Promising medical devices firm Accuri Cytometers sold to same company that bought HandyLab

(This story has been updated several times with additional information and interviews.)

New Jersey-based giant Becton, Dickinson and Co. said this afternoon that it had reached a deal to acquire medical device firm Accuri Cytometers, one of the Ann Arbor region's most promising tech companies.

Terms of the deal were not disclosed, but the transaction is expected to be finished in BD's third fiscal quarter of 2011, which lines up with the spring.

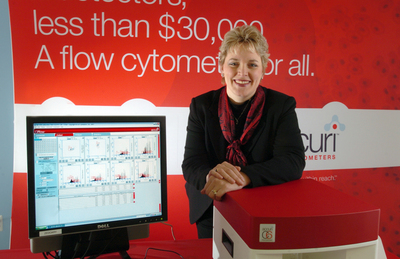

Accuri Cytometers co-founder and former CEO Jen Baird helped the company top $10 million in sales in 2009. She resigned in January 2010.

File photo | AnnArbor.com

The deal is sure to inspire fears among the Ann Arbor business community that BD may shutter Accuri's Scio Township operation, which employs about 85 workers, including more than 60 in Scio, and manufactures the device. Accuri had some $20 million in sales in 2010, nearly double what it had in 2009.

BD paid $275 million to acquire Pittsfield Township-based medical device firm HandyLab in late 2009 only to announce in October 2010 that it would close HandyLab's Pittsfield operation by summer 2011.

In a news release this afternoon, BD gave no indication about its plans for Accuri's Scio Township operation. But sources indicated that BD wants to invest in the company's local operation for the long term.

Asked to address the status of the company's local operation, BD spokeswoman Colleen White said, "I don’t have a lot of details at this stage, but I can tell you our current plan is to continue to operate the Ann Arbor facility."

BD said it would provide more details about the acquisition in a call with investors at 10 a.m. Tuesday.

"Accuri Cytometers' offering of flow cytometers for a new audience of researchers will complement and broaden BD's current offerings for life scientists," said Vincent A. Forlenza, BD president and chief operating officer, in a statement. "We believe that, once completed, this acquisition will enable BD to further contribute to medical and scientific advances, in line with our corporate purpose of helping all people live healthy lives."

The sale is sure to reap a windfall of profits for a range of venture capital investors, including Ann Arbor-based Arboretum Ventures and the InvestMichigan! Growth Capital Fund, a program managed by Credit Suisse using funds from the state of Michigan's pension portfolio.

Accuri's flow cytometry device is a system that helps doctors and researchers analyze cells more efficiently and cost effectively.

Tim Petersen, managing director of Arboretum Ventures and a member of Accuri's Board of Directors, described the deal as a "great outcome." Petersen, whose firm was also an investor in HandyLab, declined to offer details but said he was optimistic that Accuri would not meet the same fate as HandyLab.

"I think there's a tendency for people to be more skeptical and rightly so," Petersen said. "We just have a much more substantial manufacturing operation here. We're further along in the commercialization. It's my understanding that there should be more optimism."

Petersen said Arboretum reaped five times its investment in Accuri, though he declined to say how much that was.

Accuri's founders, Collin Rich and Jennifer Baird, built the University of Michigan spinoff company into a coveted technology company and a symbol of the Ann Arbor region's startup prowess.

The firm was held up in advertisements and commercials by the Michigan Economic Development Corp. as emblematic of the opportunities in the region.

Baird, who could not be reached for comment, is now CEO of Pittsfield Township-based wind energy device Accio Energy. She led Accuri as CEO until resigning in January 2010 and handing the reins to Jeff Williams, the former CEO of HandyLab, who was credited with leading HandyLab to its blockbuster sale to BD.

Williams told AnnArbor.com this afternoon that "we're very excited" about Accuri's sale.

"BD's a high-quality company," he said. "We really coveted their global distribution and this is a great way to get access to it."

BD was long viewed as a possible suitor for Accuri because the company's flow cytometry device fits well in BD's technology portfolio. BD has $7.37 billion in annual revenue and more than 28,000 full-time employees.

In October, BD said it would consolidate manufacturing of HandyLab's rapid infection-detection device into an existing facility on the East Coast. The company described the move as a logical, cost-saving measure. Of HandyLab's roughly 50 employees, some were given the chance to transfer to the new operation.

Like at HandyLab, Accuri's employees hold stock options in the company -- and they will profit from the sale to BD.

Those stock options "will become quite valuable once the transaction" is complete, Williams said.

Contact AnnArbor.com's Nathan Bomey at (734) 623-2587 or nathanbomey@annarbor.com. You can also follow him on Twitter or subscribe to AnnArbor.com's newsletters.

Comments

whatsupwithMI

Thu, Feb 10, 2011 : 2:22 a.m.

(wow I hit maximum character limit) The people I see posting here: the issue we mention isn't with business and small startups as a processes, but with outright misrepresentation (as I see it) of what that process MEANS. Misrepresentation doesn't help anyone. ---As an aside, communities of even 55k people with less going on fiscally than the AA area can support a local paper. The fact that the local subscribers voted with their $$ and a local print paper could not make it-- I wish that clued the new blog into what changes they could make. I think they still miss that mark based on the approach demonstrated in the above article.--- If we had 20 other "startups" of this type locally- that would be neat. As it is, the only two that were doing anything are now gone. Now what? We have _instead of_ a mobile, expert workforce moving to new projects: 65 people from Handy, 65 people from Accuri (we'll see) trying to figure out how to pay for their homes. Or, what state to relocate to. Build more of these, fine, there is a positive. But don't fluff it into something it is clearly _not_. Please.

whatsupwithMI

Thu, Feb 10, 2011 : 2:17 a.m.

@Dug S: I think you are a really smart guy. We've met, although you likely didn't notice. Don't stop doing neat things. However, much dismay written here isn't with "look a startup made something of value and got bought out" as: look, Nathan and the failed former AA News once again... tried to portray this as something it truly was not. Work for a startup, be a smart cookie, and... get left alone in the dirt. Get 40-60% of industry pay during that time as "we are a startup". In the sciences at least, you do a lot of what you do for personal satisfaction, and expect and are good at handling a huge amount of failure- and handling it _well_. Paying the bills is all that is needed. We do expect ALL THREE. Nathan (or his boss) _chose_ to portray this instead as a "look employees made like bandits on stock rah rah " along with other inaccurate statements about the real utcome. Actually, and demonstrably, not true statements, at least for HandyLab. A few mgmt, and whoever had six figures "free" to toss into a venture cronie firm--- those people did extremely well. Handylabs was at 70 people: 4 or 5 made millions, who knows what the v.c. people got, 4 or 5 rank and file got offers to leave AA (no existing home purchase offers). The rest got nothing in stock (if you want to say that is typical reward I'm not going to argue). Just don't have the local "news" try to gild this. We'll see what happens with Accuri. You may know better than I about that.

Dug Song

Sun, Feb 13, 2011 : 10:30 a.m.

@whatsupwithMI: Sorry I don't recognize the pseudonym, and I'm not familiar with the life sciences community here. I did meet Handy recently, who seemed like a good guy (he's also staying, and getting involved with other startups). Absolutely agree that Michigan's politically-driven economic development PR agenda is damaging, when cold, hard reality trashes false hope. 40-60% of industry pay at a funded startup is unconscionable - but also points to a captive/naive talent pool (why else would folks accept that)? Maybe the lack of a bonafide community (and therefore, norms and expectations)... We don't see startup confessionals here as happens in the Valley (failures: <a href="http://techcrunch.com/tag/deadpool/" rel='nofollow'>http://techcrunch.com/tag/deadpool/</a> - but also successes: <a href="http://techcrunch.com/2009/10/08/startupshttp://annarbor.com/business-review/promising-medical-devices-firm-accuri-cytometers-sold-to-becton-dickinson/#-101-the-complete-mint-presentation/">http://techcrunch.com/2009/10/08/startupshttp://annarbor.com/business-review/promising-medical-devices-firm-accuri-cytometers-sold-to-becton-dickinson/#-101-the-complete-mint-presentation/</a> ), where there is a shared culture of learning in business. We've done some post-mortem talks at <a href="http://a2newtech.org" rel='nofollow'>http://a2newtech.org</a> (and are due for more), I don't know if BioArbor does anything similar?

bugjuice

Wed, Feb 9, 2011 : 3:20 p.m.

When will people realize that working people are mere tools to corporate profit seekers. People, livelihoods, and community mean little to corporations. Shareholders turn blind eyes as long as their portfolio grows. We've put corporations on an unassailable pedestal, given them legal license to separate from our social structure instead of requiring that they be part of it.

Dug Song

Wed, Feb 9, 2011 : 2:39 p.m.

Congrats Jen, Arboretum, and the Accuri team! @whatsupwithMI: stock options are usually, at best, just a bonus. Startup employees should not count on getting rich off of them (e.g. <a href="http://www.bothsidesofthetable.com/2010/09/06/how-to-discuss-stock-options-with-your-team/" rel='nofollow'>http://www.bothsidesofthetable.com/2010/09/06/how-to-discuss-stock-options-with-your-team/</a> ), except the earliest founding team (hopefully, those who abated the most risk for the company). Accuri was also on its fifth round of investment (SEC filings here: <a href="http://www.crunchbase.com/company/accuri-cytometers" rel='nofollow'>http://www.crunchbase.com/company/accuri-cytometers</a> ), Arboretum investing from a 2002-vintage fund (venture funds have 10 year horizons). All investors and founders need liquidity at some point, and acquisitions are also increasingly the standard model for corporate "innovation". There's not a lot of point in second-guessing what could've been. @woodyk: Arbor Networks was a venture-backed startup that was acquired last year after growing to nearly 300 employees (a third here in Ann Arbor), is staying in Ann Arbor, and only continues to grow. Also, much VC gets spent indirectly (but hopefully locally) - e.g. Accuri's software developed at Menlo Innovations. @say it plain: It's easy to point out the failure of venture-backed startups when the vast majority of them are strikeouts, the rest base hits, and only once in a blue moon, a home run. But progress in an entrenched market often takes considerable risk. The activation energy required to take a potentially world-changing technology to market, often against giant competitors, can be more than what a small team can bootstrap. An early, innovative startup declares war against the status quo, when few revolutionary attempts are ever successful. But imagine if no one tried! Re: community, a startup team is built to learn how to grow or capture a market. And whether or not a startup is ultimately successful, its members carry that experience and ambition with them. The ecosystem is growing...

DeeDee

Wed, Feb 9, 2011 : 1:09 a.m.

With the exception of Jen Baird, I'm wondering how many of these posters have started a company or created a single job. Having started more than one myself, and created a few jobs to boot, it seems that moaning about the "greedy rich," is not a particularly well informed view of what it's like to put your career, personal livelihood, kid's college fund, etc. on the line to start a business. It takes a sturdy stomach to deal with the very hard work, and constant anxiety about whether it will ever, ever become a product (and allow you to repay all of your investors, let alone actually make any money) not to mention a host of technical, sales, management and other skills. Why pick on the people who are willing to do this and who create at least some jobs for those the shrinking automotive manufacturing sector have left unemployed? How is that helping our community? Maybe a little less complaining and more pitching in to be a part of the solution would be in order.

whatsupwithMI

Wed, Feb 16, 2011 : 3:53 a.m.

those pitching in and providing your solution are, in fact, your own employees. You know the ones that you cut lose @ sale time with no reward for their own "stomach churnings", 50-80 hr weeks, and "startup company" wages.

Jen Baird

Tue, Feb 8, 2011 : 8 p.m.

As the article hightlights, let's keep in mind that 85 employees is not 10. Accuri's manufacturing is happening right here in Ann Arbor. And building a high tech environment similar to silicon valley and boston is about having lots of small companies that are born, grow, get sold, regenerate, etc. rather than a few massive automotive companies that is the legacy here. This is a different economic growth model and it keeps a number of people employed and shipping innovative products around the world which benefits everyone in Michigan through job opportunities, investment opportunities, learning opportunities.

Lets Get Real

Tue, Feb 8, 2011 : 3:56 p.m.

Use a small nuimber of our scientists to develop new technologies, sell at a big price, generate millions for the Leadership Teams and VC, BUT don't manufacture here, don't hire here, don't contribute to this economy - leave. thanks. "The sale is sure to reap a windfall of profits for a range of venture capital investors," I am so tired of the self absorbed, self important, greedy rich who use the employees (at we're a small start-up wage) and the community (employ resources cheaply and give back little) then rape the science by selling it out to be buried by the competitor who only buys to eliminate the competition. If this is entrepreneurship, count me out. Where is the support for main street business?

DepotMom

Tue, Feb 8, 2011 : 3:41 p.m.

@ sayitplain: I think you raise some interesting points. My personal observations are most of the local CEOs & venture capitalists reinvest locally (e.g. Mr. Williams and Ms. Baird). The type of person who invests years into nurturing an idea into a profitable company is 1) smart, 2) not risk averse, 3) a regular person with a family to support & a mortgage to pay, 4) gets a taste for the thrill of new technology and is curious about the next discovery. Ann Arbor has a pretty sophisticated ecology to support this kind of person. If a local company and its investors are satisfied with the terms of a deal, why shouldn't they sell?

say it plain

Tue, Feb 8, 2011 : 2:37 p.m.

The comments here are fascinating, and really do 'spark' (ha) some interesting questions about how MI is supposed to move forward with real growth. If the special access to bright people with great tech abilities that Ann Arbor affords is merely going to be an engine of this sort, then who will really benefit but the venture capitalists (like our new governor, so is he really the guy in a position to make things different for the non-venture-capitalist/CEO type?!), the small numbers of folks who benefit from being sold to the corporate pirate types looking to get rid of upstart competitors, and the hangers-on who like to bask in the glow and largesse of these few people? It's almost exactly what *will not* spark a rebirth of MI's economy, and feels like the antithesis of community-building, every scientist for him or herself just like every businessboy, because hard work and dedication to the development of a product might very well mean being bought out by the highest bidder and having your world turned upside down. But hey, the few who started it all up might have some next idea up their sleeve, is all you can hope for...many might rather move to Seattle or Silicon Valley and at least feel a little more secure about their families' lives.

woodyk

Tue, Feb 8, 2011 : 1:51 p.m.

So where are the jobs all this high-tech entrepreneurial activity backed by venture capital is supposed to generate? It's my impression that many successful startups that are bought out by big companies get moved elsewhere. Someone please post a story about a non-automotive startup that stayed in Michigan, and generated more than 10 jobs.

trespass

Tue, Feb 8, 2011 : 2:54 a.m.

BD is one of two manufacucturers of very expensive flow cytometers. Accuri was a competitor for that market so BD decided to buy them and control both ends of the market. This is not a good thing for customers, which in the end are mostly taxpayers because most flow cytometers are bought with federal grant money or with medical care dollars. A little more in depth consideration of what the company puts in their news releases would be nice!

whatsupwithMI

Tue, Feb 8, 2011 : 2:22 a.m.

Nathan, I would love to see just _one_ article written by you that had more than flag-waving in it. Talk to your fellow blogger, Tom, for ideas as to how to proceed. Handylab had 50-odd employees, and guess how the regular employees did on stocks? zippo, nada, nach. The company (local presence terminating already, and finally gone June/ July) had handed out options, sure, but at acquisition time they had no value. CEOs made out very well though. CEOs have the risky jobs, so that makes sense. As well: B/D bought Handylab to mothball a competitive technology before it could gain a market foothold- the toys Handilab made had just barely been available in the Fisher Sci catalog before it all stopped. You won't see those products available ever again. Lets see who can scoop Nathan as to what this acquisition means for the staffers, and the product, at this new buyout at Accuri. If you are a talented scientist and looking for a reason to stay in AA, this kind of temporary job action sure isn't what you are looking for.

Nathan Bomey

Mon, Feb 7, 2011 : 11:10 p.m.

Stories from Bloomberg and Reuters: <a href="http://www.bloomberg.com/news/2011-02-07/becton-dickinson-buying-accuri.html" rel='nofollow'>http://www.bloomberg.com/news/2011-02-07/becton-dickinson-buying-accuri.html</a> <a href="http://www.cnbc.com/id/41464331" rel='nofollow'>http://www.cnbc.com/id/41464331</a>