Some Washtenaw County teachers waiting on school employee pension reform to submit retirement notices

AnnArbor.com

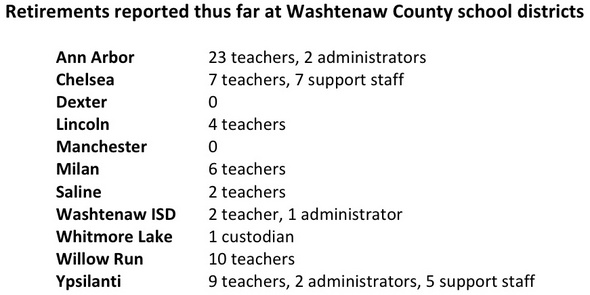

Eighty-two teachers, administrators and support staff in Washtenaw County have submitted retirement notices so far this year. Officials said overall, the number of notices are down, with the exception of Ann Arbor, Willow Run and Ypsilanti. Ann Arbor has stayed about the same, while 16 for Ypsilanti and 10 for Willow Run are slightly higher than normal for this time of year.

Senate Bill 1040, which would revise the school pension program, currently is tied up in the Senate Appropriations Committee.

Rep. Rick Olson, R-Saline, said the Michigan Public School Employees Retirement System (MPSERS) is a $45-billion “unfunded liability” that is “just crying out for a cure.”

He said there are three ways to repair the system — by cutting benefits, increasing employee contribution rates or "finding a money tree somewhere.”

Rick Olson

Dori Gross, a human resources coordinator for Dexter Community Schools, said she has not had any Dexter employees submit retirement notices yet for the 2012-13 school year.

“One person with transportation retired in January and we’ve had people thinking about it a lot and talking about it, especially with the changes that might be taking place in Lansing,” she said. “I’m predicting a lot of our notices will come in right before June 30 when the state decides.”

As it stands, Senate Bill 1040 would increase the percentage employees contribute to their pensions.

Olson said there are about five plans within the existing system with contribution rates of 2.3 percent to 6.4 percent. The bill would require all within MPSERS to pay a minimum of 5 percent to 8 percent in to their retirements.

"An unintended consequence (of the legislation) could be teachers saying, 'I have to retire quickly,'" Olson said.

John McGehee, executive director of human resources for Lincoln Consolidated Schools, had four teachers indicate they will retire at the end of the school year. He said the district’s preliminary research shows there are about 17 employees eligible, so he expects there will be at least a few more retirements after the state decides where it stands on MPSERS.

Milan Area Schools had two teachers submit retirements at each grade level, elementary, middle and high school. The district is evaluating whether it will fill the positions.

Saline Superintendent Scot Graden said his district is weighing the same possibility, adding the MPSERS legislation also will play a role in whether Saline must lay teachers off next year, he said at a recent Board of Education meeting.

Saline is facing a structural deficit for 2012-13. So far, the district has received three teacher retirements and one resignation from a teacher whose husband has been relocated for work.

This year, for every $1 schools pay out in salary, districts are paying in another 24.46 cents to MPSERS. If no reform is passed, between MPSERS and social security contributions, next year school districts could pay nearly 40 cents toward teacher pensions for every $1 in payroll.

One custodian is retiring from Whitmore Lake Public Schools. The position will not be filled because of budget constraints, said Superintendent Kim Hart.

“It’s possible some teachers might be retiring and haven’t let us know,” Hart said. “But most of those who were eligible retired with the state retirement incentive a few years ago. We have a fairly ‘young’ staff.”

The Board of Education has looked at reducing staff for next year and that may include teachers, Hart said, but the board has not settled on a number or a date yet for making that determination.

Ann Arbor Public Schools, which is the only county school district that offers an incentive for early notification, expects 34 employees will leave or retire at the end of the year. Twenty-three are retiring teachers and two are retiring administrators, Assistant Superintendent for Secondary Education Joyce Hunter and Director of Community Education and Recreation Sara Aeschbach. The rest are leaving the district.

AAPS is weighing staffing cuts for the 2012-13 school year as well. It could cut as few at 32 and as many as 64 teachers, according to plans announced last week for reducing the district’s $17.8 million budget shortfall. If the target ends up being 32, the district could cut staff through attrition and avoid layoffs.

Eliminating the district’s early notification incentives for retirements is on the table to help reduce the budget deficit. It is projected to save AAPS $40,000.

Two teachers in the special education department and one administrator at the Washtenaw Intermediate School District will retire in June. Superintendent Scott Menzel anticipates the positions will be filled unless there is a decline in the number of students who require special education services.

School officials said the high number of retirements at Willow Run and Ypsilanti likely is due to the districts' dire financial situations as well as recent consolidation discussions.

Staff reporter Danielle Arndt covers K-12 education for AnnArbor.com. Follow her on Twitter @DanielleArndt or email her at daniellearndt@annarbor.com.

Comments

Ralph

Mon, May 7, 2012 : 9:53 p.m.

Good luck in trying to recruit the brightest into the teaching profession. I'd never encourage any of my children to work in the teaching profession.

Dog Guy

Tue, May 8, 2012 : 8:17 p.m.

I have been honest with my children by telling them "Public school teaching beats working for a living in every way."

Basic Bob

Tue, May 8, 2012 : 10:40 a.m.

That's not a new problem. H. L. Mencken, the "Sage of Baltimore" recognized it nearly a century ago.

Klayton

Mon, May 7, 2012 : 5:20 p.m.

I think school districts should pay their teachers an extra 5K each year...do not do pension plans and tell their teachers they can put the 5K into a Roth IRA each year. I am a teacher, but I am not depending on the state for my pension, I contribute part of my salary every year to a Roth IRA. I am planning on using Medicare when I hit 65 (hopefully) since I have no idea if I will get any medical plan (in reality most people do not, so I am fine with teachers not getting one either). I prefer to control my own retirement and not be dependent on state law makers to make the right decisions. I wish other teachers would also take control of their retirements, in doing so, we could save districts money (state too) that could go towards the children.

Wake Up A2

Mon, May 7, 2012 : 10:23 a.m.

Well what Rick Olsen forgot to tell you is they planned the bill to catch all those retiring at the end of the year, yet many teachers have read the bill and will be leaving earlier in order not to be caught up in this mess. What this has done has left many classrooms without their teachers at the end of the year. If that committee was fair, they would have the same equation as the other state employes, Your age and years of service equals 85, but since they seem to have it out for the educators this won't happen. BTW: since the michigan economy is still tied to the auto makers, why not have what the "private sector" has, 30 and out? Because the legislature wants to make the teachers pay..... Most of my students teachers will have to work 38 years under the new bill..... How many private sector jobs are that long? I work in the private sector and that seems to be a bit over the top. Also, with new teachers getting no health care in retirement, how will the state find teachers for our future students? Do your research, under this bill that will have close to the worse retirement in the country in coming years..... Not a good way to insure our kids future.

Chase Ingersoll

Mon, May 7, 2012 : 1:52 a.m.

Around the country, no unions have had more influence in local and state elections than the teachers unions. In Illinois it was the teachers unions who more than any other organization ensured the elections of Rod Blagojevich. Meanwhile the product that the public schools produce (High School Diplomas) mean little or nothing as the majority of high school students are not "college" prepared, as in Ypsilanti, where the ACT scores average a mere 16. So regardless of how deserving an individual teacher might be it is no different from the auto worker who busted himself on the line, every day for 30 years and invested in GM stock/bonds. When the GM stock was no longer worth anything because the costs to produce and legacy debt were greater than the competitive market value of the product they produced, the company failed and workers lost jobs, retirees lost pensions and shareholders were wiped out. A collective devils bargain that was un-sustainable, is now a shared purgatory. Mene, Mene, Tekel u-Pharsin Chase Ingersoll

maestra27

Mon, May 7, 2012 : 10:49 p.m.

Don't forget that when the economy is good, auto workers share in healthy bonuses. Teachers will never have that luxury. Comparing the two is not quite an "apples-to-apples" comparison. http://www.huffingtonpost.com/2012/02/29/gm-employee-bonuses-paid-500-million_n_1309645.html

Michael K.

Sun, May 6, 2012 : 11:40 p.m.

Incompetent politicians refused to use realistic planning numbers and failed to provide sufficient funding to meet obligations as they were incurred. That is near-criminal behavior. Neither pensions or social security were meant to be funded out of current income. Sufficient funds should be/should have been invested at the time the obligation was incurred to grow with the markets at an annualized average rate. We also need to get our corporate pension funds isolated from corporate books and legally protected before more of those funds disappear (are stolen.) When that happens and a company goes bankrupt we all pay a portion of the lost pension through taxes.

u812

Mon, May 7, 2012 : 12:01 a.m.

don't talk bad about the business community they are the almighty god and can do no wrong while were at it we should lower there taxes again especially with all the good paying jobs they brought in the last year and half.

Lac Court Orilles

Sun, May 6, 2012 : 10:49 p.m.

Teachers should reconsider retiring because because your golden years may turn out to be otherwise. There are just too many unanswered questions at this time for any of those in the teaching profession. How did Rick Olson get on the joint house and senate task force? What are his qualifications? What was his performance rating when he was a school finance manager? How many Democrats are there serving on this four person joint house and senate task force so both points of view are considered equally? Rick Olson already determined that teachers should live on less when he voted to tax your pension, and now he will be asking those of you in the profession to live on less again as he votes for more business tax breaks. It's obvious that Rick Olson is not serious about considering broad alternatives for a solution when he mentions his "money tree." Using this term is a slap in the face to anyone who devoted their lives to teaching the youth of this state. Teachers deserve to live in a state where their representatives work for them too and not just for corporate interests and the extreme wealthy.

Susie Q

Mon, May 7, 2012 : 12:05 a.m.

Many retired school/public employees will not be enjoying any of their senior "golden years"; they will be working at the Golden Arches to pay for the tax cuts for businesses.

janofmi

Sun, May 6, 2012 : 8:22 p.m.

Rep Olsen said the the public school retirement fund is an "unfunded liability." Hmmmm...then where is all of the $$$ that I paid and my district paid during my 40 years of teaching? The pension program is funded by teachers and districts. Also, what many do not understand is school Boards and employees have negotiated wages and fringe benefits to allow for the increase in the districts' responsibilities for funding the retirement system. I also agree with olddog, where is the repayment of $$ taken from the pension fund and placed into the State's general fund?

Steve

Mon, May 7, 2012 : 12:05 a.m.

@Michisbest-better check the facts and stop listening to the republican talking points. Teachers have always contributed to their retirement Pre-1990 my father paid a percentage of his check to the state system, in 1990, the retirement plan changed to the fixed MIP (what I currently contribute under) and a few years later the MIP was modified to a higher contribution rate. Please do a little bit of research before blidly drinking the Kool-Aid.

DonBee

Sun, May 6, 2012 : 10:38 p.m.

Basic Bob - The current administration recognizes the issues and is trying to fund them. They are hampered by their desire to not raise taxes. They are also hampered by the increasing demand by Washington to fund programs that Washington creates, but does not fully fund. Last year the state had to find $700 million for changes in health care requirements that Washington passed. This year in addition to that $700 million, they need another $500 million or so. The numbers will jump again in 2013 and 2014. Finding the money to cover the promises made to public employees will be difficult. Right now we have a large enough hole that if we stopped all government costs for a year (no roads, no schools, no paychecks, no welfare, no.. you get the idea), we could almost cover the pension hole, a second year and we might cover the pension health care hole. It would take a significant increase in taxes for everyone to fill this hole. And... the hole is growing, as people live longer. When much of this system was created after World War II, the idea of retiring at 55 made sense, today I am not sure. Just like the need to raise the social security age, it may be time to raise the MPERS retirement age. A modest increase for teachers over 45 from the current 85 to 90 (age+years of service) and for those over 35 to 95, and those under 35 to 100 (which woul mean most would retire around 64) would really help. Another thing that would really help would be to stop the ability to buy years of service in the system. it is not a great answer, but it may be the only way to honor the promises.

Basic Bob

Sun, May 6, 2012 : 9:40 p.m.

It is an unfunded liability, there is less money in the bank than what we need to cover future pension costs. Some of this is hard to predict because it is based on *predictions* of stock market investments, *predictions* of how long people live, *predictions* of how much your health care might cost in the future. What is clear is that we have failed to predict accurately in the past and now more money needs to be set aside to cover these costs. Why didn't we spend more money to cover these costs? Ask your former (term-limited) lawmakers and the multitude of lobbyists in Lansing. It was not important to them at the time. Now it should be.

Michisbest

Sun, May 6, 2012 : 8:41 p.m.

jonofmi teachers do not pay anything towards thier pension so stop saying you have! Teachers can even buy 5 years to add to thier pension credit. It is also complteely portable. They can go in and out of the workforce,change jobs, districts with no reduction in benefits. That is part of the probelm the rest of the world has to pay for all this.

Macabre Sunset

Sun, May 6, 2012 : 8:22 p.m.

Ahh, the concept of a pension and being able to retire... I don't think those of us under 50 will have that luxury in the future.

Edward R Murrow's Ghost

Sun, May 6, 2012 : 3:18 p.m.

DonBee wrote: "There was no raiding of any retirement fund." Wrong. There was some raiding of the fund, but that alone does not explain the situation in which the public school employee fund finds itself. The problem? The state did not keep its promises when obligations to the fund shift from the state to local school districts under Proposal A. Source: http://www.mlive.com/education/index.ssf/2012/04/a_look_at_the_history_of_mpser.html So, no, Governor Engler only raided the fund for a little bit. But he and the Republican-dominated legislatures of the last 20 years have consistently failed to fulfill the promises put forward when Proposal A went before the voters. GN&GL

YpsiLivin

Tue, May 8, 2012 : 1:01 a.m.

Mick52, I'm self-employed. When I perform work for my clients who promise to pay me and then don't, that's theft. When a restaurant prepares a meal for a customer, who eats and then leaves without paying, that's also theft. Why are you allowing the State - which promised to make payments into the pension fund and then didn't - to a different standard? Not paying into the pension fund to cover the cost of a plan benefit in order to use that money for something else is T-H-E-F-T. Diverting pension payments before they enter the fund has the same effect as withdrawing money from the fund: the pension fund gets shorted. A promise to pay is a promise to pay, plain and simple. The State of Michigan promised to make payments into the pension fund, but then decided to do something else. Now, after years of not fulfilling its promise, the State now says that the pension is a big problem and the people who are in the fund need to fix the mess the Legislature caused. And what guarantees is the State offering to the pension participants that it will stick to the script once the pension contributions are raised? None. If you participated in MPSERS and watched the State of Michigan regularly underfund your retirement benefits, and then tell you that YOU will need to come up with the money to replace the funds the State diverted with NO guarantee that your increased contributions will not also be diverted, how would that sit with you?

Edward R Murrow's Ghost

Sun, May 6, 2012 : 10:18 p.m.

"Your article reports that Gov Engler, in times of fiscal crisis, cut funding (not raiding) to the MPSER health care fund." Really? Cutting funding below what was needed so that money could be spent elsewhere isn't "raiding"? Really? Go ahead and stick with that story if that's what rolls your socks up and down. And, in the meantime, as the article makes clear, the state did not keep its promises under Prop A. GN&GL

Mick52

Sun, May 6, 2012 : 7:16 p.m.

Edward, did you read the article you posted? And do you own a dictionary? Raid (verb): "to steal from; loot: a worry that the investment fund is being raided. " (http://dictionary.reference.com/browse/raided?s=t) Your article reports that Gov Engler, in times of fiscal crisis, cut funding (not raiding) to the MPSER health care fund. Not the retirement fund. Cutting funding is not "raiding." Just like how cutting business tax is NOT giving millions to your buddies, it is taking less. Why is it that democrats have so much trouble with definitions. From the article: "The MEA lawsuit went up to the Michigan Supreme Court, which ruled in favor of Engler. The court majority said the state Constitution protected the funding of MSPERS pensions, but the health-care subsidies were at the discretion of lawmakers. Bottom line: Engler did not take money out of MPSERS. But he cut the allocation to MPSERS and forced the fund to use some of its reserves to cover ongoing costs." In regard to pensions, your article points out that a booming stock market increased the fund so high that a reserve fund was created with $200 million. But that money was paid out so that contributions could be lowered and that money was used to pay for health care costs in the years 2003-04, 2004-05 and 2005-06. Who was Governor then? I strongly disagree with any taking from any fund (and lowering contributions) intended for a specific purpose because it looks like "a good idea at the time," because we never know what conditions will be faced in the future.

Dog Guy

Sun, May 6, 2012 : 1:41 p.m.

Waiting? It is easier to add to the front end of retirement than to add to the rear end.

Ed Kimball

Sun, May 6, 2012 : 1:40 p.m.

The headline should say "waiting FOR" pension reform, not "waiting ON". Restaurant servers wait on their customers. The rest of us wait for things to happen.

eastsider2

Mon, May 7, 2012 : 12:50 a.m.

Agree, agree, agree. Most grammar guides support this. "Wait for" is best. Be a leader, AA.com

Topher

Sun, May 6, 2012 : 12:32 p.m.

Does anyone know if there has been reform for representatives and their health care benefits? As I recall they received health care for life after only 6 years of service. http://www.annarbor.com/business-review/push-to-eliminate-lifetime-health-care-benefits-for-michigan-lawmakers-gains-steam/ How about they give up those health care benefits and save some money? That's a money tree right there.

Susie Q

Mon, May 7, 2012 : 12:01 a.m.

They were not able to gather enough votes to lower the benefits for the legislators who had already "earned" the lifetime benefits at age 55. But they have had no compunction about changing the rules for public employees who are vested. I hope they will also vote to raise the premiums that all the ex-legislators oay for health care since that is the proposal for public school employees.

u812

Sun, May 6, 2012 : 11:54 p.m.

how come everyone has to take a pay cut just because some have,seems like a race to the bottom.

Topher

Sun, May 6, 2012 : 3:44 p.m.

@DonBee - Thanks! This is great to hear. Although it looks like 50 members were exempt from the ban. I'm guessing there's more to that story.

DonBee

Sun, May 6, 2012 : 2:31 p.m.

Topher and Local - Look here: http://www.mlive.com/lansing-news/index.ssf/2011/10/lifetime_lawmaker_benefits_ban.html

local

Sun, May 6, 2012 : 12:48 p.m.

That would mean voting to not give themselves those benefits, not going to happen. Most people in Michigan have had to take pay cuts as well, is our legislature willing to vote themselves pay cuts as well?

Stephen Lange Ranzini

Sun, May 6, 2012 : 12:24 p.m.

This sentence is extremely misleading and should be corrected: "This year, for every $1 schools pay out in salary, districts are paying in another 24.46 cents to MPSERS. If no reform is passed, between MPSERS and social security contributions, next year school districts could pay nearly 40 cents toward teacher pensions for every $1 in payroll." The current statutory rate of federal Social Security tax on wages is 15.3%, though it is temporarily reduced to 13.3% through the end of 2012 as an economic stimulus measure. Between the statutory rate and the current rate school districts currently pay 37.76% toward teacher pensions and when the federal rate reverts to the 15.3% rate January 1, 2013, the combined payment would be 39.76%, if nothing else changed so going over 40% is not such a major increase as the article strongly implies. See: http://tinyurl.com/SocialSecurityTaxeRates As with the state program, the federal program is in dire shape. The temporary tax rate reduction over the past several years is quickly bankrupting the federal Social Security fund which now projects that it will be exhausted in 24 years (2036). See: http://tinyurl.com/SocialSecurityDemise

Stephen Lange Ranzini

Sun, May 6, 2012 : 3:31 p.m.

@Ed Kimball: Assuming for a second that you are correct and the employee share of the federal wage taxes is excluded in the 40% calculation as to next year's "over 40%" projected payments, the sentence is still wrong, since the increase would be from 30.11% (24.46% + 5.65%) to +40%, of which federal wages would be 7.65%, so the MPSERS portion would be at least 32.35%.

Ed Kimball

Sun, May 6, 2012 : 1:38 p.m.

Speaking of misleading, of that 15.3%. 7.65% comes out of the employee's paycheck (or 5.65% out of the 13.3%); the employer pays the other 7.65%. And those payments are currently on the first $110,100. On amounts above that, the employee and the employer each pay only 1.45%; these payments fund Medicare. The increase from 24.46% to 40% IS significant, since both numbers apply to the MSPERS portion alone, whereas your 39.76% number includes Social Security and Medicare taxes. Fixing the Social Security Fund problem is not economically challenging. Eliminate the $110,100 cap on taxable wages, gradually increase the full retirement age from 67 to 70 (as we increased it from 65 to 67 several years ago, and gradually increase the minimum age to collect Social Security from 62 to 65 in parallel, and Social Security will last a long time. Gathering the political will to make these changes is the challenge.

average joe

Sun, May 6, 2012 : 1:20 p.m.

The key phrase being-"...between MPSERS and social security contributions,..." vs. just contributions to MPSERS alone. Sure, when you add something the total is usually more. Is this 'bending the facts' sentence something the author came up with, or is it from an official statement from someone involved in the issue?

jcj

Sun, May 6, 2012 : 12:47 p.m.

There you go confusing the issue with facts!

Heather

Sun, May 6, 2012 : 12:04 p.m.

Your comment is spot on, Old Dog! The teacher retirement fund was first raided during the Blanchard administration, as I recall. I, too, want to know when that will be repaid.

Jonny Spirit

Mon, May 7, 2012 : 11:31 a.m.

Hey Mike52 READ THIS, "A look at the history of MPSERS -- and claims that the retirement fund was robbed by former Gov. John Engler" http://www.mlive.com/education/index.ssf/2012/04/a_look_at_the_history_of_mpser.html

Basic Bob

Sun, May 6, 2012 : 7:48 p.m.

The faces change, but the urban legends endure.

Mick52

Sun, May 6, 2012 : 6:42 p.m.

Okay DonBee says it was never raided, Heather says it was. Which is it? Heather I think you should post some documentation supporting your post.

gretta1

Sun, May 6, 2012 : 11:28 a.m.

Sara Aeschbach will be a loss to the system. She does an amazing job with Rec and Ed. Hopefully her decision is not due largely to the increasingly difficult circumstances facing AAPS staff.

Harry

Mon, May 7, 2012 : 5:04 p.m.

I am sure she does a great job but there are 100 more just like her that will also do a great job.

jns131

Sun, May 6, 2012 : 1:56 p.m.

Her leaving may be a huge loss to to others. But not to us. We left due to a lot of reasons and hopefully a lot of changes will come to rec and ed after this.

olddog

Sun, May 6, 2012 : 10:22 a.m.

Correct me if I am wrong--I was under the impression that the school retirement fund had been raided several times in the last 10 years to cover over state expenditures. If this is true what does the state owe the fund and if they paid it back would it cover the deficit?

Ralph

Mon, May 7, 2012 : 9:49 p.m.

I'm not sure, since the school districts are now responsible for payments, that the state can raid the fund. During the Engler years when the state was only paying in, along with contributions from teachers, the state took out 10's of millions and never repaid it.

Jonny Spirit

Mon, May 7, 2012 : 11:18 a.m.

maestra27 you are 100% correct. Teachers now have to pay for Engler STEALING from the teachers. Read about it people, this is ridiculous, this is your government. Hey Rick Olsen the money tree was the $145 million the State found 3 months ago. But why put it back towards the place you stole it from, just put it back in your pocket!

maestra27

Mon, May 7, 2012 : 12:02 a.m.

Please read the following article to better understand why MSPERS has become a $45 billion unfunded liability. "A look at the history of MPSERS -- and claims that the retirement fund was robbed by former Gov. John Engler" http://www.mlive.com/education/index.ssf/2012/04/a_look_at_the_history_of_mpser.html

DonBee

Sun, May 6, 2012 : 2:27 p.m.

olddog - There was no raiding of any retirement fund. What was done to the state employees fund, was during the 8 years of Governor Granholm, the state did not contribute to the state employee retirement fund. It was already slightly underfunded. With 8 years of no contribution, and a poor market (even for bonds) the fund for state employes is now more than $40 billion underfunded. Governor Snyder put $800 million in it last year to try to shore it up. The total state budget is roughly $45 billion just to give you an idea of how big the problem is.