Human services funding on the chopping block as Ann Arbor officials confront budget deficit

Ann Arbor officials are considering a $116,714 reduction in funding for nonprofit human services agencies to address next year's budget shortfall.

And another $48,700 could be cut in the following year, according to budget proposals laid out during a special Ann Arbor City Council work session Monday night.

Combined, that would equal a nearly 13 percent reduction in the $1.276 million the city gives each year to community groups like Food Gatherers, Avalon Housing, Big Brothers Big Sisters of Washtenaw County and the Women's Center of Southeastern Michigan.

Ann Arbor remains a rarity in supporting such causes with its general fund money, but those allocations are being reviewed as city leaders face a $2.4 million budget deficit for next year.

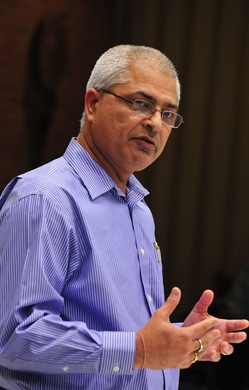

"These are tough issues we are dealing with, and we are all in this," said Sumedh Bahl, the city's community services area administrator, who presented the latest budget proposals.

Sumedh Bahl, Ann Arbor's community services area administrator.

Ryan J. Stanton | AnnArbor.com

Mayor John Hieftje and other council members reacted with concern to the potential cuts to human services programs.

"I'm sure other council members will join me in asking for some alternative scenarios with the human services funding," Hieftje said.

Council Member Carsten Hohnke, D-5th Ward, offered a similar take.

"It's important to remember that there's a strong link between the investments we make in human services and the investment we're required to make in safety services," he said.

The focus of Monday's discussions was on the community services area, which includes planning, parks and community development. Bahl laid out a series of proposals aimed at trimming $232,399 from those budgets for the fiscal year starting July 1.

Another $234,790 in reductions is proposed for the following year.

The current year budgets for those three units total about $7.8 million, meaning the reductions targeted for next year are just under 3 percent. The city's total general fund budget is about $81.5 million this year.

City Administrator Roger Fraser said each unit in the city has been asked to come up with reduction measures to meet budget targets, but the merits of making specific cuts ultimately will be weighed against other options yet to come before council.

Bahl laid out one notable expense proposal. He said the Ann Arbor Housing Commission is requesting $154,000 in each of the next two years to hire two new full-time employees.

Currently, there isn't an organized approach to maintaining the Housing Commission's buildings and equipment due to lack of a maintenance manager, Bahl said. The commission also desires to add a financial analyst position to track its finances.

Much of the discussion on parks centered on the city-owned Huron Hills Golf Course, which continues to require a subsidy from the city's general fund.

The city recently solicited proposals to privatize management of the course, but city officials turned down an offer from Pittsfield Township-based Miles of Golf.

In a five-page memo given to council members, Bahl said both Huron Hills and the Leslie Park Golf Course have seen remarkable improvements in financial performance. Attendance is up 56 percent in four seasons at Huron Hills and up 48 percent at Leslie Park.

The actual loss for both courses for fiscal year 2010-11 is $371,319 — about $119,636 better than the $490,955 originally projected, according to the memo.

Projections for the next two years show the courses operating at a subsidy of slightly higher than $250,000 — down from more than double that amount two years ago. The subsidy just for Huron Hills is estimated at $162,000 next year and $160,000 the following year.

Bahl laid out five options Monday night for council members to consider as they think about alternative uses for Huron Hills instead of a golf course.

One option involves essentially letting the area go and converting it to walking trails. That could reduce the city's costs on Huron Hills to as low as $68,000 a year.

Another option is to establish it as a natural area space with prairies or grassland, as well as trails. That could take hundreds of thousands of dollars each year for the next six years, followed by annual costs of at least $94,000 in year seven and beyond.

The other three options include turning Huron Hills into a soccer field, disc golf course or space for community gardens. Cost estimates weren't available for those options.

Ann Arbor officials continued to have discussions about the future of the Huron Hills Golf Course Monday night.

File photo

Bahl said legacy costs related to Huron Hills need to be considered, including $27,945 in annual retiree health care costs that won't go away. Also, it has two full-time city employees — one represented by the Teamsters and another represented by AFSCME.

Per union contracts, those employees can't be laid off while any temporary, seasonal or contract employees are still employed in their areas.

Hieftje said perhaps the "trigger point" then for considering alternatives for Huron Hills is when positions open up within the city that those employees can shuffle into. In the meantime, Huron Hills is improving, and the city should step back from repurposing it, he said.

"Let's give it a chance," he said. "It's on an upward trend, staff's been doing a great job with it and they've cut costs and raised revenues, so hopefully things are going to work out there."

Colin Smith, the city's parks and recreation manager, pointed out a lesser known fact Monday: Both golf courses could be funded with parks millage dollars instead of the general fund.

"We still see losses in both courses," added Tom Crawford, the city's chief financial officer. "The strategy we're going to do with golf has got to be figured out."

Council Member Margie Teall, D-4th Ward, said she wondered why the city continues to single out Huron Hills when many of the city's recreational amenities — including the Senior Center, Buhr Park Ice Arena, Veterans Memorial Pool, Buhr Park Pool, Mack Pool, and Cobblestone Farm — are costing the city hundreds of thousands of dollars every year to run.

Hohnke said he's concerned about the challenges council members will be faced with in the coming months as budget decisions have to be made. He noted some uncertainties exist around the amount of funding the city could see in the next year from the state of Michigan and from the Ann Arbor Downtown Development Authority.

"You're really getting down to some difficult choices, so I remain concerned," he said. "I think the staff have done a good job of presenting some options and we'll all have to get together as a community and kind of see which ways we want to go to deal with that."

Other budget proposals for next year include:

- Eliminate software that parks staff uses sparingly ($7,000)

- Changes related to rental housing inspection ($170,000)

- Energy savings at recreational facilities, including changing lights at Cobblestone Farm and Mack Pool to LEDs, and replacing pool boilers and rink compressors ($65,083)

- Decrease advertising, conference, training, travel, postage, materials and supplies in planning ($1,602)

- Allocate 10 percent of historic district coordinator's time to construction fund for review of construction permit applications in historic districts ($9,292)

- Projected revenue increase in planning fees ($10,000)

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529.

Comments

a2why

Tue, Feb 8, 2011 : 4:10 a.m.

Huron Hills is a wonderful course for beginners and kids, and it would be a shame for it to be let go. Personally, I love being able to bring my kids during family-friendly sunday afternoons to introduce them to the game of golf. As far as disc golf goes, what can't we do both? Have night disc golf during golf season, and all day disc golf from november to march. You could generate revenue from parks and recs lessons and clinics, leagues, tournaments, and donations (or green fees??), and they could both share the city 'administrative' costs.

Eirik Kauserud

Tue, Feb 8, 2011 : 3:53 a.m.

Another disc golf course is a phenomenal idea. Low maintenance cost. Low start up cost. Fun for all ages and it's not seasonal, you can enjoy it year round!

Edward R Murrow's Ghost

Thu, Feb 3, 2011 : 4:59 p.m.

"Adding $3632 to the $103,769 from above gets the average total compensation of an Ann Arbor city employee to $107,401 per year." Indeed it does. Now what, exactly, do we think this means? It certainly does not mean that this is what every city employee receives. This is simply a talking point bereft of any real meaning. But at least there is a factual basis to it. That's a refreshing change. Now, let's take the next step, shall we? An earlier A2.com piece lays out the average pay (i.e., what shows up on one's W2) and cost of employment (e.g., benefits, employer payroll tax, etc...) for some city employees by their job category. That chart can be found at: <a href="http://www.annarbor.com/news/controlling-employee-costs-may-be-ann-arbors-biggest-challenge/">http://www.annarbor.com/news/controlling-employee-costs-may-be-ann-arbors-biggest-challenge/</a> So rather than discuss a meaningless average that lumps everyone together no matter their skills, education, and experience, it seems the table at the above link is a useful place to start. Those who think that Ann Arbor city employees are over-compensated ought then make their case using private sector comparisons to this table given similar levels of skills, education, and experience. And if they cannot make that comparison or are unwilling to do so, one can only conclude that they cannot make their case. I won't be holding my breath while I wait. Good Night and Good Luck

discgolfgeek

Thu, Feb 3, 2011 : 4:26 p.m.

I am an avid golfer (both disc and ball). Huron Hills (HH) is a great track for beginning and senior golfers and no other area course serves this purpose as well as HH does. But if it is too costly for the city to support, I say it should be redeployed as soccer fields on the river (east) side of the course and walking trails/disc golf/cross country skiing/sledding on the (west) hilly side of the course. There is ample land on the east side so community gardening and a skate park could also be put in. The hilly side would make for an amazing disc golf course and it's time Ann Arbor put in a quality course (sorry, Bandemer and Mary Beth Doyle Park are not great disc golf courses although they are good for beginning players) like so many other cities have. Disc golf can be played by folks of ages and can co-exist easily with walkers/hikers/runners. A disc golf course requires little upkeep compared to a ball golf course. Disc golf is one of the fastest growing sports in the country. Go out to any park in the winter time that has a disc golf course -- a high percentage of the users are disc golfers, who play the sport year around. That's why parks like Independence Lake and Kensington put in a disc golf course -- it draws lots of people and helps justify the existence of the park.

AlphaAlpha

Thu, Feb 3, 2011 : 2:44 a.m.

"Adding $3631.58 to the $103,769 from above gets the average total compensation of an Ann Arbor city employee to $107,401 per year." This brings new meaning to the phrase "Cool 107". The Cool 107 Club. Where human service contributions are 'too expensive'.

Chris

Thu, Feb 3, 2011 : 1:15 a.m.

It seems to me that disc golf would be a great way to save money at the site. Disc golf has been shown to be low impact and low maintenance relative to a regular golf course. Plus there's a growing community with local clubs and leagues who will bring visitors from out of town and help to enforce standards and volunteer time and resources for course maintenance. This particular site is quite open and I believe there's more than enough space to accommodate a full disc golf course (up to 27 holes) and walking/XC ski trails so long as the effort is well planned.

Vivienne Armentrout

Wed, Feb 2, 2011 : 10:27 p.m.

Although the City of Ann Arbor has (in my memory) always allocated some modest amount of general funds to human services, in the past much of that funding came from the Federal Government as CDBG (Community Development Block Grant) money. Ann Arbor was one of the first CDBG communities in Michigan and consequently was grandfathered in for more generous provisions than recently established CDBG communities. In 2008 the City moved to join the Urban County, which is now (I believe) the only CDBG community in the county. By doing so, it transferred the HOME grants, CDBG funds, and other such entitlement funds to the Urban County. But it also gave up its grandfathered status. Here is an excerpt from a memo by Jayne Miller as background to that Council decision. "Unless HUD provides a waiver to the City, the portion of CDBG funds spent on human services will be reduced from the City's current grandfathered $396,000 (equal to 38% of the CDBG allocation this year) to a possible 15% (which represents approximately $196,000), the current human services cap required by HUD. This change would mean that the City would need to spend the approximately $200,000 in CDBG funds, that in the past would have been spent on human services, on another activity that is CDBG eligible. In 1989, the City of Ann Arbor was granted permission to devote $396,000 of CDBG funds to human services, thereby exceeding the 15% cap in place for other entitlement communities. Since 1989, when this amount was first instituted, the percentage of CDBG funds for human services has ranged from 26% to 38%, where it is today." If I recall correctly, the Council then allocated general funds to those agencies that had been receiving CDBG funds in order to make up the shortfall that surrendering the CDBG human services funds caused.

Brian Kuehn

Sat, Feb 5, 2011 : 1:08 a.m.

I am sorry Vivienne, but your explanation and historical recap is confusing. Urban County? In a nut shell, are you saying that in the past the Federal government gave Ann Arbor $396,000 which was partially or totally passed on to charitable entities? Then in 2008 the City joined the Urban County (whatever that is) and therefore $200,000 of Federal aid could no longer be given to local charities? So City Council decided to direct $200,000 of your and my tax dollars to charities that formerly received money from the Federal government (via the City). Is that what you said? And in conclusion, I presume that you think it is okay for the City to tax you and me and then direct your and my tax dollars to charitable organizations of their choice. Does that match what I think you were trying to say?

a2why

Wed, Feb 2, 2011 : 8:02 p.m.

Regarding the Huron Hills Golf Course operating costs... I've read in a financial document that in 2010 the golf course paid $136,000 for city overhead. $87,000 was for a municipal service charge, and $25,000 for information technology. Could AA.com find out what the $87,000 is for exactly? And is $25,000 seriously for the huron hills website on a2gov??? You know, the same website as of February 2nd, is telling us that the golf course is open in December weather permitting... My kids could construct a better, more-up-to-date website.

Terry

Wed, Feb 2, 2011 : 3:19 p.m.

Disc golf is an all-year, all-ages lifetime sport. A well-designed course in the Huron Hills property would weave in other aspects like walking and running trails and community gardens. They are absolutely not exclusive uses. And disc golf presents no more management or maintenance problems than a decent, active walking trail.

Basic Bob

Wed, Feb 2, 2011 : 2:42 p.m.

Human services is a core function of local government. Ann Arbor needs find ways to cut internal costs such as utility usage, human resources, and information technology.

poindexter1

Wed, Feb 2, 2011 : 2:12 a.m.

Gamebuster has some valid points here. Just how much of those funds is Avalon Housing going to spend $600.00 on additional toilets for there tenants? Perhaps if that non profit ran their organization more like that as their counterparts, they could really be successful and house more disadvantaged people as well as not fire/layoff half their staff. Good thing they dont do background checks or drug test- they wouldnt have hardly anyone left to run their organivation.

snapshot

Wed, Feb 2, 2011 : 2:09 a.m.

The poor get poorer and hungry while the golfers tee off at taxpayer expense....perfect. What a screwed up social system and Ann Arbor considers itself to be socially conscientious, except when it interferes with their tee time. We need strong leadership to start cutting these costs where they don't make the less fortunate people suffer. Instead we have leadership that caters to the affluent, at taxpayer expense. Sleep tight in your warm beds folks. Maybe if you were forced to go without eating and then forced to sleep in your car for a week, you'd have a different feeling about that subsidized tee time.

AlphaAlpha

Wed, Feb 2, 2011 : 1:34 a.m.

Ryan J Stanton provided clarity when he stated: "Hoping to add some clarification to the discussion around city employee compensation, here is a paragraph from a story I wrote on the subject last year: "The average Ann Arbor city employee earns a base salary of $65,198 and receives $32,993 in benefits. By those calculations, the average active employee costs the city $98,191 per year, a figure slated to rise to $103,769 next year. And that's not including overtime, which is an expense of more than $2.76 million on its own." <a href="http://www.annarbor.com/news/controlling-employee-costs-may-be-ann-arbors-biggest-challenge/"">http://www.annarbor.com/news/controlling-employee-costs-may-be-ann-arbors-biggest-challenge/&quot;</a> What if we include the cherished OT overtime? $2.76 million shared by ~ 760 workers = $3631.58 per person. Adding $3631.58 to the $103,769 from above gets the average total compensation to: $107,401 per year. Is that appropriate? Many believe not.

snapshot

Wed, Feb 2, 2011 : 2:26 a.m.

Factor in that they most government workers aren't obligated to actually produce during their work hours and their cost far outways their value to the taxpayer.

zeeba

Tue, Feb 1, 2011 : 11:31 p.m.

People who argue that Huron Hills should be closed because there are other golf courses in the area overlook the fact that it is one of the very few that is suitable for beginning golfers who are just taking up the game. It's wide open, has few hazards and you don't get a lot of impatient hyper-competitive types behind you pressing you to play faster. It's also one of the more affordable courses in the area, which makes it a good place to take kids who want to learn how to play.

snapshot

Wed, Feb 2, 2011 : 2:23 a.m.

Are you kidding me? You're talking about an affordable (because of taxpayer subsidies)golf course while folks are cold and hungry. What do use for a moral compass, a putter?

Ryan J. Stanton

Tue, Feb 1, 2011 : 10:15 p.m.

Here are the documents presented last night, in case anyone wants to check them out. Particularly, the memo on Huron Hills offers more detail on each of the options for the property (and a map of cross country ski trails if any of you are feeling adventurous): <a href="http://a2docs.org/doc/258/" rel='nofollow'>http://a2docs.org/doc/258/</a>

Olan Owen Barnes

Tue, Feb 1, 2011 : 10:08 p.m.

What is the Huron Hills Gold Course?

Jen Eyer

Tue, Feb 1, 2011 : 9:42 p.m.

A comment that contained false information was removed.

Dog Guy

Tue, Feb 1, 2011 : 8:38 p.m.

Individually, we contribute to those nonprofits which we support. The city absolutely must step in and contribute our money to those nonprofits which we do not support, or what is representative government for?

Brian Hall

Tue, Feb 1, 2011 : 5:59 p.m.

I not only question the prudence of using public money to support non-profits but the legality of supporting the women's Center of Southeast Michigan. While I am unaware of any in Michigan, there have been successful civil rights lawsuits nationwide prohibiting the use of public funding to support non-profits or other organizations that exclude a portion of the population from their services. These lawsuits almost universally involve state support of domestic violence shelters that exclude men from thier services. While I believe the Women's Center provides much needed and valuable services to the community, a review of its website indicates it does in fact exclude men from some of its services. I would think funding this organization with public money would clearly violate the civil rights act that prohibts organizations that recieve public funding from disciminating against any group in society.

Kimberli Cumming

Fri, Feb 4, 2011 : 1:57 a.m.

Dear Mr. Hall, Thank you for sharing your concern and for giving The Women's Center of Southeastern Michigan a chance to respond, both in this forum and in our conversations throughout this afternoon. We appreciate you taking the time to e-mail, call, and visit The Center. The Women's Center of Southeastern Michigan is a women's resource center that offers an interwoven "safety net" of critical human services: personal counseling, individual financial counseling, job coaching, tax return assistance, and divorce support. Men volunteer and participate in ALL of our services, with the sole exception of our divorce groups. For safety reasons (both physical and emotional), we invite men to seek divorce services elsewhere. Many of the women we serve are in coercive relationships with their partners, and we believe that they are entitled to feel safe when they are in our space. Men who are interested in divorce support have a choice of several alternatives. Mixed-gender divorce support groups are available at local churches as well as at Schoolcraft College in Livonia. A list of resources can be found on our website at: <a href="http://womenscentersemi.org/local_resources#15" rel='nofollow'>http://womenscentersemi.org/local_resources#15</a> Should there ever be enough men who wished to participate in divorce support services at The Women's Center, we would certainly consider providing a divorce support group for men. In the meantime, I think it's important to clarify that the public funding received by The Women's Center supports our Personal Counseling program, which provides access to low-cost, high-quality mental health services to women and men, girls and boys, regardless of ability to pay. Thank you again, not only for voicing your concern, but for taking the time to dialogue with us.

BobbyJohn

Tue, Feb 1, 2011 : 10:37 p.m.

Discrimination against anyone is an attack on all.

dotdash

Tue, Feb 1, 2011 : 6:06 p.m.

This sounds like an argument one makes just to argue with something. If you think the center provides "much needed and valuable services", then there must be something that's better worth your thought and effort than attacking them.

Jon Saalberg

Tue, Feb 1, 2011 : 5:40 p.m.

I can't help but point, as I have regularly, that this is the city administration that thought it necessary to build a multimillion dollar underground parking structure that the city doesn't need. If these folks are willing to put forward a $50M project out of, who knows what, why expect any other decisions that make sense.

Bill

Tue, Feb 1, 2011 : 5:25 p.m.

The real issue at hand is how do we, as a municipality, make this piece of property (Huron Hills) profitable? Well, build the skate park complex that Trevor Staples has proposed for years and make it a premier destination for beginner and advanced skaters! Charge equipment rental and entry fees as well as skate event fees and offer a premier concession stand and skate board shop. Around the skate park complex, rent out garden plots and convert the remainder of the property to nature trials for k-12. Problem solved.

rusty shackelford

Tue, Feb 1, 2011 : 5:22 p.m.

Why don't they just increase the links fees until it pays for itself? Then increase them a little more to help subsidize other parks programs? Privatization would lead to higher fees for golfers anyway, so instead of selling it at a cut rate why not just get more out of the investment we made long ago?

Mary Schlitt

Tue, Feb 1, 2011 : 5:14 p.m.

"My concern with human services is that there is no accountability for the funds that are allocated to these groups. Year after year, the same groups receive funding but we never hear exactly what impact these organizations have on the community." I think it is important to note that non-profits that receive this funding must report specific, quantifiable outcomes that directly impact community-wide human services objectives. This is in addition to any reporting that non-profits provide to their funders (individuals, foundations, corporations, etc.) and for certain agencies - statewide or national governing bodies. Here is a brief overview from the Office of Community Development that outlines the impact these organizations have on our community. <a href="http://www.ewashtenaw.org/government/departments/community_development/plans_reports_data/Non-Profit_Investment.pdf" rel='nofollow'>http://www.ewashtenaw.org/government/departments/community_development/plans_reports_data/Non-Profit_Investment.pdf</a> "For every one dollar that local government invests, these agencies secure over ten dollars of outside resources: that means dollars flowing directly into our community."-Non-Profit Funding in Washtenaw County: An Economic Analysis of Return on Investment.

Ryan J. Stanton

Tue, Feb 1, 2011 : 5:11 p.m.

Hoping to add some clarification to the discussion around city employee compensation, here is a paragraph from a story I wrote on the subject last year: "The average Ann Arbor city employee earns a base salary of $65,198 and receives $32,993 in benefits. By those calculations, the average active employee costs the city $98,191 per year, a figure slated to rise to $103,769 next year. And that's not including overtime, which is an expense of more than $2.76 million on its own." <a href="http://www.annarbor.com/news/controlling-employee-costs-may-be-ann-arbors-biggest-challenge/">http://www.annarbor.com/news/controlling-employee-costs-may-be-ann-arbors-biggest-challenge/</a>

BobbyJohn

Tue, Feb 1, 2011 : 10:35 p.m.

It is upsetting to hear that average city employee compensation is going up 6% in this god-awful year. How can taxpayers be paying over $100k/year for each employee?

Ryan J. Stanton

Tue, Feb 1, 2011 : 6:07 p.m.

I and others here try to keep watch over those commenters who sometimes make misleading or false statements, and I have corrected AlphaAlpha and other commenters in the past when needed. None of us are interested in having discussions on AnnArbor.com deteriorate to the point where fact falls by the wayside. Thanks for sharing our philosophy and contributing to the discussion.

Edward R Murrow's Ghost

Tue, Feb 1, 2011 : 5:33 p.m.

Thanks, Ryan. Of course the point here is that no one ever said what alphaalpha quotes, and, though he does not do it in the immediate post above, alphaalpha consistently compares private sector PAY with public sector COMPENSATION. Indeed, he does it several posts above his most recent. Frankly, I tire of policing what can only be his purposeful misrepresentations and misstatements of fact and am hoping that A2.com might become more vigilant in this regard. Otherwise, your website no longer is news with opinionated yet fact-based discussions. Instead, it becomes a source of disinformation, one that A2.com permits to happen. And that would be unfortunate. Good Night and Good Luck

braggslaw

Tue, Feb 1, 2011 : 4:58 p.m.

People who are passionate about these causes should consider private donations.

Stephen Landes

Tue, Feb 1, 2011 : 4:18 p.m.

I have never supported the use of tax dollars to make contributions to charitable organizations; that's something individuals should do on their own. However, suggesting that change in spending priorities in the midst of difficult economic times seems to me to be wrong. Worse, it "feels" like a proposal that is just put out there so other things will seem like better alternatives. It is what happens with schools when the proposal for closing some funding gap is "let's do away with arts and music" to make the inevitable request for a millage increase seem like the lesser of two evils. The problem with our City budget isn't donations to a few service agencies any more than withholding a dollar from the Salvation Army kettle is the solution to one's personal finance concerns. The problem is a continual spending spree disconnected from economic reality. One commenter pointed out the arts coordinator position recently filled and this article mentions the two additional people that City wants to hire. And, not to be personal about this, we have a "community services administrator" -- why? What City Council and our City Administrator need to do is sharpen their pencils and get busy benchmarking what private business pays for people and services and then negotiating with the unions to find ways to become as cost-effective as the private sector. This does not necessarily mean outsourcing all functions to private contractors, but it should mean that unions will have to compete with the private sector on total value. If the unions can present a case with strong evidence that they add more value than private sector suppliers or non-union workers that would be fine (for example, unions could take over at their own cost all the training required for new employees as a good use of union dues and a real value add from their existence). Of course this approach requires the Administrator and Council to actually do the hard work they are expected to

gamebuster

Tue, Feb 1, 2011 : 3:44 p.m.

Watch out!! When we want to cut down Human Service Fund, we might end up investing more in jail system in the long run. You might know that over 30% of people being jailed are even suffering mental illness. Currently, our government (even Washtenaw County) are diverting both "Human Service Fund" & "Housing Fund" to non-profits. This coming July, the pilot program called "Coordinated Funding" will begin its finding cycle through "United Way" (called single -point entry) Please think about the overhead costs taken by both "United Way" and "Office of Community Development" Our Housing Fund goes to "Avalon Housing", please check "Near North Low-income Housing project", it costs over $330,000 per apartment. (you can buy a house here). Avalon will even pull down 1500 Pauline 47 units, (they're supposed to rehab the apartments only) and invest $8 million to rebuild 32 new units. (Use big money, but lose 15 units) The 10-15% cash kicked- back (developer's fee) from the whole project would definitely allow the non-profit to hire more staff. Here, we even don't talk about the money used to tend for the current tenants. Officials, we're all in tough economy. If we need to cut down "Human Service Fund", first, we need to cut off the "Middle Men". In Washtenaw County Budget 2011, they call them "Outside Agencies". If you still insist on funding the "Middle Men", please please offer strong supervision & reviews. Money for the poor/vulnerable should not have gone big non-profits' staff salary & benefits. Allocating Human Service Fund & Building low-income housing are government job.

Rusnak

Tue, Feb 1, 2011 : 3:33 p.m.

Otherwise, shouldn't the citizens of Ann Arbor support these worthy causes on a direct basis? I do not like the idea of my tax dollars being directed by City Council to certain charities. I prefer to make my donations direct rather than have them taxed and disbursed through government. Have to agree. So, glad I do not live in A2.

dotdash

Tue, Feb 1, 2011 : 3:03 p.m.

Those of you posting about selling the HH golf course missed the whole bruhaha about that in Sept-Oct-Nov. The city can't legally sell it, and community opposition to leasing it to a private enterprise was very strong.

DaLast word

Tue, Feb 1, 2011 : 2:58 p.m.

The city should seel the land that the golf course is on for what ever. There are plenty of courses in this area that could use the extra business, some are even going out of business. This is a case of the city using people's tax money to compete against them.

DaLast word

Tue, Feb 1, 2011 : 2:54 p.m.

Bahl laid out one notable expense proposal. He said the Ann Arbor Housing Commission is requesting $154,000 in each of the next two years to hire two new full-time employees. This is a pretty decent wage, where do I apply.

John B.

Tue, Feb 1, 2011 : 6:27 p.m.

That's the full cost for two people, per year. Figure about one-fourth of that would be the salary for one person per year, or about $38,500. (About half of the cost of an employee goes to things other than wages/salary).

xmo

Tue, Feb 1, 2011 : 2:52 p.m.

I did not see an option to sell the Huron Hills Golf Course? It must be worth something? That way, things stay pretty much the same except that the city is not dumping money into it. I am glad to see that reality is finally hitting the city government! Like Prez Obama says, we have to learn to ldo ess with less!

Ryan J. Stanton

Tue, Feb 1, 2011 : 3:45 p.m.

Remember, sale of park land in Ann Arbor requires voter approval. This is just a guess on my part, but such a proposal probably would not pass muster with voters.

EyeHeartA2

Tue, Feb 1, 2011 : 2:23 p.m.

So Bahl wants to hire 3 more people? Typical government response to a budget crisis. Spend more money. How about he just reorganizes his minions to cover the work. You know, like the rest of the world who are accountable for their budgets have to do. Council should tell him this: "You organize your work any way you want. You just need to do it with 33% less money than you got last year. No, your workload remains the same. ....And if you can't do it, we can find someone who can, and for less money" Maybe we can add another art director and a visionary model railroad builder while we are on a roll. I think the mayor would support these.

Watcher

Tue, Feb 1, 2011 : 2:09 p.m.

Why are human services being funded out of the City's general fund? The human services function was set up to administer federal funds that could not be used for general fund expenses.

KeepingItReal

Tue, Feb 1, 2011 : 1:58 p.m.

My concern with human services is that there is no accountability for the funds that are allocated to these groups. Year after year, the same groups receive funding but we never hear exactly what impact these organizations have on the community.

Christopher LeClair

Tue, Feb 1, 2011 : 1:29 p.m.

Unfortunately, cutting some funding to even the best of charities is a necessity. Times are tough and money is tight and some temporary cuts can help the burning hole. I'm sure that once the economy picks back up and more tax dollars start flowing in that the Council would love to once again increase funding. Time for some serious fundraising!

EyeHeartA2

Tue, Feb 1, 2011 : 1:21 p.m.

While we are railing on the golfers at Huron HIlls, it would be interesting to see how much we "subsidize" the following: 1. Sledding at Vets park and Huron Hills 2. Pools at Vets, Buhr and Fuller 3. Soccer at all the parks, Fuller and Olsen with the dedicated feilds 4. Tennis at numeous parks 5. Ice skating at Buhr and Vets 6. Water slides at Vets and Fuller 7. Frisbee golf at Bandimere 8. PIcnics 9. Walking Golfing is just one activity that a taxpayer may or may not be involved in, just like the above. Personally, I wouldn't mind seeing a good chunk of the Golf course turned into soccer fields, and maybe with the over abundance of golf courses around here, it makes sense to find something else to do with it Keep in mind, we will all just subsidize the next purpose. Just like we subsidize the farmers outside the city not to build on land most of us will never even see.

dotdash

Tue, Feb 1, 2011 : 1:16 p.m.

The golf course represents an investment of time and money over years. If the city ever intends to operate it as a golf course again, it is probably cheaper to keep up what we've got now than let it go and then try to reconstruct it later. You can't just rebuild the landscaping, etc. once it's full of weeds and buckthorn and the sod is gone. Let's think longterm.

Gill

Tue, Feb 1, 2011 : 1:01 p.m.

Finally I recalled the last retort of a great princess who was told that the peasants had no bread or social services, and who responded: "Let them play golf!"

Craig Lounsbury

Tue, Feb 1, 2011 : 12:49 p.m.

"Another option is to establish it as a natural area space with prairies or grassland, as well as trails. That could take hundreds of thousands of dollars each year for the next six years, followed by annual costs of at least $94,000 in year seven and beyond." Thats not a "natural area" thats a garden. A true natural area wouldn't cost anything beyond a one time cost to tear down the building. Then just stand back and let nature do her thing.

Craig Lounsbury

Tue, Feb 1, 2011 : 1:23 p.m.

To add to my own post, I'm not necessarily advocating the abandonment of the course I merely resent the notion that a natural area requires hundreds of thousands of dollars in annual maintenance because it doesn't. What they want is a manicured facsimile of a natural area.

Brian Kuehn

Tue, Feb 1, 2011 : 12:42 p.m.

I am not sure why the City donates money to charitable organizations. If the organization is performing a core service for a fee (e.g. Recycle Ann Arbor) then it makes sense. Otherwise, shouldn't the citizens of Ann Arbor support these worthy causes on a direct basis? I do not like the idea of my tax dollars being directed by City Council to certain charities. I prefer to make my donations direct rather than have them taxed and disbursed through government.

zeeba

Tue, Feb 1, 2011 : 11:18 p.m.

Because charitable organizations save the city money by performing functions it otherwise would be obligated to do - like providing beds for the homeless on nights like tonight. Think of it as a type of privatization.

Christopher LeClair

Tue, Feb 1, 2011 : 5:39 p.m.

These organizations cannot survive on voluntary donations alone. While you might prefer to have your money so you can donate it directly, others would prefer to have their money so they can pocket it. Tax dollars go towards the development of a community and these charities equally work towards developing this wonderful community.