outdoor6709

Tue, Jan 29, 2013 : 4:02 p.m.

Yes clownfish, funding for public art comes by charging contractors a 1% fee. So when a contractor bids a contract that shoud cost $1 million the contractor adds 1% and turns in a bid for $1,010,000. Public art is not free no matter what the council tells us.

Stephen Lange Ranzini

Tue, Jan 29, 2013 : 3:39 p.m.

@Karkaland: In 1999, just before the current mayor took office, Ann Arbor had only $119 million in debt, more cash in the bank than that, and large surpluses in the pension fund. Some ill-advised pension fund paid for early retirement buy-outs later and the pension fund is deeply in the red. After the Rog Mahal, Garage Mahal and other wasteful spending, the debt is sharply higher. While the city is still healthy, it is now deeply in debt and the trendline is troubling.

Kafkaland

Tue, Jan 29, 2013 : 3:19 p.m.

At first glance, this looks quite healthy. The pension liabilities seem to be an isue and the city needs to continue to work on getting this under control. But otherwise, the spending cuts seem to have kept the city on solid financial ground, even in this tough economic climate. And the other recommendations of the auditor in particular in the IT area shouldn't be too hard to address. Overall, I don't think I can complain much about the fiscal stewardship of the city.

Elaine F. Owsley

Tue, Jan 29, 2013 : 1:46 p.m.

Quick! Somebody hide that surplus or they'll spend it on some dumb street art.

clownfish

Tue, Jan 29, 2013 : 2:48 p.m.

Do you actually know anything about where the funding for art comes from? How many art committee hearing have you attended?

Stephen Lange Ranzini

Tue, Jan 29, 2013 : 1:13 p.m.

In addition to the $488.3 million in total liabilities, the city is planning on issuing up to $120 million in debt to fund the new waste water treatment plant, so that will take total liabilities of the city over $600 million: "Ann Arbor City Council approves $120M bond issuance for wastewater plant renovations" http://www.annarbor.com/news/ann-arbor-approves-120m-bond-issuance-for-wastewater-plant-renovations/

Stephen Lange Ranzini

Tue, Jan 29, 2013 : 12:50 p.m.

Translations: The city had an increase in net assets of $36.8 million = The city had net income of $36.8 million in its most recent fiscal year. The city's bond debt was $240.0 million (down $2.3 million), the unfunded pension fund liability was $86.1 million (up. $28.5 million), and the retiree health care plan was underfunded by $162.2 (up by $3.5 million)= The city's total liabilities rose to $488.3 million. The headline is misleading for two reasons: the city's overall liabilities increased and did not really drop and the city's general fund surplus is only a small part of the overall operation which ran a $36.8 million surplus.

Ryan J. Stanton

Tue, Jan 29, 2013 : 4:46 p.m.

From the audit: "$73,463,230 is unrestricted and may be used to meet the government's ongoing obligations to citizens and creditors, subject to the purpose of the fund in which they are located. This balance is comprised of $23,913,683 in governmental activities and $49,549,547 in business-type activities."

Stephen Lange Ranzini

Tue, Jan 29, 2013 : 4:18 p.m.

@Ryan Stanton: As noted in your article $73.5 million of the $184.2 million in cash on hand outside the pension fund is unrestricted, while $88.5 million of the cash held by the city is restricted for specific purposes. Plenty of money there to do what is necessary, to achieve adequate basic services: fire, emergency response and police protection up to national standards, and for fixing the roads (and doing more automation of the lights and other traffic control systems).

Stephen Lange Ranzini

Tue, Jan 29, 2013 : 4:09 p.m.

@Ryan Stanton: Much of the surplus is restricted, true, but a large amount of that sum is only restricted based on past actions of city council that could be repealed by a vote of council.

Ryan J. Stanton

Tue, Jan 29, 2013 : 2:25 p.m.

Regarding your other point, I was going for clarity in separating out the different liabilities, as each of them is different in nature. I remember when the GASB standards changed and governments everywhere had to react and start accounting for these large unfunded liabilities related to future retiree health care benefits. Many governments were, and many still are, following a "pay as you go" model. You have to remember it's a long-term liability and we're actually seeing the city of Ann Arbor play catch-up through its VEBA and contribute millions to the pre-funding of future benefits now. You're right, there's still a big dollar amount there in the "unfunded" column, but it might not be as doom and gloom as it looks. Keep in mind the funded ratio has gone from 30.2% in 2010 to 34.2% in 2011 to 35.1% in 2012, so the city is making some progress. Is it enough progress? That's a fair question.

Ryan J. Stanton

Tue, Jan 29, 2013 : 2:23 p.m.

Saying the city had a $36.8M surplus in a headline could imply to the average person that the city has $36.8M left sitting around that it could use toward anything it wants, and there are restrictions on most of those funds based on the source of the funds, and in some cases, future plans already for those funds. For example, the financial statements on Page 38 show about $12.6M of the surplus is found in the water and sewer utility funds. I believe those funds will be used toward the tens of millions of dollars in water and sewer capital projects in the works right now. But I would bet if I put "$36.8M city surplus" in a headline I could easily trick a bunch of people into thinking the city could go out and use those dollars to hire a bunch of new police officers and firefighters.

Brad

Tue, Jan 29, 2013 : 12:30 p.m.

I'd like to hear more about the family member that provided $44K worth of goods/services.

Ryan J. Stanton

Tue, Jan 29, 2013 : 1:08 p.m.

I'm requesting more information about this. Stay tuned.

Stephen Lange Ranzini

Tue, Jan 29, 2013 : 12:27 p.m.

Three of the auditor's findings regarding IT are quite serious and require immediate remedial action: "Passwords are not required to be changed at regular intervals. The city does not have a disaster recovery plan. A backup and data retention policy does not exist and backups are not tested." I read the response from management to the audit in the link and it was a list of excuses why they weren't doing very basic and necessary things. Immediate action is needed and until these issues are effectively addressed, the city is: 1. Vulnerable to outside hackers due to the passwords being static. 2. Vulnerable to major disruption in operations if there is a disaster since no planning has occured to mitigate the impacts of a disaster. 3. Vulnerable to permanent data loss because the city doesn't ensure that it's data backup system is correctly and accurately being performed and full system restores can be done from the backup tapes. These are serious issues that need to be addressed!

outdoor6709

Tue, Jan 29, 2013 : 1:04 p.m.

Serious issues that need to be addressed. Are you kidding? AA is the feel good capital of Mi. We can address public art, tilt at windmills, create green zones. But to actually solve long term problems requires more energy than Mayor or council are willing to expend.

Jack

Tue, Jan 29, 2013 : 12:13 p.m.

Ryan - Can you tell me where the $83M revenue for services is in the report? The pie chart says over 54% of the city's revenues come from property taxes. Charges for services only results in a little over 21% of revenues. But your article says that says that revenues for services ($83M) are more than revenues from property taxes ($76.5M). ?????

Ryan J. Stanton

Tue, Jan 29, 2013 : 1:06 p.m.

Page 17 has the revenues and expenses for FY 2011-12 compared to FY 2010-11. The numbers in the body of the article are the totals for governmental and business-type activities. The pie charts, as the titles indicate, are just governmental activities. They don't include business-type activities like water, sewer, stormwater, golf courses, airport, solid waste, parking, etc.

HB11

Tue, Jan 29, 2013 : 12:06 p.m.

Two things: 1) The city's internal auditor most DEFINITELY should be reporting to the audit committee, and NOT the CFO. That is bad chain-of-command and could create a conflict of interest. 2) "As of June 30, 2012, the city's pension plan was 82.7 percent funded (compared to 88 percent the year before)." Pensions are unsustainable.

Jack

Tue, Jan 29, 2013 : 11:53 a.m.

"•The annual payroll of active employees covered by the city's pension and retiree health care plans was $44 million" I assume it is worded in this manner because it relates to permanent employees only? Does it include benefits? Also, as to the $83M in revenues for services, how is this broken down, i.e., roughly what are the largest contributors to this revenue?

Jack

Fri, Feb 1, 2013 : 5:38 a.m.

Thanks, Ryan.

Ryan J. Stanton

Tue, Jan 29, 2013 : 1:18 p.m.

I had a story a little while back noting the city paid out nearly $55 million in wages in 2011, and that number didn't include the worth of health care benefits but it did include cash perks on top of salaries. So it would seem the $44M is just wages.

Ryan J. Stanton

Tue, Jan 29, 2013 : 1:13 p.m.

There's a chart at the end of the story with a full breakdown of the charges for services. Water and sewer charges are more than half the $83M.